Preferred Stock vs Common Stock Investing

Post on: 2 Июль, 2015 No Comment

by Jeremy C Bradley on 2011-09-27 4

When I first embarked on learning stock market basics. I thought that a stock was a stock was a stock, but there are actually two distinct forms: preferred and common. Let’s talk about the differences and show some examples of each type.

Common Stock Investing: Whats Involved?

Common stock, like its name implies, refers to ordinary shares of a corporation. You purchase these from a stock brokerage. an online trading platform, or sometimes directly from the company itself.

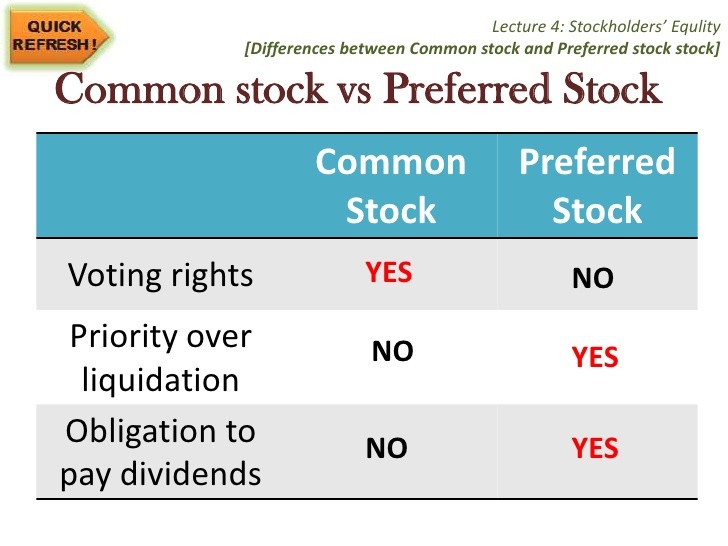

Owning common stock gives you voting shares –- the right to vote on corporate policy and on who sits on the board of directors. There is no fixed dividend paid to you if you own common stock because the price of the stock fluctuates with the market. The amount you earn from owning common stock will depend on the profit the company makes, on the performance of the stock on the market, and on how well the company does in public perception.

Common Stock Example: Google

Most stock that people buy is common stock. Most of us use Google on a daily basis. As a public company, Google issues common stock. When the company first offered shares, the price per share was $85. It has soared to many times that amount per share and has experienced huge growth.

Googles Historical Stock Price Chart

However, Google is also a good example of the volatility that common stocks can face. In 2011, Googles stock price slipped a bit from the peak. This is remarkable because Google stockholders are accustomed to 30% growth year-over-year. This is even more amazing when we take a look at Googles balance sheet: it reveals the fact that they are sitting on many billions in cash. That sounds like a lot, but it works out to a price per share thats much lower than its current price (i.e. youre paying a premium for it, which shouldnt be a surprise). The lesson here is: know a lot about the common stock you are purchasing before you buy it. Im not saying that Google is a bad stock to own (you could do much worse!) but extreme growth like what Google has seen in years past cannot be sustained indefinitely.

Preferred Stock Investing

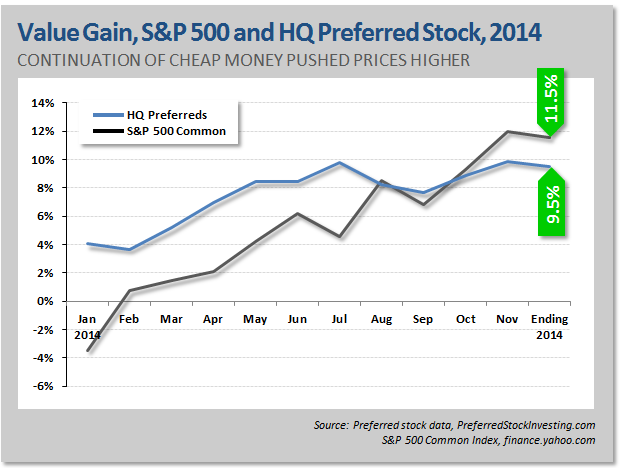

Lets turn to preferred stock. Its an area that not enough investors really understand. Thats because preferred stocks arent really stocks at all –- they are hybrid instruments that have qualities of both an equity and a debt instrument. As such, preferred stocks are ranked lower in priority than bonds but higher than common stock. Thus, if a company happens to go bankrupt, preferred stock holders get their dividends paid before common stock investors. But the downside to this is that common stock tends to perform better than preferred stock.

Also, preferred stockholders have a set dividend they receive at the appointed dividend payment cycles. On the other hand, common stockholders can receive dividends if the company chooses to pay them, and the value of those payments are based upon the value of the stock at that time. For more on stock ownership, check out how to invest in shares of common stock .

In consideration of the static dividend payment, preferred stockholders give up the right to vote. That’s right folks, preferred stockholders might get preferential treatment when it comes to payments. Some investors want a say in how a company is run, and so they opt for common stock. Others, like myself, are interested in steady dividends and buy preferred stock. Preferred stocks afford investors a certain level of security. With these stocks, investors are slightly more secure about placing their hard earned cash into the stock market.

Almost every company that issues common stock also has preferred stock offerings. However, usually no more than 10% of a company’s offerings are in preferred stocks. So there are a few things to remember when thinking about purchasing preferred stock:

1. You need to make sure that the company is financially healthy. Does it have enough cash to pay the dividends required to preferred stock holders?

2. Look at the companys interest coverage ratio. The higher this number is. the better chance they can make good on their dividends to preferred stock holders.

3. There is no official preferred stock rating system, like there is for common stock, but you can try using the bond rating system as an alternative. Stock experts suggest that a company with a BBB or Baa rating or higher is considered a good investment.

So here’s what I’d do if I wanted to buy individual stocks: take a look at the company in question. Decide if you want to buy common or preferred stock by taking a look at the company’s financials. With regards to Google, Id buy only common stock. Why? Because their balance sheet doesnt reflect an accurate balance to stock ratio (in other words: they will end up trying to sell more shares than their account balance can pay for, should they go under). Preferred stock in Google doesnt make sense to me because theres no guarantee that they can pay dividends over the long haul.

Where & How to Buy Preferred Stock

Okay, so let’s assume you’ve made the decision to buy preferred stock. Where would you go? Check these resources out:

1. Get more information. Start by checking out a financial information portal. Winans International (at winansintl.com) is a good starting point. Companies like Winans specialize in the management and research of the stock market.

2. Use tools to track your portfolio. There are also websites dedicated to preferred stocks. Epreferreds.com is the most widely used and charges about $10.50 per day, or $295 a year, for access.

3. A newsletter can help you with research. The Forbes/Lehmann Income Securities Investor newsletter, available for a price, is another great resource as it provides a list of hot preferred stocks. But take note that it doesnt come cheap.

If you aren’t comfortable doing your own research, then consult a stock broker or a certified financial advisor. These folks can give you the nitty-gritty details on buying preferred stock. No matter which route you choose, there are a few things to remember:

Investing in a wide range of stocks, preferred or common, is a good strategy because this keeps your exposure to wild market swings at a minimum. If you can diversify your portfolio as much as possible, you’ll avoid a financial crisis when one of the stocks plummets.

Also remember that the commissions on preferred stocks are roughly equivalent to those on common stock. There is typically no minimum amount that you must buy of any one preferred stock, although many brokers will require you to deposit at least $500 to open an account with their firm. What I like about preferred stocks is the flexibility that comes with this: I can use that $500 to buy as many or as little preferred stock as I want.

Categorized under: Investment