Pimco Total Return Size matters Fundmastery Blog

Post on: 8 Апрель, 2015 No Comment

By Kurt Brouwer

Pimco Total Return (PTTRX/ PTTDX) has nearly $240 billion in assets. Its absolute size dwarfs many bond funds, in fact, it dwarfs the GDP of many countries. The question arises then, is it too big? If size and success leads to hubris (the ancient Greek concept of arrogance and overconfidence), then Pimco could have problems.

This piece in the Wall Street Journal discusses this issue and points to some similar bond funds [emphasis added].

Pimco: Too Big to do Battle? (Wall Street Journal, July 31, 2010, Jane J. Kim)

But the portfolio—with $237.2 billion in assets—is so big that some say it cant operate as effectively in some markets as it once did. A bigger stake in low-yielding Treasurys, meanwhile, raises concerns about whether the fund, which has scored gains of 6.7% so far this year, can continue to beat the market

Whenever a top-performing fund rakes in a substantial amount of new money, investors worry whether its size will hurt future returns. Mr. Gross, however, points out that some investors were worried when the fund hit $100 million, then $1 billion and then again at $100 billion. Weve been able to outperform by our standard 100 basis points already in this particular year, he says. Theres still an unlimited amount of fish in the bond sea, he says, adding that the supply of new bond issues is increasing 100 times more than contributions to the fund

My view is that bond funds actually can benefit from size, but a growing asset base can actually hurt stock funds. With stock funds, particularly those that start out by investing in small company stocks, size poses a problem. When the fund gets big, it can no longer take meaningful positions in small companies.

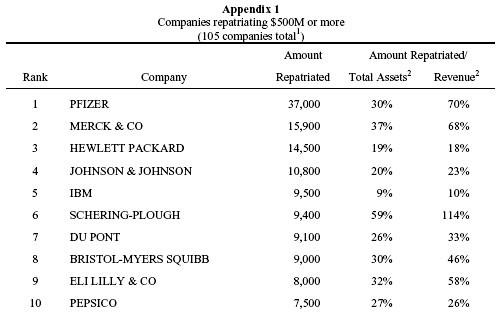

With bond funds, I have long believed that size is a benefit. Size gets them access to investment opportunities and insights and capabilities that a smaller fund may not get. And, as Bill Gross pointed out in the article below, the bond market is huge. In case you are concerned, this table from the WSJ article linked above gives some alternatives to Pimco Total Return:

Source: Wall Street Journal / Morningstar

The Vanguard Total Bond Market fund is an excellent index fund which seeks to capture the broad bond market. As such, it is a solid choice. The Harbor Bond Fund is essentially Pimco Total Return because Pimco is the portfolio manager or sub-advisor. The other funds listed are solid choices, although I do not have much experience with any of them. The piece also mentions DoubleLine Capitals Total Return Fund (DBLTX), which I like, but it is not shown in the chart.

I personally am not terribly concerned about the issue of size at Pimco because I have not seen signs of incipient hubris in my contacts with the folks at Pimco.

For example, Bill Gross metaphors and analogies are as bad as ever and this months Investment Outlook had one of the worst he has ever penned. When they start editing Bill, maybe Ill start worrying.

So, as long as the folks at Pimco stick with the principles that brought success in the first place, Im going to stay on board.

Kurt Brouwer owns shares in Pimco Total Return Fund (PTTRX) and he owns shares in DoubleLine Total Return Fund (DBLTX)

An underwhelming economic recovery Next

Income investing: stocks vs. bonds