Preferred Stock Investors What Is Your Rate Of Return

Post on: 28 Май, 2015 No Comment

Whether you are considering buying or selling, understanding the potential or actual annual rate of return of a preferred stock investment is important to any strategy. But accurately calculating this key value can be a bit tricky.

There are a variety of calculations, each of which use a variety of assumptions and, therefore, offer values that can vary. The calculation that you use depends on how closely these assumptions align with your objectives.

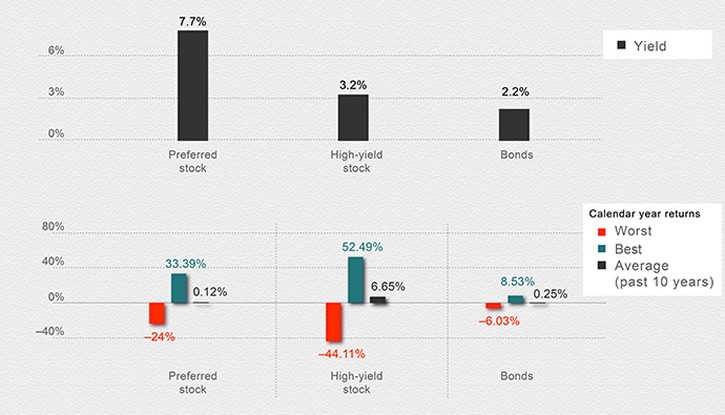

And some calculations are more useful for certain types of investments than others. Bond investors, for example, are use to analyzing Yield-To-Call or Yield-To-Maturity values while those investing in bank Certificates of Deposit look at Annual Percent Return or Annual Percent Yield.

While all of these values can be meaningful and interesting, they all have strengths and weaknesses when applied to a preferred stock investment. Yield-To-Call produces an annual return value that assumes that your shares are redeemed by the issuing company on the security’s call date. It also assumes that all dividend payments are of equal value.

But preferred stocks are rarely called on their call date. And the first and last dividend quarters are typically not a full quarter in length so the first and the last dividend payments are usually not for the same dollar amount as all other quarters. Plus, you cannot use Yield-To-Call at all when considering a purchase of a preferred stock that has exceeded its call date.

Yield-To-Maturity is a formula that calculates your annual return assuming that you hold the shares until the security’s maturity date. But most preferred stocks have a maturity date that is decades into the future and is therefore commonly ignored by preferred stock investors. The shares are much more likely to be redeemed by the issuing company or sold by the shareholder than held until the maturity date so Yield-To-Maturity, while getting around the call date problem, is unlikely to reflect the preferred stock investor’s actual experience.

Yield-To-Worst uses the Yield-To-Call formula but for a variety of future dates. Then you pick the worst value. How to best apply the result of this exercise to a preferred stock investment can be unclear.

Most brokerage accounts and online quoting sites, when presenting annual dividend yield for a preferred stock, use Annual Percent Yield (APY), also referred to as simple yield or dividend yield, using the following formula:

The advantage of simple yield is that the formula does not need to know your sell date or sell price; rather, it reports the annual dividend yield for one year using your purchase price and assumes that you will receive four equal dividend payments in that year.

But the downside is that simple yield assumes that the investor does not reinvest the dividends. Further, simple yield does not consider the duration of the investment nor does it capture any capital gain or loss that the investor incurs upon sale; it’s result makes a statement about dividend earnings only. While adequate to use for comparisons (see A Two-Step Method Identifies Underpriced Preferred Stocks for an example), simple yield is not intended to present the total return of a preferred stock investment.

Spreadsheets And Calculators

Another problem with using yield values, as calculated by an electronic spreadsheet such as Excel or OpenOffice or a financial calculator, is that, pursuant to international standards, these tools produce a result that assumes annual compounding of interest, rather than quarterly compounding (OpenOffice is a free electronic spreadsheet program that emulates Microsoft’s Excel. Although there are probably exceptions, functions that work in Excel should also work in OpenOffice. OpenOffice is available for Windows and Mac computers from OpenOffice.org ).

Even if you specifically configure Excel’s YIELD function for four payments per year, the returned value cannot be used for an investment that pays quarterly dividends.

For example, if you compare the YIELD function’s results for two identical investments, but one pays a single dividend per year while the other pays four quarterly payments per year, the problem with the YIELD function presents itself. The investment that pays more frequently should calculate a higher yield (due to quarterly, rather than annual, compounding) but that is not what happens with the bond-oriented YIELD function. The longer the duration of the investment the greater the error becomes.

=YIELD(date(2001,1,1), date(2010,12,31), 8%, 100.00, 150.00, 1, 0)

Follow along in the formula: You purchased this dividend-paying investment on January 1, 2001 and sold it on December 31, 2010 (ten years). It pays an 8% annual dividend. You paid $100 for it originally and you sold it for $150. Dividends are paid 1 time per year at the end of the year. The zero at the end tells Excel to use 30 day months and a 360 day year (12 months of 30 days each). This is common for bonds and preferred stocks.

The above Excel YIELD function calculates an annual yield for this investment of 10.99%.

Now here’s the same investment, except I tell the YIELD function that dividends are received four times per year (next-to-last parameter):

=YIELD(date(2001,1,1), date(2010,12,31), 8%, 100.00, 150.00, 4, 0)

Remember, the more frequently the investor receives dividends the higher the return should be (quarterly compounding is better than annual compounding). But that’s not what happens with Excel’s YIELD function (or with financial calculators). Where the annually paid investment returned a YIELD value of 10.99%, the Excel YIELD function returns an incorrect value of 10.83% when told that dividends are received quarterly. The value should go up, not down.

Financial calculators and Excel’s YIELD function, by international standard, use annual compounding which produces an incorrect result for preferred stock investors.

Effective Annual Return

Preferred stock investors need a return calculation that has much more flexibility than these yield alternatives, a calculation that reflects the realities of investing in preferred stocks — partial first and last quarter dividend payments, equal quarterly dividend payments in between with quarterly compounding, capital gains and losses and the ability to specify the duration of your investment, your purchase price and sell price.

Such a calculation is called the Effective Annual Return (EAR).

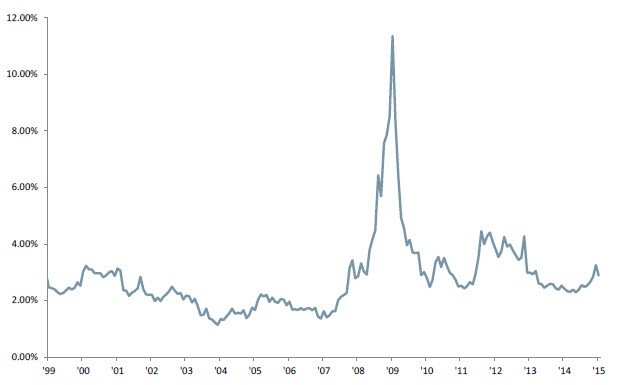

The EAR calculation assumes that the investor not only reinvests their dividends, but does so at the same dividend rate as the preferred stock shares that generated the dividend. If you hold your shares during a period of increasing dividend rates, this assumption will understate your annual return since future dividends, when reinvested, would produce a higher return. If, for example, you believe that preferred stock dividend rates are likely to be higher in the future, then the EAR calculation is going to slightly understate your actual return. Conversely, if future rates are lower than today the EAR value will slightly overstate your return.

There are two ways to calculate EAR, one that is tedious and very prone to error but can be done with a piece of paper and a regular calculator and a second that is very easy to set up but requires an electronic spreadsheet program (such as Excel or OpenOffice).

To read about both methods: I publish two preferred stock research newsletters each month, one free and one on a subscription basis. Those signing up for the free CDx3 Newsletter receive a 22 page special report titled Calculating Your Rate Of Return . The report presents both methods for calculating EAR and compares the results.

I will present the easy electronic spreadsheet method here.

Two Steps

EAR for a preferred stock investment is calculated in two steps. The first step deals with the quarterly nature of preferred stock dividends. This is called the quarterly internal rate of return. Once we have the correct quarterly internal rate of return value for our quarterly dividends, we can annualize that value to produce the EAR in the second step.

Step 1: To calculate the quarterly internal rate of return, use the following RATE function:

RATE( [number-of-div-payments], [quarterly-div-amount], -[purchase-price], [sell-price] )

Note that the [purchase-price] value is entered as a negative number (cash out). I’ll show you how to adjust this RATE function to accommodate the first and last partial dividend payments momentarily.

Step 2: To produce the EAR with quarterly compounding, use this formula:

( (1 + [r])^4 ) — 1

The [r] value is provided by the RATE function in Step 1.

Let’s apply this two-step EAR calculation to three real preferred stocks as you would use them in Excel or OpenOffice (the below formulas can be copied directly into your spreadsheet).

The source for all preferred stock data in this article is the CDx3 Notification Service database and Preferred Stock Investing, Fourth Edition. see PreferredStockInvesting.com. Disclaimer: The CDx3 Notification Service is my preferred stock email alert and research newsletter service including data for all preferred stocks and Exchange Traded Debt Securities traded on U.S. stock exchanges.

Note that while these are real preferred stocks, these scenarios are intended to illustrate how the EAR calculation is performed; the scenarios themselves are entirely fictitious.

Scenario #1: JPM.PC from JP Morgan (NYSE:JPM ), 6.7% Coupon, April 2, 2015 Call Date, $25.00 Par

You purchase JPM.PC on its March 29, 2010 IPO date for $25.00 and hold it for five years (20 quarters) until JP Morgan calls your shares for par on JPM.PC’s call date of April 2, 2015. The quarterly dividend paid by this 6.7% preferred stock is $0.42 per share. Your EAR is 6.891%, higher than the 6.7% coupon due to the value of reinvested quarterly dividends.

Step 1: =RATE(20, 0.42, -25, 25 ) = 1.680% quarterly internal rate of return

Step 2: =( (1 + 1.680%) ^ 4) — 1 = 6.891% Effective Annual Return

Here’s how to set this up in Excel or OpenOffice.

By setting this up and plugging in your four values, this spreadsheet will calculate your quarterly internal rate of return from Step 1 and your Effective Annual Return from Step 2. Note that for older or stripped-down versions of Excel you may have to install the RATE function from the product CDs.

Scenario #2: BWF from Wells Fargo (NYSE:WFC ), 7.875% Coupon, March 15, 2013 Call Date, $25.00 Par

You purchase BWF on its March 7, 2008 IPO date for $24.50 and hold it until Wells Fargo prematurely calls BWF pursuant to Section 171 of the Wall Street Reform Act on January 1, 2013 (19 quarters). Your EAR is 8.622% which allows for not just reinvested quarterly dividends but also your $0.50 capital gain.

Step 1: =RATE( 19, 0.49, -24.50, 25 ) = 2.089% quarterly internal rate of return

Step 2: =( (1 + 2.089%) ^ 4) — 1 = 8.622% Effective Annual Return

This scenario uses a purchase price of $24.50 at IPO. Savvy preferred stock investors are able to purchase newly issued preferred stocks for discounted market prices (below par) by taking advantage of how new preferred stocks are introduced to the marketplace by their underwriters. Doing so is explained in the Seeking Alpha article titled New Preferred Stocks: How To Buy Shares For A Discount Below Par .

Scenario #3: PSB.PT from PS Business Parks (NYSE:PSB ), 6.000% Coupon, May 14, 2017 Call Date, $25.00 Par

You purchase PSB.PT today at $24.36 then sell it for $25.80 on June 30, 2014 (9 quarters). Your EAR is 8.933% since the duration of this investment is shorter than the others (i.e. you made the money quicker) and realized a $1.44 capital gain.

Step 1: =RATE( 9, 0.38, -24.36, 25.80 ) = 2.162% quarterly internal rate of return

Step 2: =( (1 + 2.162%) ^ 4) — 1 = 8.933% Effective Annual Return

Step 1 of the EAR formula presented throughout this article can be slightly modified to accommodate the partial first and last dividend quarters that are common with preferred stock investing. Here’s the modified formula.

RATE( [number-of-div-payments + 1], [quarterly-div-amount], -[purchase-price minus extradays-div-amt], [sell-price minus quarterly-div-amount] )

For an explanation, please see the special report titled Calculating Your Rate Of Return mentioned above.

University accounting professors will tell you, as one did with me, that the EAR calculation also works for those who consume, rather than reinvest, the quarterly dividends. The thinking goes that once the dividend is received, the investor will put that cash toward the alternative that provides the highest value, whether or not that value comes in the form of cash (as with reinvesting the dividend) or continued life (as with using the dividend to purchase groceries). If the investor chooses to buy groceries over reinvesting at, say, 7%, then continued life must have a value of at least 7% to the investor.

So the EAR value properly reflects the return to the investor regardless of how the investor chooses to realize the value of their dividends (more shares or more groceries).

I’ll let you chew on that one.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.