Preferred Stock ETFs Great Choice for Income Investors ETF News And Commentary

Post on: 1 Июль, 2015 No Comment

Markets have seen a soft start to the year, thanks to concerns related to economic recovery and emerging markets. Though major indices receovred last week, they have failed to deliver positive returns so far since the start of the year. (read: 3 Low Risk ETFs for a Stormy Market )

The Fed has trimmed asset purchases twice since December last year. Though the gradual withdrawal of monetary stimulus is definitely a matter of concern, unsupportive economic data including two months of back to back weak U.S. job growth is making investors jittery about the rosy picture projected earlier.

Also, an uninspiring earnings outlook from most of the companies for this year has added to the woes, making investors believe that last year’s party is now over and the markets are due for some correction now.

Not only are things unpleasant here, China, the world’s second largest economy, is currently faced with a shadowy financial market and concerns related to growth. (read: China ETFs Struggle on Weak Data, Bailout Speculation )

Also, the axe on stimulus has not spared the emerging markets. These countries are witnessing an outflow of cheap foreign money, causing their currencies to see the worst fall in five years.

Interest Rates Plunging

Surprisingly, the turmoil in the emerging markets has led to a dip in U.S. interest rates, even in the face of the Fed taper. Investors in emerging market nations are fleeing their risky securities for safe haven U.S. T-Bills. This massive surge in demand for safe haven investments has sent interest rates southward. In fact, the rates on the benchmark 10-year government bond have fallen to 2.7%, 30 basis points lower than the rate seen at the beginning of January.

Rock bottom interest rates have precipitated demand for high yielding investment avenues. Though there are quite a few options, the current combination of falling rates and higher equity risks makes investing in preferred stocks as one of the most favored spots. (read: 3 Bond ETFs Surging as Interest Rates Tumble )

Preferred Stock ETFs in Focus

Not only do the preferred stocks offer considerably higher yields, they also provide an opportunity for capital appreciation. They are hybrid securities having the characteristics of both debt and equity. The preferred stocks pay the stockholders a fixed, agreed-upon dividend at regular intervals, like bonds.

Preferred stocks are thus quite stable and generally have a low correlation with other income generating segments of the market like REITs, MLPs, corporate bonds and TIPs. ( Are Preferred Stock ETFs Worth the Risk?)

Though investors can buy individual companies’ preferred stocks, buying preferred stock ETFs can be a very convenient way to invest in a basket of diversified companies at a low cost.

Below we have highlighted three ETFs, which not only offer substantial yields but also provide good opportunity for capital appreciation.

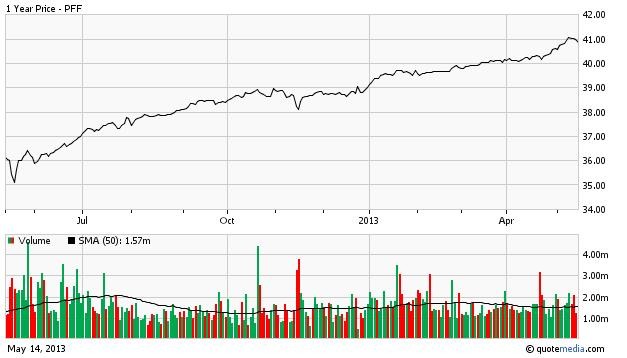

iShares U.S. Preferred Stock ETF ( PFF )

The fund is the most popular preferred stock ETF in its space with an assets base of around $8.5 billion. The fund has a very attractive payout, with the 30-day SEC yield at 6.26%.

PFF tracks the S&P U.S. Preferred Stock Index, holding 316 securities in its basket.  Though well diversified as far as individual stocks are concerned, the fund has some concentration risks related to sectoral allocation. More than 70% of the fund assets are allocated towards financials (banks, financial services and insurance).

However, the fund is pretty liquid, with daily volume exceeding 1.7 million shares a day. The fund charges 48 basis points as fees to investors.

HSBC Holdings plc (2.63%), GMAC Capital Trust I (1.88%) and Barclays Bank plc (1.75%) are the top three holdings of the fund. (Read: Complete Guide to Preferred Stock ETF Investing)

Though a spike in Treasury rates was a drag for this fund and it lost 7.3% in 2013, the fund has added a decent 3.8% since the start of the year.

PowerShares Preferred Portfolio (PGX)

Another fund targeting the preferred stock space is PGX. The fund holds a portfolio of 192 preferred stocks in its basket, tracking the BofA Merrill Lynch Core Plus Fixed Rate Preferred Securities Index.

The fund is well spread out among individual stocks, as no single stock holds more than 4.01% of the total fund assets. Like PFF, financials dominates this fund as well, with energy, consumer discretionary and materials having less than 0.5% exposure in the fund.

Barclays Bank plc (4.01%), HSBC Holdings plc (3.11%) and Morgan Stanley Capital Trust VII (3.09%) are the top three holdings of PGX.

With the 30-day SEC payout yield of 6.46%, the fund too to is a solid income destination.

The fund has returned 4.3% in 2014.

PowerShares Financial Preferred Portfolio ( PGF )

Launched in December 2006, PGF tracks the Wells Fargo Hybrid and Preferred Securities Financial Index, managing a fund size of $1.4 billion.

Holding 73 preferred stocks in its basket, the fund provides an exposure to U.S. listed securities issued by financial institutions. (see all Convertibles/CEFs/Preferred Stock ETFs )

The fund seems to contain some concentration risks as the top ten holdings form around 40% of the total fund assets.

Like its above mentioned counterparts, the fund too has a notable 30-day Sec yield of 6.32%.  Though PGF lost 7.78% in 2013, it is up 3.6% since the start of the year.

Bottom Line

There has been an important shift in the preference of asset classes this year. While equities were the most sought after by investors in 2013, they are now abandoning these risky asset classes and changing their portfolio asset allocations.

Given moderate GDP growth, low inflation and subdued interest rates, preferred stocks are certainly expected to be on the investors’ favorite list this year. Investors should however keep in mind that the high payout from this asset class does not come without its own share of risks.

Preferred stocks carry the risk of regulation changes, higher interest rates and heavy concentration in financials.  As such, investors should carefully analyze the risk-reward characteristics of the above mentioned funds and then decide which fund best fits their investment objective.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>