Premium Of Swells V Bunds

Post on: 20 Апрель, 2015 No Comment

U .S. government debt is cheaper than it has been in 25 years, at least when compared to German bunds.

Yields on German securities plummeted after European Central Bank President Mario Draghi said the bank will start buying sovereign bonds next week and include debt with negative yields. With the Federal Reserve debating raising interest rates for the first time since 2006, that pushed the premium for Treasuries to the most since 1989, the year the Berlin Wall came down.

The U.S. market has detached from Europe, for the most part, said Jim Vogel, head interest-rate strategist at FTN Financial in Memphis, Tenn. Domestic investors have decided to start selling faster before an expected rise in interest rates, as deflation concern recedes.

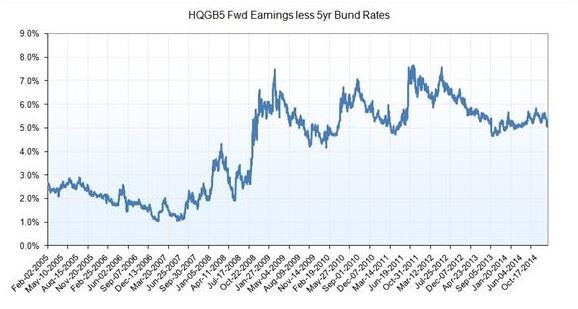

The benchmark 10-year yield dropped 0.2 basis points, or 0.02 percentage point, to 2.12% as of 5 p.m. in New York, according to Bloomberg Bond Trader data. The yield on its German counterpart slid four basis points to 0.35%. The moves pushed the spread to as much as 177 basis points.

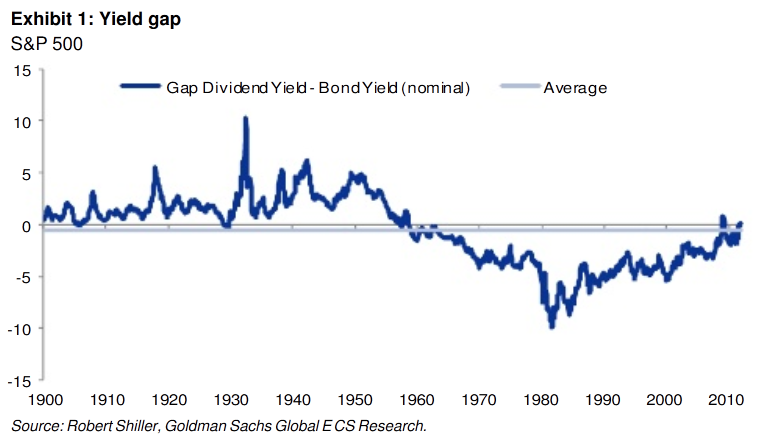

Though Treasuries appear cheap versus German debt, they’re still historically expensive, according a Fed measure known as the term premium.

The extra yield investors demand to hold longer-term U.S. debt was below zero at negative 0.11 percentage point Wednesday, indicating they’re overvalued. The term premium has averaged 1.17 percentage points on a monthly basis since September 2008, when the financial crisis intensified.

Draghi’s speech drove yields lower from France to Italy and Portugal, where they approached record levels.

How negative can we go? Draghi said of the bonds the bank will buy. Until the deposit rate.

Policymakers held the deposit rate at minus 0.2% Thursday, along with the benchmark rate at 0.05%. They committed to their first asset purchases next week in a program amounting to 60 billion euros ($66 billion) a month through September 2016.

The ECB is willing to buy negative bonds that changed the market’s calculus, said Tyler Tucci, a U.S. government-bond strategist in Stamford, Conn. at Royal Bank of Scotland Group, one of 22 primary dealers that trade with the Fed. That news helped spark the rally in European government bonds. In the U.S. he said, there’s a ton of other things at play.

Of key importance to the Fed is the nonfarm-payrolls report Friday, which is forecast to show the U.S. added 235,000 jobs, its 12th straight month above 200,000. A stronger labor market is seen as giving the Fed more room to raise interest rates.