Portfolio Diversification

Post on: 3 Июнь, 2015 No Comment

Diversification is a risk management technique and strategy that mixes a variety of investments within a portfolio. The appropriate asset allocation depends on the individual investor’s time horizon, financial goals and risk tolerance. There are important tradeoffs between the goals investors have in each respect.

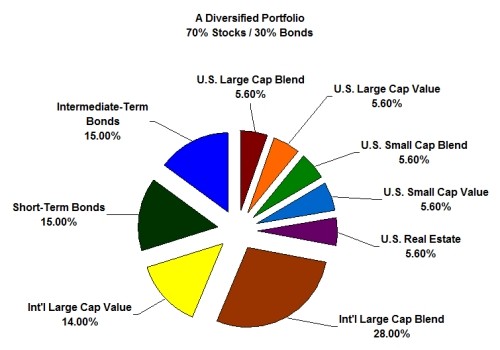

The main fundamental asset classes are cash, equities, bonds and real estate.

Investors should invest only in what they understand. It is risky to not know what you are doing.

-

Capital preservation is the primary goal of investment management and a satisfactory capital return thereafter.

Investors should not invest a large proportion of their portfolios in a stock simply because it screens as deeply undervalued. Regardless of a stock’s risk profile and apparent returns, be cautious about investing more than 10% in any one security and limit your combined weighting to speculative stocks and stocks with a high required return to 5% of your portfolio.

Investors should prefer undervalued companies with established, proven business models, a record of recurring earnings and dividends, conservative balance sheets, and competent, ethical and shareholder-focused management and directors.

Intellectually and emotionally, selling is much harder than buying. This is especially so when a stock falls below purchase price on news which undermines your initial investment thesis. But at these times the first cut is the best cut.

Short-term trading is hard to do well as the timing of trades is crucial to return maximisation, but you are unlikely to consistently pick the right times. Long-term investing is easier and you are more likely to succeed because time reduces the contribution to returns of trade timing.

The ‘sleep-at-night’ test, which assumes you are honest with yourself about the risks in your portfolio, is the most telling test of whether the securities you own are suitable for your risk tolerance and are diversified enough.

Why Diversification?

The aims are to reduce portfolio volatility and the risk of permanent capital loss. The strategy can be neatly summed up in the timeless adage Don’t put all your eggs in one basket .

The rationale behind the technique is a portfolio of different types of investments that will on average yield optimal returns while moderating or offsetting the risk posed by any individual investment within the portfolio.

Benjamin Graham, the founder of value investing. insisted on widespread diversification for value investors. Graham’s equity investments had a margin of safety individually but also the protection of a larger, diversified portfolio which ensured the portfolio’s investments would work out well in aggregate

The principle of diversification was consistent with Graham’s view that capital preservation is the primary goal of investment management and a satisfactory capital return thereafter.

Diversification should be implemented across two levels: between asset classes and within asset classes.

The principle of diversification was consistent with Graham’s view capital preservation is the primary goal of investment management, and a satisfactory capital return thereafter.

Read more about Value Investing | Portfolio Diversification & Risk Management