Protect your portfolio with these 5 basic hedging strategies

Post on: 20 Май, 2015 No Comment

J.J.Zhang

It’s a fact of life that markets fluctuate. But occasionally markets experience bouts of extreme volatility and declines, which can wreak havoc on portfolios. Statistics over the last 100 years show 5% pullbacks typically happen about three times a year, 10% to 15% corrections every one to two years and 20% bear drops every three to five years.

It’s easy to ride out small fluctuations given a long time horizon. But with rare large declines there’s something to be said for having a bit of protection or hedge — either for peace of mind or for performance. After all, according to Warren Buffett, Rule No. 1 is to never lose money. Considering the fast and sudden correction that just happened, it’s never bad to have options for next time.

A common reaction is that it’s unnecessary — buy and hold, diversify into passive low-cost index funds with a long time horizon and you don’t have to hedge at all, paper losses are just paper after all. There is truth in that. In a perfect environment, hedging is not necessary but unfortunately we don’t live in a perfect world with perfect portfolios managed by perfect individuals.

First, real people are emotionally driven and occasionally irrational actors. It’s well known losing money feels twice as awful as making money feels good. It’s painful and preventing it is psychologically valuable.

Second, people don’t have infinite time horizons. Are you in retirement? That 10% correction or 20% bear market matters. Look what happened to retirement plans during the several years of the financial crisis bear market.

Third, distributing risk and having a solid floor is just good practice. It’s no different than paying for fire or catastrophic medical insurance — it’s inefficient and maybe unnecessary but damn nice if things fall apart.

Last, hedging can be considered as another method of diversification. Similar to having a bond or gold allocation, having non-equity-correlated or inversely correlated assets can improve returns; remember, a 50% decline requires a 100% recovery to break even.

So how does one hedge? There are many possibilities; each with pros and cons so there is no ideal strategy. Instead, it’ll vary depending on each investor’s preferences. But here are some common approaches:

Stay in cash

The most obvious strategy is to sell some equities and move to cash. Cash doesn’t lose value in the short term and can be easily deployed later on. However this is less a hedge and more nonparticipation. Though cash is king in times of crisis, it’s generally a poor long-term option since it’s difficult to time a jump back in and meanwhile you lose out on any asset returns. Nobody ever got rich holding cash.

Defensive rotation

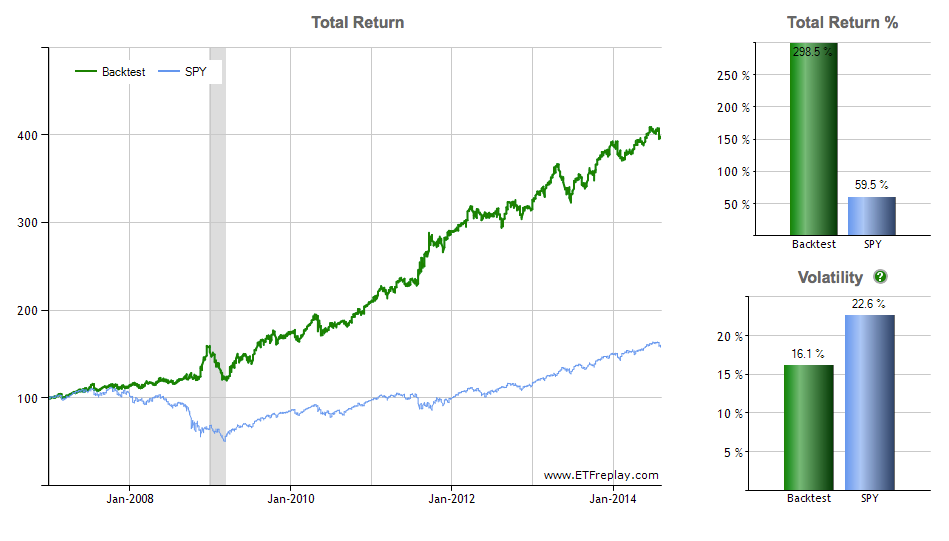

Rotating into defensive sectors or assets such as consumer staples, utilities and bonds is another strategy. Similar to the cash option, this strategy is more a mix between tactical diversification and hedging rather than being a pure hedge. It’s perhaps the most practical and comfortable option for many since it maintains exposure to assets and nets profits from them but tactically shifts the portfolio to favor low or negative beta assets.