Princeton Economics International

Post on: 26 Июнь, 2015 No Comment

Allocating Your Investments Among Asset Classes

There has been an infinite number of asset allocation models proposed, and no one in particular suits every investment portfolio goal. Additionally, these are generally constructed from a brief periods of correlation and an assumption that whatever trend is currently in motion will remain in motion.

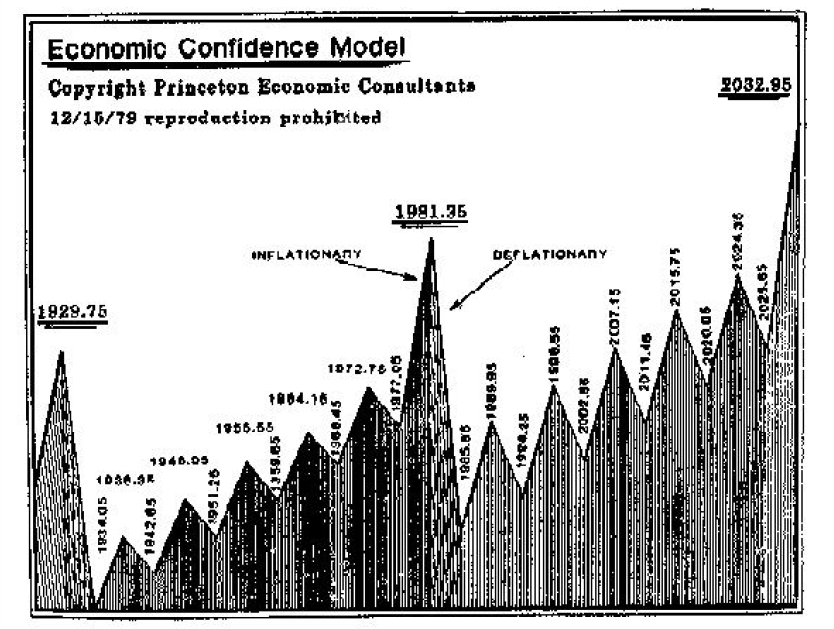

The problem with asset allocation once again is that it’s all based on historical statistics for any given asset class that typically lacks the real historical database of at least 100 years. Without great depth to the historical database used for the construction, you will only see one side of a trend. How will know how your portfolio would survive a Great Depression when you rely on a database of just 50 years or less? Unless you have the historical database to support the model construction, it will rapidly introduce tremendous risk that is the very object such a model is trying to eliminate or reduce. It becomes impossible to construct a truly perfect asset allocation model absent a historical database.

We must begin with the historical database in order to correlate the very basics of asset allocation structure. For example, breaking asset allocation down to the most basic asset classes you can very realistically begin to create a portfolio that generally has the risk/return characteristics that are the goals established for the time frame.

The typical asset allocation models are constructed using the inadequate three-class very basic asset allocation design.

The Industry Conservative Asset Allocation Model

The typical “conservative” asset allocation model that was dominant among pension funds took a very low exposure to “risky assets” they assumed were stocks, focusing instead on a predominant allocation to conservative asset classes like bonds and cash. This model has been responsible for the collapse in long-term interest rates because the bulk of pension funds were trying to eliminate risk and predicated their expectations and promises on the standard 8% yield on long-term bonds of the 1980s. As the population grew older, the bid for long-term government bonds increased driving the yield down to the point that many pension funds are now insolvent using this asset allocation model.

Moderate Asset Allocation Model

The so-called “moderate asset allocation” model has been attributing more into equity compared to bonds and cash. These portfolios have done far better than the “conservative” model that relied heavily upon bonds seeking a no-brainer management strategy.