Read and Understand the Company Income Statement

Post on: 16 Март, 2015 No Comment

Let’s face it, making investing decisions isn’t easy. The best investors take the time to learn as much as possible about a company before making the decision to invest in it. One great way to get information about a company is to review its financial statements. The income statement is one of these documents. Learning how to read and understand it properly can help investors to understand more about a company’s profitability.

Before going into any detail about the income statement itself, let’s define what profitability means. Profit is technically defined as revenue minus expenses, or how much money a company brings in versus how much it pays out. Profitability is a more general term used to describe the ability of a business to consistently generate profit over time. If a company can consistently generate more money from revenue than it pays out for expenses, it is generally considered profitable.

It is also important to understand the difference between revenue and expenses. Revenue is simply how much money a company makes over a given period of time from its business activities. This includes but is not limited to sales of goods or services, investments, commissions paid by customers, and profits made from the sale of assets.

Expenses, on the other hand, are costs that companies incur while attempting to earn revenue. Expenses include things like payments to suppliers, employee salaries, leases for building or equipment, and depreciation of assets.

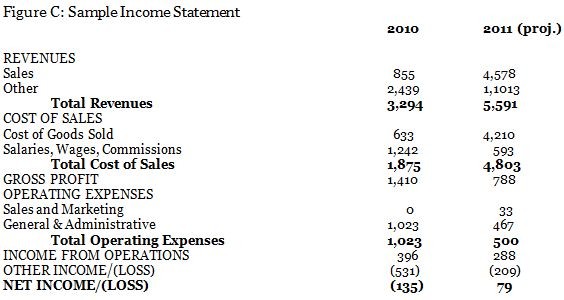

Now that we have an understanding of the basic terminology, let’s briefly outline how the income statement is organized. The top line shows the total amount of revenue a company has generated over the specified time period. As you work your way down to the bottom line, different types of expenses are deducted step by step. Operating expenses are usually the first to be deducted. Then the rest of the expenses are then deducted, ultimately leading to the bottom line, or net income.

Because there is so much information to analyze, many people use ratios and other calculations to make sense of it all. A few of the most common calculations are listed below.

- Gross Margin = Gross Profit ÷ Revenue

- Operating Margin = Operating Income ÷ Revenue

- Net Profit Margin = Net Income After Taxes ÷ Revenue

- Return on Equity = Net Income ÷ Average Shareholder Equity for the Time Period

- Return on Assets = Net Income ÷ Total Average Assets for the Period

While understanding the most recent income statement is important in itself, another important thing to understand is how the current income statement relates to previous statements. For example, let’s say you notice that a company has made a profit of $10 million in its 2009 income statement. However, you also notice that it made a $20 million profit in 2008. Although the company was profitable in 2009, the 50% decrease in profit from the previous year is cause for concern and you decide you need to do more research to find out why this happened.

To summarize, you can utilize the income statement to gain valuable information about the company’s profitability. Since profitability is arguably the most important indicator of a company’s success, understanding it can enable you to make better investing decisions.