PostRecession Investing Rules For Wise Risk Takers

Post on: 9 Июль, 2015 No Comment

The following are some rules for post-recession investing.

Return to investing and investing wisely

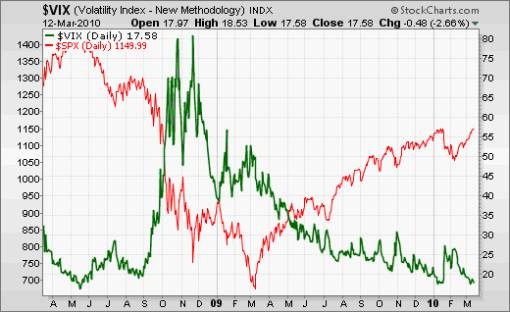

When the markets were up, you were an optimistic investor. Post-recession, the level of optimism is at a low. But you ought to return to investing. And this is the right time to do it. The general guideline to invest during this period is to exercise caution with aggression.

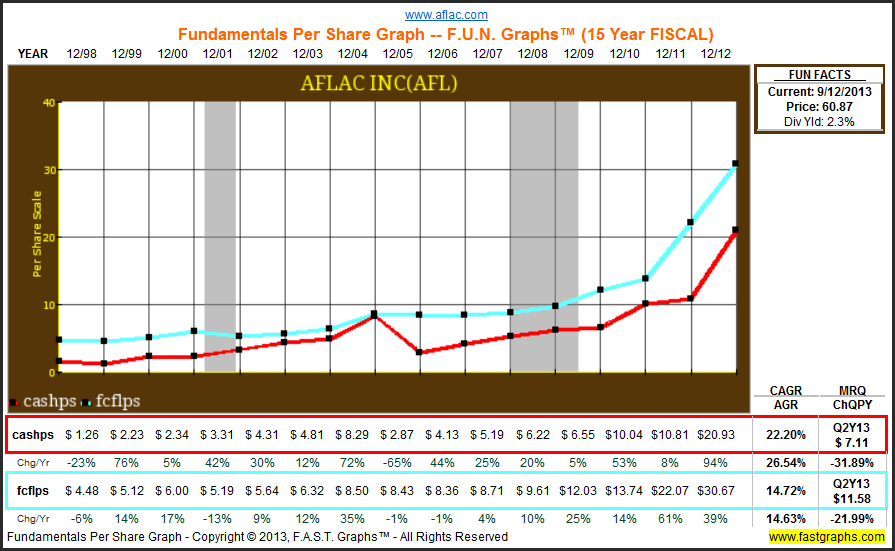

You have to aggressively look at stocks, commodities, foreign exchange. and government bonds. You have to spend time analyzing them. If their fundamentals are good, you just buy them. This is one of the rules for post-recession investing. When something looks good, it is good!

Understand the level of risk you can tolerate

Assess the amount of funds that will go into your post recession investing endeavors. Do you have enough bank balance to negate a steep decline in your investments? What if a double-dip recession happens and spirals your investments into chaos?

The level of risk you can tolerate is an important determinant to success when investing post a period of recession. It is always good to be safe than sorry.

Make cross-border investments

You can invest in certain commodities such as timber across the borders. You typically buy commodity stocks from timber companies at the stock exchange. By doing this you gain access to the foreign country.

Cross border investments can be made for other commodities such as coal. Make investments in such essential commodities. Another high value commodity for cross border investment is crude oil. Post recession or just before it is the ideal time to invest in crude oil.

Invest in real estate

Rules for post-recession investing differ by investors. But all of them would agree on one thing. Real estate is a high-worth investment segment after a recession. If you are a forward thinker, you’d know the weight of this statement.

During the recent recession, many brave investors invested in properties. After the recession, another section of investors saw potential in real estate. They were not proven wrong when the economy improved. Most of them, if not all made profits in excess of 50%.

Precious metals

Rules for post-recession investing are about seizing the opportunity and not letting it pass. After a recession, the demand for precious metals picks up gradually. But most investors or the common junta don’t notice this. As a wise investor, you ought to notice this trend and invest in precious metal commodities and stocks. Remember that the buzz-phrase when it comes to post-recession investing is – Make it fast!