PowerShares ExchangeTraded Fund Trust II(NYSEARCA SPLV) Five Defensive Funds To Guard Your Nest Egg

Post on: 18 Май, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

The following outlines five funds that may be useful tools for your portfolio in the event that stocks have reached their peak.

PIMCO Enhanced Short Maturity ETF (MINT)

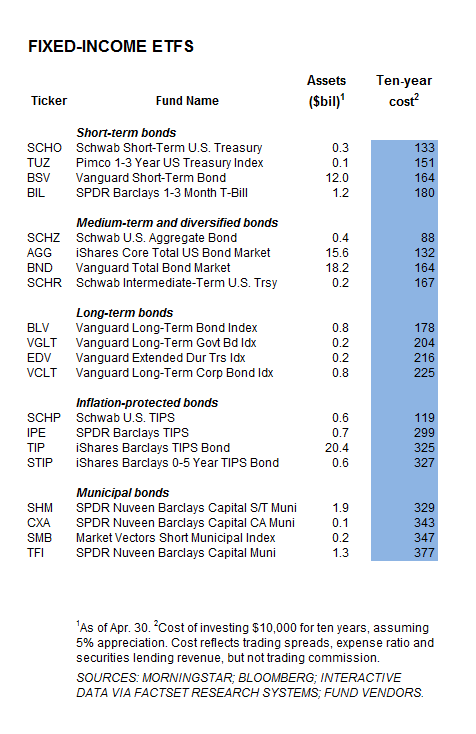

Conservative investors that are looking for a modest yield while having a low sensitivity to interest rates might consider an ultra-short duration bond fund such as the PIMCO Enhanced Short Maturity ETF (MINT).

According to Index Universe. this ETF has accumulated more than $1.7 billion in new assets this year as investors have looked to shorten the duration of their fixed-income portfolios. With the yields in money market accounts essentially at zero, even an ETF like MINT with a distribution yield of 0.77% looks attractive. Particularly when you consider that there are very little price fluctuations because of its focus on the short end of the yield curve. This option could present an excellent safe harbor for retirees or minimum-volatility seekers that aren’t concerned with a few months of reduced coupon payments.

An ultra-short bond fund should be used as a temporary holding spot for excess cash that you want to put back to work in stocks or bonds at more attractive prices. It reminds me of a phrase I often use: “nice place to visit, but I wouldn’t want to live there”. This conservative option will serve your portfolio well during times of volatility.

James Balanced Golden Rainbow Fund (GLRBX)

When it comes to picking a conservative allocation fund for your portfolio there is no better place to turn than the James Balanced Golden Rainbow Fund (GLRBX). This 5-star Morningstar rated fund has been persistently outperforming its peers for over two decades. Its investment mandate is to achieve total return through both growth and income while preserving capital in declining markets.

The fund primarily invests in undervalued stock and fixed-income securities with a healthy balance between the two asset classes. One of the keys to the funds success has been the lee way that it gives its managers to increase or decrease the amount of stock or bond exposure in the portfolio. That way they are able to tactically shift their strategy to adapt to changing market conditions.

With a total expense ratio of 1.07%, GRLBX is a bargain for the expertise and track record that it has provided investors for the last two decades.

PowerShares S&P 500 Low Volatility Portfolio (SPLV)

I have been a big fan of low volatility ETFs since the initial launch of the PowerShares S&P 500 Low Volatility Portfolio (SPLV) back in 2011. The basis behind the strategy for this ETF is to take the underlying S&P 500 index and identify a subset of 100 stocks that have the lowest price volatility for the last quarter. What you are left with is a unique portfolio of stocks that typically have very steady returns and smaller price fluctuations. The top sectors within SPLV include utilities, consumer staples, and financials which combined make up nearly 70% of the fund’s asset allocation.

Generally you will see these low volatility funds decline less than their fully loaded index peers during periods of price decline. For trend followers and active managers these funds may give us the ability to stay invested during periods of short-term market corrections instead of getting stopped out of a position.

This ETF makes an excellent addition to any portfolio as a core large-cap holding in adiversified investment vehicle . In addition, PowerShares also has low volatility ETFs available in small-cap, mid-cap, and international regions.

Vanguard LifeStrategy Conservative Growth Fund (VSCGX)

If you are looking for a conservative index fund with a low expense ratio, then the Vanguard LifeStrategy Conservative Growth Fund (VSCGX) may be a perfect fit. The fund sticks to a rigid allocation of 28% domestic stocks, 12% international stocks, 48% domestic bonds, and 12% international bonds. This 40/60 allocation of stocks and bonds is widely considered to be a conservative asset allocation benchmark.

One of the advantages of owning a balanced fund is that the volatility in bonds and stocks offset each other which create a smooth price trend. While you give up the potential for higher returns, you also gain the assurance that you will not experience as much drawdown as a typical stock-only index.

One of the most attractive qualities of VSCGX is its 0.15% expense ratio which is one of the lowest in the industry. Vanguard has always been known as a company that will stand behind low fee index strategies for their investors.

iShares Floating Rate Note ETF (FLOT)

Floating rate notes make an excellent alternative to traditional fixed income because they contain an adjustable coupon feature that resets every 90 days according to an interest rate index such as Libor. This makes them less susceptible to interest-rate volatility.

The iShares Floating Rate Note ETF (FLOT) holds investment grade floating rate notes primarily of financial and industrial sector companies. This ETF has been very stable despite the volatile interest rate environment this year because of the very short duration of its portfolio. FLOT represents notes with the highest credit quality which is why the yield is only 0.45%, however the price of this ETF should remain stable even if interest rates move higher.

Floating rate notes have been well publicized as an alternative safe haven to longer duration bonds in the event that the Federal Reserve starts to tighten their monetary policy. This ETF may be a temporary hiding spot for a portion of your portfolio in the event that we see additional volatility in credit this year.

This article is brought to you courtesy of David Fabian from Fabian Capital Management .