Prudent Investor Rule

Post on: 16 Март, 2015 No Comment

No other protection is wanting, provided you are under the guidance of prudence.

—— Juvenal (60-140).

Altruist follows the Prudent Investor Rule. The Prudent Investor Rule is a legal doctrine which provides guidance to investment managers regarding the standards for managing an investment portfolio in a legally satisfactory manner.

Basically, prudent investing amounts to a process which one follows. If the process followed in making investment decisions is prudent (based on what is known and not known at that time), then the decisions being made are prudent, regardless of subsequent results. Example: It would be imprudent to invest one’s money in a lottery. The relative prudence of the decision isn’t affected by the fact that the investor may have subsequently won the lottery. If she won the lottery, then she got lucky and had a spectacularly good result despite a spectacularly imprudent investing decision. But winning the lottery doesn’t justify the imprudence of playing the lottery in the first place. Indeed, while we’d all like to win the lottery, it simply isn’t prudent to try to do so.

Investing prudently is a process, not a performance guarantee.

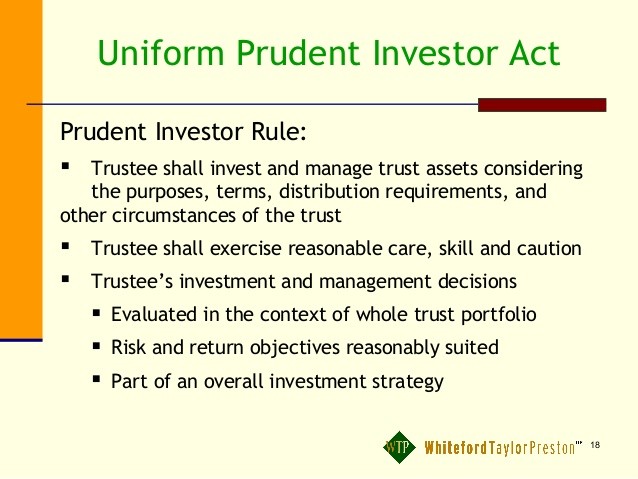

In 1994, the National Conference of Commissioners on Uniform State Laws developed The Uniform Prudent Investor Act. based on the Prudent Investor Rule. The Uniform Prudent Investor Act has been passed as law, with various modifications, in most states. An example of this law, with modifications, is the Michigan Prudent Investor Rule. Here are some comments thereon .

A related model statute, The Uniform Principal and Income Act. was developed by NCCUSL in 2000. Here are some comments thereon. An example of this law, with modifications, is the Michigan Uniform Principal and Income Act. Here are some comments thereon. This law provides guidance on classifying assets in a trust as either principle or income, for the purposes of distribution.

Another related model statute, the Uniform Prudent Management of Institutional Funds Act. was developed by NCCUSL in 2006. Here and here are some comments thereon. An example of this law, with modifications, is the Michigan Uniform Prudent Management of Institutional Funds Act. Here are some comments thereon. This law provides guidance on the management of charitable endowments.

The Prudent Investor Rule traces its history back to an earlier doctrine known as the Prudent Man Rule. That legal standard was established in 1830 by a Massachusetts Court decision (Harvard College v. Amory, 9 Pick. (26 Mass.) 446, 461 (1830)):

All that is required of a trustee to invest is, that he shall conduct himself faithfully and exercise sound discretion. He is to observe how men of prudence, discretion and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

The most authoritative useful description of the current Prudent Investor Rule is probably that of the influential American Law Institute (in Restatement of the Law Third, Trusts: Prudent Investor Rule. 1992):

§ 227. General Standard of Prudent Investment

The trustee is under a duty to the beneficiaries to invest and manage the funds of the trust as a prudent investor would, in light of the purposes, terms, distribution requirements, and other circumstances of the trust.

This standard requires the exercise of reasonable care, skill, and caution, and is to be applied to investments not in isolation but in the context of the trust portfolio and as a part of an overall investment strategy, which should incorporate risk and return objectives reasonably suitable to the trust.

In making and implementing investment decisions, the trustee has a duty to diversity the investments of the trust unless, under the circumstances, it is prudent not to do so.

In addition, the trustee must:

conform to fundamental fiduciary duties of loyalty (§ 170) and impartiality (§ 183);

act with prudence in deciding whether and how to delegate authority and in the selection and supervision of agents (§ 171); and

incur only costs that are reasonable in amount and appropriate to the investment responsibilities of the trusteeship (§ 188).

The trustee’s duties under this Section are subject to the rule of § 228, dealing primarily with contrary investment provisions of a trust or statute.