Price Momentum Key For Tactical ETF Investor

Post on: 16 Июль, 2015 No Comment

Oil has declined in a way no one saw coming. The trajectory of bond yields has surprised most for some time now. U.S. equity valuations are rich by most measures and suggest returns ahead will be muted at best. What’s an investor to do in an environment mired with curveballs?

Stephen Blumenthal, founder and CEO of CMG Capital Management Group, says going tactical is the only way to invest today, and that for a tactical investor, opportunities abound.

ETF.com: Since we last talked in 2014, oil has dropped precipitously. How has that affected where you see tactical opportunities now? What role is oil playing in the way you’re allocating assets today?

Steve Blumenthal: Everything we do is systematic and disciplined. We measure assets against assets. If we’re looking at sectors, we’re measuring consumer discretionary against energy. In that price movement, you can see where leadership is. We run a tactical all-asset strategy, for instance, that includes exposure to energy and consumer discretionary, large-cap value and midcap growth, fixed income, emerging market, international equities, all these asset classes, and we want to position to those that are exhibiting leadership in terms of price momentum.

With oil, energy has not been in the leadership realm for some time. I had no idea oil would decline 50 percent; I don’t think anybody did. But what we did know was that it wasn’t the asset class to be in. There were better choices to be in that were exhibiting good performance and good leadership. REITs have been phenomenal. Utilities had a very good period. Consumer discretionary, although it hasn’t shown up yet at the top relative to our collection of assets, is doing OK.

ETF.com: When you’re building a portfolio based on price momentum, are you looking more to the past, to how an asset has performed, than to the future?

Blumenthal: Let me give you an example. We have what we call our tactical rotation strategy. It looks at the S&P 500 Index, and we can express that with many S&P 500 index ETFs.

Low fee is best, so we’ve been long the iShares Core S&P 500 ETF (IVV | A-98). And we’ve been long the Vanguard REIT ETF (VNQ | A-84). We have a basket and we look at the S&P 500. We look at total bonds. We look at REITs. We look at Treasury bills as a possibility to move to. We look at the PowerShares DB Commodity Tracking ETF (DBC | C-61). our commodity fund.

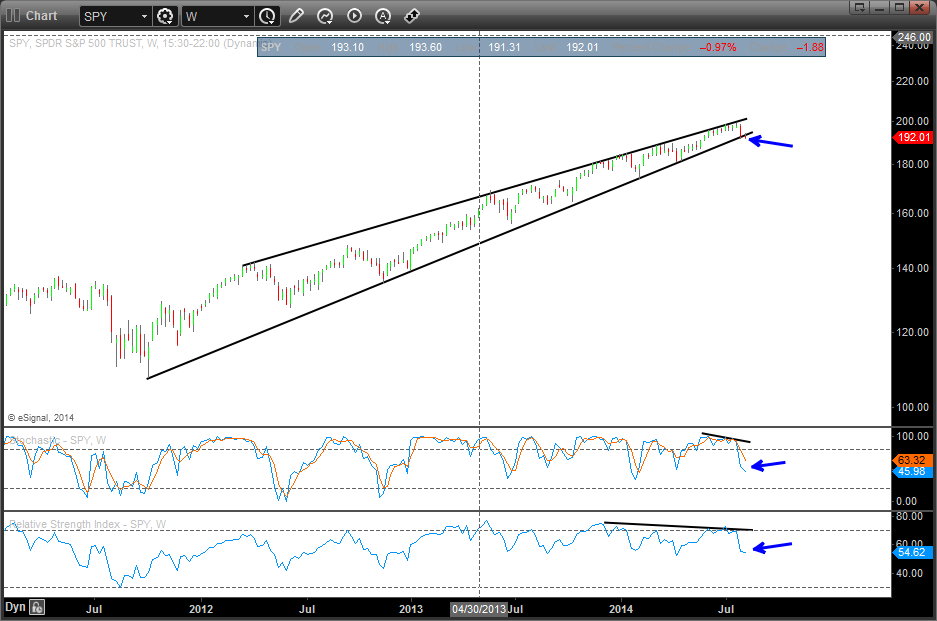

When you run the relative-strength math—say, anywhere from 30 to 100 days—you see how well these assets have done. Commodities, for instance, haven’t shown up on the radar for some time. I think we’re four years into a 20-year secular bear market in commodities.

But whatever I think doesn’t matter to the model. The model’s simply saying which of these six assets are moving up in price, compared to all of the others. We’re looking at the price momentum over a defined period of time.

Again, commodities haven’t shown up, and we’ve completely avoided a disaster in the commodity market. We’ve been largely long S&P 500 and REITs for the last five months.

ETF.com: Where are you seeing opportunities today when it comes to fixed-income exposure?

Blumenthal: We’ve been long the iShares 20+ Year Treasury Bond ETF (TLT | A-85) and we’ve been long the Vanguard Total International Bond ETF (BNDX | B-57) for the past six months. We’re 50 percent long each of those. That may change.

ETF.com: That’s your entire fixed-income allocation today? TLT and BNDX?

Blumenthal: Much like the tactical rotation where we look at a grouping of ETFs linked to rates and commodities, in the fixed income we have a separate collection of seven things such as TIPS and Treasury bills, high-yield bonds and high-grade corporate bonds. Treasurys have been the right place to be.

A year ago, you had 25 economists that thought interest rates were going to go from 3 to 3.25 percent, but they went to 2.20 at the end of the year. And now we’re around 1.85 percent. It’s a great example of having a fundamental view, and getting that fundamental view right, or not.

What shows up in price momentum is telling you what’s going on. Where is the demand and what’s leading? The idea isn’t only to position to the leadership, but it’s to not lose as much as the bottom things lost. You want to seek to gain, but you really want to seek to not be in the poorest asset allocations.