Protecting High Income With An Inverse ETF Dividends Income Daily

Post on: 12 Апрель, 2015 No Comment

Its been four years since the Fed reached the bottom of the yield curve. In December 2008, interest rates settled at an official 0% to 0.25%, creating big problems for income-oriented investors.

As it stands now, official interest rates literally cannot go any lower. Market rates may, but there’s always the risk to investors that those rates will rise eventually. And as my colleague, Louis Basenese, recently pointed out, high yield bonds and bond funds are risky things to own.

Still, many investors have chosen to bite the bullet, despite the obvious risks. One such ETF popular with income investors is the iShares iBoxx $ High Yield Corporate Bond ETF (NYSE: HYG ).

While I agree with Louis that buying HYG isn’t the greatest idea at this point, for those who own the ETF already, there’s an excellent way to mitigate the risks involved while still getting income out of it…

Guard Against the Downside with SJB

Since late 2008, HYG has doubled its share price, from around $45 per share to over $90 per share today. Despite this 100% capital gain and a testament to why many income investors own this ETF HYG sports an SEC 30-day yield of 5.54% (as of November 1).

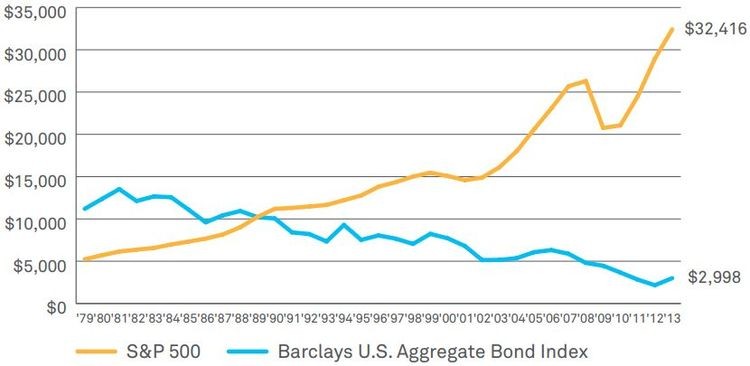

Given that Treasury yields are non-existent e.g. iShares Barclays 20+ Year Treasury Bond Fund (NYSE: TLT ) has a 30-day SEC yield of 2.73% it’s a no-brainer that higher-yielding funds like HYG are currently very popular.

That’s today. But what happens when interest rates rise?

Ever since the Fed slashed rates to zero, it’s been a matter of speculation. Bill Gross, head of Pimco, famously predicted in early 2011 that Treasuries were about to crash. He was wrong. Instead, Treasuries rallied, sending share prices higher and yields even lower.

Now, I can’t predict exactly when the crash actually will happen, but it’s only a matter of time.

So what should we expect when it does occur?

Due to the inverse relationship between yields and bond prices, we’ll see the share prices of funds like HYG go down. True, the 30-day SEC yield will rise, but not by enough to compensate for the downside risk.

If things get really bad again and the Risk Off scenario drives investors to sell everything like in 2008 then a loss of 50% and a return of HYG to $45 per share is indeed possible. And youd need a heck of a lot of income to recoup that loss.

A more desirable scenario is a healthier economy with higher interest rates. When HYG was launched in 2007, it traded around $65 per share. But even that would still be a big loss from today’s price.

But no matter how severe or slight the loss, one way to protect your gains or your investment capital on a fund like HYG is to use inverse ETFs.

Simply put, inverse ETFs attempt to deliver returns that are the opposite of the investment or index they track.

For high-yield investors, a fund like the ProShares Short Junk Bond ETF (NYSE: SJB ) is an option.

Launched in early 2011- around the same time as Grosss ill-timed prediction the fund is relatively new and illiquid (it doesnt trade many shares each day).

In direct contrast to HYG, SJB is down more than 20% since its inception and the two ETFs are almost perfectly negatively correlated. Take a look…

So how do you use this fund? Very carefully.

Pairing SJB with HYG will eliminate much of the volatility, both negative and positive. This means you wont make money and you probably wont lose money, either.

I say “probably” because although they appear to be perfectly inversely correlated, they’re actually not. As such, a slight loss is still possible and you still need guard against that by tracking its performance diligently.

Having said that, inverse funds do, indeed, help reduce risk. For an income investor, that means high income can be earned with less worry.

Bottom line: Interest rates will eventually rise. And when they do, bonds and bond funds of most stripes will decline. Use inverse ETFs like SJB to help manage that risk and create income with a higher degree of safety.