Preferred shares How to navigate rising rates The Globe and Mail

Post on: 2 Июль, 2015 No Comment

It’s time to take stock if you’re one of the many investors who manoeuvred around low bond yields by putting money into preferred shares.

International Business

But let’s not overdramatize the risk. As with bonds, the danger with preferred shares in a rising rate environment is a decline in price. If you hold preferred shares issued by a blue-chip company, there is minimal risk that your quarterly dividends won’t be paid. Remember two things: Preferred shareholders only take a hit after a company has stopped paying dividends on its common shares, and rising interest rates suggest the economy and corporate earnings are strong enough to sustain dividend payments.

Be honest with yourself – how would you react if the price of your preferred shares fell by 10 to 15 per cent? Investment industry pros think people don’t have much resilience after years of financial market surprises.

“They can’t withstand the volatility,” said Tara Quinn, a preferred share specialist in the ScotiaMcLeod Portfolio Advisory Group. “They want to get out to save their capital.” Translation: They want to sell at the worst possible moment – after their investments have declined in value.

The preferred shares most vulnerable to rising rates are known as perpetuals. The name comes from the fact that these shares pay a quarterly dividend indefinitely – there’s no firm date for redemption or for resetting the dividend to reflect changing interest rates. In a sense, that’s a plus for income-seekers because some perpetuals offer dividend yields in the 5 per cent range in some cases. Interest rates will have to rise quite sharply to get you that much in a guaranteed investment certificate.

Here’s the problem with perpetuals. They could fall sharply in price if interest rates jump. In fact, Ms. Quinn did an analysis showing the price of a perpetual preferred share that yielded 5 per cent when first issued would fall 16.7 per cent if long-term government bond yields rose by a full percentage point.

A decline of that magnitude is unlikely, however. The reason is connected to another factor in determining market prices for perpetuals – the credit spread, or premium these shares offer over the 30-year Canada bond.

The more risk investors see in perpetuals, the higher the credit spread gets. The spread is about 2.60 percentage points right now, a level that could shrink a bit in Ms. Quinn’s estimation if we see improved economic growth. If she’s right, it implies a rise in perpetual preferred share prices that would offset declines caused by rising rates. Slightly offset, that is. Ms. Quinn said price declines in the 10 per cent range are still quite possible.

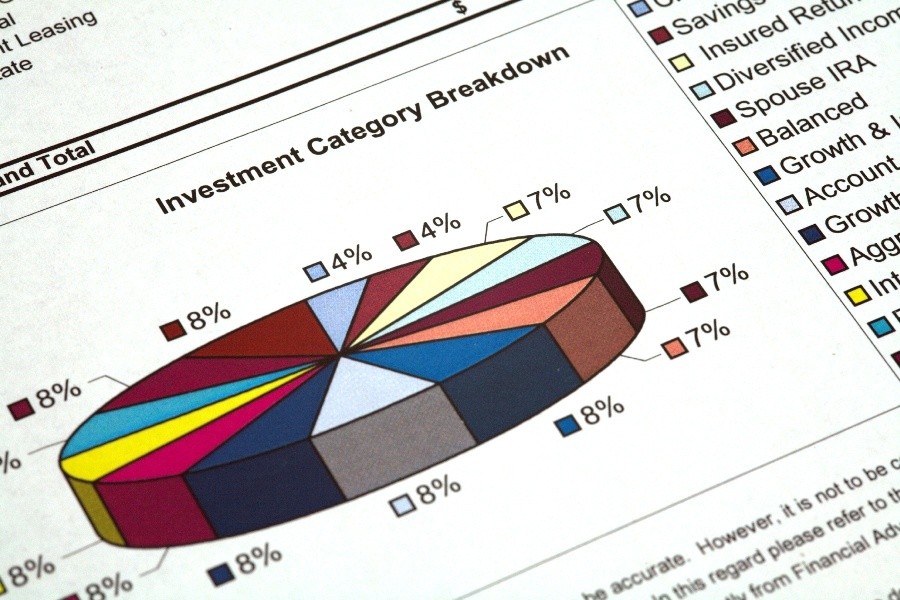

Alexandre Cassis, a portfolio manager with Fin-XO Securities in Montreal, suggests investors avoid perpetuals altogether. He’s been recommending clients use a portfolio of 10 different preferred shares, seven of them in the rate-reset category and three in the floating rate group.

In a rising rate environment, rate resets have an edge over perpetuals in that they are periodically reviewed by the companies that issue them. Issuers have the option of either redeeming the shares or resetting the payout so it’s in line with current market conditions. This explains why rate reset preferreds are considered to be less vulnerable to rising rates than perpetuals, which have a fixed payout that never gets adjusted.

Rate resets issued by the banks are a special category that I addressed in a recent column (online at tgam.ca/C83x). As for non-bank rate resets, they can be dividend to two groups, one of them trading at a premium to their $25 issue price and the other trading at a discount. A premium suggests investors expect a rate reset preferred share to be redeemed at the next reset date for $25. If you pay more than that for these shares, you face a capital loss on redemption.

Mr. Cassis suggests buying shares with reset dates staggered through the next four or five years. Think in terms of a bond or GIC ladder – you want preferred shares resetting every year so that you have the opportunity to benefit from adjustments to prevailing rate trends.

What’s preferred among the preferred

Adviser Alexandre Cassis of Fin-XO Securities in Montreal is suggesting this portfolio of preferred shares for his clients right now. These shares were chosen because they should cope well with rising interest rates.

Rate reset preferred shares