Pimco s Total Return ETF Versus Pimco s Total Return Mutual Fund

Post on: 8 Апрель, 2015 No Comment

Pimco's Total Return ETF Versus Pimco's Total Return Mutual Fund

July 25, 2011 Virginia Munger Kahn

Later this year, investors will get the chance to invest in Pacific Investment Management Company’s new Pimco Total Return exchange-traded fund. The fund, which will be managed by Bill Gross and follow a strategy similar to his flagship Pimco Total Return mutual fund, offers investors the chance to access the skills of one of the world’s most successful fixed-income managers at a quarter or a third the cost of his mutual fund.

The new ETF, which is expected to launch sometime this autumn, will have an expense ratio of 55 basis points compared to 75 to 85 basis points for the retail shares of the mutual fund. (The Total Return mutual fund’s institutional shares, which require a minimum $1 million investment, are the cheapest way to play at 46 basis points.) The Total Return ETF is Pimco’s fifth actively-managed ETF.

Besides offering non-institutional investors a cheaper, more tax efficient way of getting access to Bill Gross’s talents, the Total Return ETF will, like other ETFs, offer more transparency into the fund’s portfolio. This has raised hopes among some investors that they will be able to mimic Gross’s trades without actually having to buy his funds, and has raised concerns about the potential for front running.

But mimicking Gross’s trades and front running a bond fund are not that easy. Bond markets such as U.S. Treasures are huge, so market moving trades are difficult. And besides, many bonds don’t trade on public exchanges, but rather in individual transactions. The value the ETF will provide other investors will be gleaning Gross’s views on corporates, treasuries and other sectors on a more timely basis, says Timothy Strauts, a Morningstar ETF analyst. That won’t affect Bill Gross or his funds.

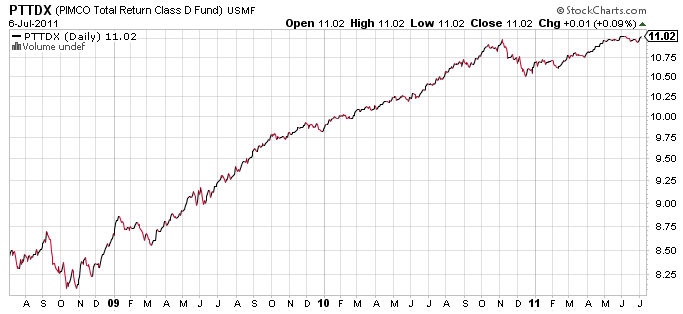

The key question now is how closely the ETF will track the performance generated by the Pimco Total Return mutual fund, which has consistently beaten its benchmark and been among the top performers in its peer group. Pimco, in naming the ETF Total Return, is clearly signaling it expects the ETF to closely track the mutual fund.

In fact, the investment strategies followed by the two funds, described in their prospectuses, are identical in almost all cases-the expected allocation to fixed income securities is at least 65%; duration will be kept within two years of the Barclays Capital U.S. Aggregate index; and both funds can invest in high yield bonds (up to 10%), foreign currency bonds (up to 30%) and emerging market bonds (up to 15%).

The only difference in strategies-and it’s significant-is that the Pimco Total Return mutual fund may invest without limitation in derivative instruments such as options, futures and swap agreements. There is no such language in the ETF’s prospectus.

The SEC is currently reviewing the use of derivatives in mutual funds and ETFs and while the review is underway, there’s a freeze on derivatives in new offerings, says Todd Rosenbluth, S&P mutual fund analyst. He adds that until the issue is resolved, the Total Return ETF will not be able to mimic the mutual fund.

The Pimco Total Return mutual fund makes extensive use of futures, options and swaps to manage risk, generate incremental returns, and gain exposure to positions quickly and efficiently. With a huge asset base of $242.8 billion, which can make trading cumbersome, the mutual fund benefits from the flexibility and liquidity that derivatives provide, says Eric Jacobson, Morningstar’s director of fixed income research. As of March 31, 2011, Pimco Total Return fund’s top four holdings were financial futures, according to Morningstar.

It’s too early to know how closely the ETF will track the mutual fund or how successful it will be given the restriction on derivatives, Rosenbluth says. That’s the key issue for people to consider. There clearly will be some differences, but how meaningful those differences are remains to be seen.

But Jacobson does not believe the lack of derivatives exposure will hurt the ETF. Because the ETF is expected to be smaller in terms of assets under management, Gross and his team should not have trouble buying cash bonds alone, he says. For example, instead of buying mortgage futures, the ETF will buy actual pools of mortgages.

Moreover, neither Jacobson nor Strauts believe the lack of derivatives in the ETF will result in a wide disparity in how the two funds perform. Jacobson notes that Gross is the subadvisor for the Harbor Bond and Managers Pimco Bond funds that employ the same strategy as the Total Return fund. While both of those funds use some derivatives, neither uses them nearly as much as Total Return. And their returns have been almost identical to Total Return’s after expenses are factored in, he says.

The Total Return ETF and mutual fund should have the same allocation to market sectors such as treasuries, corporates and foreign bonds and the same risk characteristics, such as standard deviation, Strauts says. Based on the performance of Total Return’s sister funds-Harbor Bond and Managers Pimco Bond-he figures returns should be within 20 basis points of each other on an annual basis.

One final point to consider when comparing the two Total Return versions: Due to the mutual fund’s derivatives exposure, it often distributes capital gains. That shouldn’t be a problem with the ETF thanks to its share creation and redemption process, Strauts says.