Portfolio Management Blending Asset Allocation And Momentum

Post on: 26 Июнь, 2015 No Comment

Of all the strategies, both passive and active, that you’ve investigated and summarized in the blog, which ones do you believe a typical investor could practically implement and benefit from? This question, posed by Rick Ferri to Steve LeCompte in a recent interview. elicited two answers from Steve LeCompte.

1) One very simple approach is to maintain a portfolio of five to 10 equally weighted asset classes (via low-fee funds, selected for diversity), rebalanced annually. This is a simplification of what is known as a Strategic Asset Allocation (SAA) plan.

2) Typical investors seeking an active edge might consider instead a strategy that selects monthly just two or three asset class proxies that have recently been strongest (such as the Simple Asset Class ETF Momentum Strategy mentioned above). This riskier strategy seeks to exploit the apparent persistence of trends in asset prices. One approach to this momentum strategy is known as the Cluster Weighting Momentum (CWM) model.

How might an interested investor actually blend these two highly recommended strategies into one portfolio management model?

Strategic Asset Allocation Dashboard: We begin with a Strategic Asset Allocation plan as laid out in the following Dashboard. While the following model allows more flexibility than the five to ten asset classes recommended by LeCompte, it is very easy to narrow the choices down to U.S. Equities (VTI. VOE. and VBR ), Developed International (NYSEARCA:VEA ), Emerging Markets (NYSEARCA:VWO ), U.S. Real Estate (NYSEARCA:VNQ ), International Real Estate (NYSEARCA:RWX ), and U.S. Bonds (NYSEARCA:BND ). Once the asset classes are selected, the next decision is to determine what percentage to allocate to each asset class. LeCompte recommends equal percentages.

I prefer to differentiate between asset classes. This is a personal and difficult decision and it needs to fit the risk tolerance of each investor. In the following Dashboard the target or assigned percentages are shown with the white background. This slide is from an operating portfolio and the actual holdings are coded with a color background. Light purple indicates the asset class is below target, light blue-green is within target limits, and red indicates the asset classes (Money Market in this example) that are above target.

Instead of selecting equal weights, as suggested by LeCompte, the following portfolio is tilted toward value. The easier decision is to take his advice and apply equal percentages to the asset classes of choice. LeCompte recommends rebalancing the portfolio annually. If the portfolio management ends with this asset allocation model, annual rebalancing is fine. Other options are to rebalance quarterly or twice a year. Regardless, use commission free ETFs where possible. All the ETFs suggested above are commission free for TD Ameritrade clients.

ETF Rankings: The second part of this blended management model adds a bit of complexity, but based on research, also adds return while reducing risk. This is a winning combination.

The first step is to select ETFs or other securities one wishes to use to populate the portfolio. Approximately 30 ETFs are included in the following table. While one could limit the choices to 5 to 10 as suggested for the asset allocation part of this management model, more are recommended if one is using the Cluster Weighting Momentum (CWM) model as we need ETF that carry a low correlation with other ETF in order to enhance this part of the blended management model.

In addition to ranking the securities, they are also broken into ten clusters based on correlations. This does require some special software, but it is available for a modest cost from a third party.

Risk reduction is on par with seeking portfolio return and that is where SHY comes into the picture. Pay special attention to securities that are under-performing SHY. ETFs such as VNQ, VWO, BIV. TIP. TLT. etc. are securities we want to avoid as they lag SHY, our cutoff ETF. Over time this ranking will obviously change.

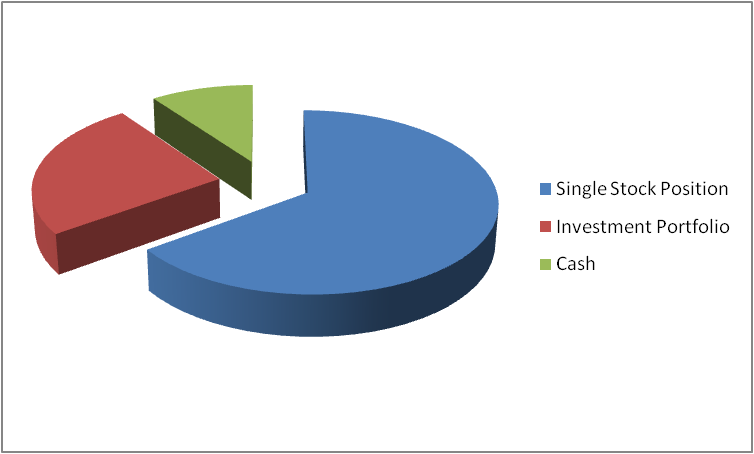

Buy-Hold-Sell Recommendations: Based on Cluster Weighting Momentum (CWM) analysis, particular ETFs rise to the top and are favored for investment. Those currently meeting this standard are VUG. SCZ. LQD. JNK. and UNG. In addition to identifying what ETFs are of interest, the software recommends the number of shares to invest based on the available cash. In the above example, $70,000 in cash is available.

If following the CWM model one would concentrate the portfolio in the five recommended ETFs and then wait until the next portfolio review. I review each portfolio I track every 33 days. There are several reasons for selecting something in excess of 30 days. 1) To avoid the wash sale problem. 2) To avoid short-term trading fees on commission free ETFs. 3) To rotate the portfolio review throughout the month so it does not occur at the same time of the month.

Where does the blending of these two management models occur? The asset classes are kept in balance so long as the ETF used to populate a particular asset class is outperforming SHY and the price of the ETF is above its 195-Day Exponential Moving Average. That data is also included in the above table.

Available cash is used to over-emphasize holdings in ETFs that are recommended in the CWM analysis. This is done to take advantage of the momentum effect mentioned by LeCompte.

Take two specific examples. VUG is one of the recommended ETFs to emerge from the CWM analysis. As a result, Large-Cap Growth would be emphasized and we would go over target in this asset class. On the other end of the spectrum, VWO and VNQ are under-performing SHY. Therefore, we would under-weight Emerging Markets and U.S. Real Estate.

The two investment strategies recommended by Steve LeCompte can successfully be blended into one portfolio management model.

(click to enlarge)

Disclosure: I am long VUG, VOE, VEA, SCZ, LQD, JNK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. I am long ETFs other than those mentioned above.