Rally to continue amid volatility

Post on: 25 Апрель, 2015 No Comment

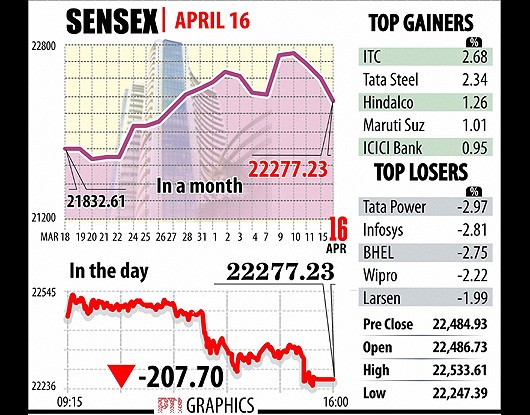

Indian markets have been one of the best performers globally, with its benchmark indices — the BSE Sensex and the National Stock Exchanges Nifty — rallying around 30 per cent this financial year, on expectations the new central government will boost the economy through proactive policy-making.

Some global events like a 50 per cent decline in crude oil prices over the past few months, to a six-year low, and liquidity injection by major central banks like the Bank of Japan (BoJ) and European Central Bank (ECB), have helped. Similarly, the policy action by the US Federal Reserve (US Fed), and the Reserve Bank of Indias move to lower the interest rate and manage the rupee, have aided sentiment.

While the Sensex on Thursday topped the 29,000 mark, for the first time, the Nifty recently breached the 8,850 level. With these indices at record highs, is there room for more upside over the next six to 12 months? If so, which are the sectors likely to lead the next leg of rally?

The road ahead

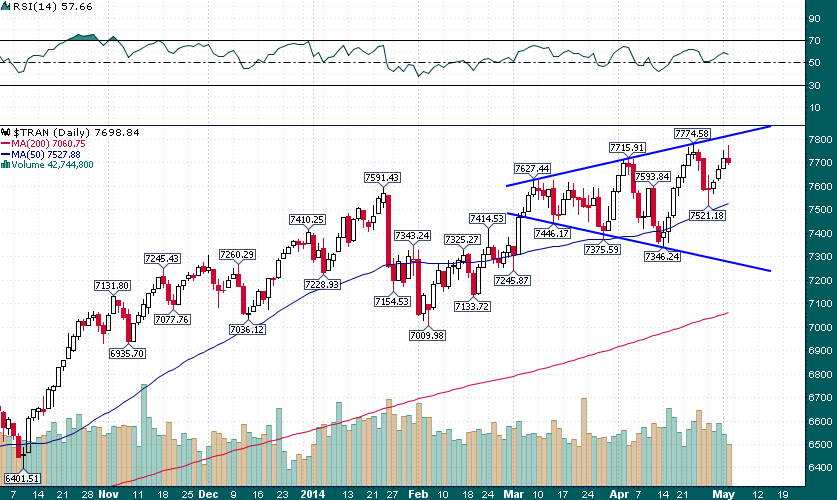

Experts believe the Indian markets will continue their upward march but the rally will be marked with volatility. They base their bullish stance on the premise that the improvement in Indias macro environment over the past year is durable and will improve further. Besides the global landscape, market participants will also keep an eye out for the progress made by the government on reforms and policy framework.

Foreign flows into India are likely to remain strong, too, especially after the ECB announced a programme to keep purchasing bonds worth Euro 60 billion ($69 billion) a month, until after September 2016.

The ECB stimulus, a report from Bank of America-Merrill Lynch says, should support portfolio equity inflows to Indian markets, offsetting to some extent the monetary tighetning by the US Federal Reserve. Jyotivardhan Jaipuria, managing director & head of research at this foreign research firm, expects the BSE Sensex to touch 33,000 by December this year and pencil in $25 billion of portfolio inflows in 2015-16.

In the near term, however, the Federal Open Market Committee (FOMC) meeting towards the end of this month, and Indias Union Budget in February (for the governments blueprint for reforms and plans of maintaining fiscal prudence), will also be keenly watched.

Expectations of normalisation by the US Fed and a subdued commodity pricing environment will continue to drive multi-asset differentiation within emerging markets (EMs). Indias embrace of long-pending supply-side reforms, together with an investment-driven macroeconomic stabilisation, will allow the country to deepen its relative attractiveness in 2015, Abhay Laijawala, managing director & head of research at Deutsche Equities India, points out in a recent report.

We assign a high likelihood of a sovereign ratings upgrade for India, as most macro indicators have exhibited an improvement in the past two years. We are setting a December 2015 Sensex target at 33,000 (imputed Nifty target of 9,936). Our key overweights are financials, industrials, and materials, while our key underweights are consumer staples, information technology services and telecom, he adds.

A rating upgrade is likely to result in higher foreign institutional investor (FII) allocations for the country, say experts.

Recently, the International Monetary Fund also pegged Indias gross domestic product growth at 6.3 per cent (marginally down from 6.4 per cent projected in October) in 2015-16, and 6.5 per cent in 2016-17. The World Bank, too, projected India to edge past China in 2017, clocking a seven per cent growth rate, against Chinas 6.9 per cent.

Prabhat Awasthi, managing director & head of equity research, Nomura Financial Advisory, who expects the BSE Sensex to scale up to the 33,500 level by the end of December, remains overweight on financials, automobiles, industrials and technology. His key underweights are consumer staples, pharmaceuticals, metals and telecom.

Corporate earnings

Though the Street remains optimistic over the next 12 months, corporate earnings, experts say, will have to remain equally supportive.

Markets will make steady progress from here on. We have been arguing that if earnings growth picks up to double digits, say between 15 per cent and 20 per cent, markets can see a corresponding rise of about 20 per cent. The Sensex could scale up to 33,000 within the next 12 months, says Taher Badshah, senior vice-president & fund manager, Motilal Oswal Asset Management Company.

In case of the earnings sustain another year of around 20 per cent growth, the Sensex can even move up to the 35,000 level. In case the government can resolve the issues related to coal mining, companies in this space could see a leg up in earnings, he adds.

But there are potential risks as well. Currency movement, analysts say, is one. If countries start looking inwards to protect their respective currencies, the volatility on the forex market can spill over to equities. Any major upset in Chinese economic growth can also impact sentiment.

We have already seen this in the case of Russia, on the back of a sharp decline in oil prices. While this can create volatility and bring about some correction, it will not puncture the rally. Continuing quantitative easing programme of the past five years, coming out of the US and followed by Japan and the euro zone, can be a medium-term risk, where it can lead to some excesses. But we clearly are not in a bubble zone yet, Badshah says.