Put call parity

Post on: 5 Июль, 2015 No Comment

Put Call Parity Formula | Put-Call Parity Equation

As stated before, Formula 5-1 is just one variation of the put-call parity formula. We can rearrange it algebraically and come up with other forms that will provide.

Put-Call Parity: CNBC Explains — Stock Markets, Business.

Put-call parity demonstrates the relationship between shorts, puts, calls, and bonds. The proper combination of each can yield equal payouts. This relationship is.

Put-Call Parity Definition & Example | Investing Answers

PUTCALLPARITY.COM — Home

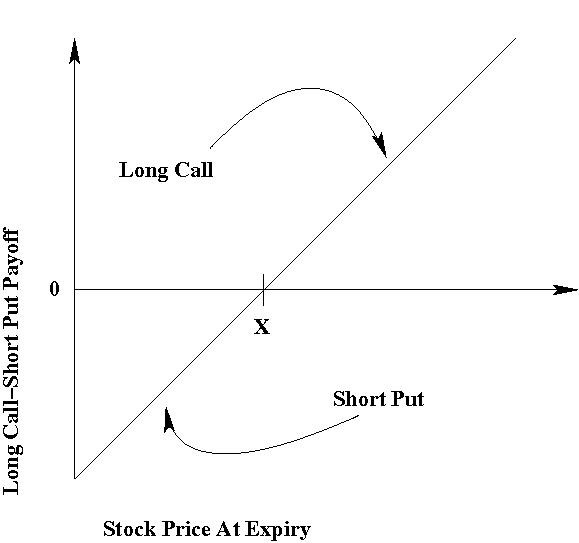

In financial mathematics, Put-Call Parity is the relationship between the price of a put option and a call option on a stock according to a standard model.

What is Put-call Parity? definition and meaning

Definition of put-call parity: The relationship between the price of a call and the price of a put for an option with the same characteristics (strike.

Put-Call Parity | Sunshine Profits

The put-call parity is useful as part of a hedging/ speculative strategy for a trader who wants to participate in the futures market. The put-call parity explains the.

C S Xe P S X r t r C P C S X T C P — NYU Stern | NYU Stern

Arbitrage Example Demonstrating Put-Call Parity William L. Silber and Jessica A. Wachter 1. Put-call parity is an arbitrage relation between the price of a put, the.

A Primer on Put-Call Parity and How to Use It

This week, we review what are known as the put/call parity rules. If you know one rule — and you remember your high school algebra — you can quickly master all the rules.

Wilmott Forums — What is put-call parity?

well to get this started. Put-call parity is a strong arbitrage relation between Euro-style call prices C and put prices P with the same strike price K.

1. Put call parity — OU Department of Mathematics

3 10. The Black-Scholes formula: Greeks put = call e T S-shaped curve put = call symmetric hump, peak to left of stock price, further left with higher T

The Put-Call Parity Theorem — John Norstad’s Home Page

1 THE PUT-CALL PARITY THEOREM 1 1 The Put-Call Parity Theorem Theorem 1 For a given time to expiration t and strike price E let: S = the current value of a non.