PIIGS government deficits corresponds to half of the Eurozone

Post on: 10 Апрель, 2015 No Comment

PIIGS government deficits corresponds to half of the Eurozone

Thursday, 22 April 2010 | European Affairs

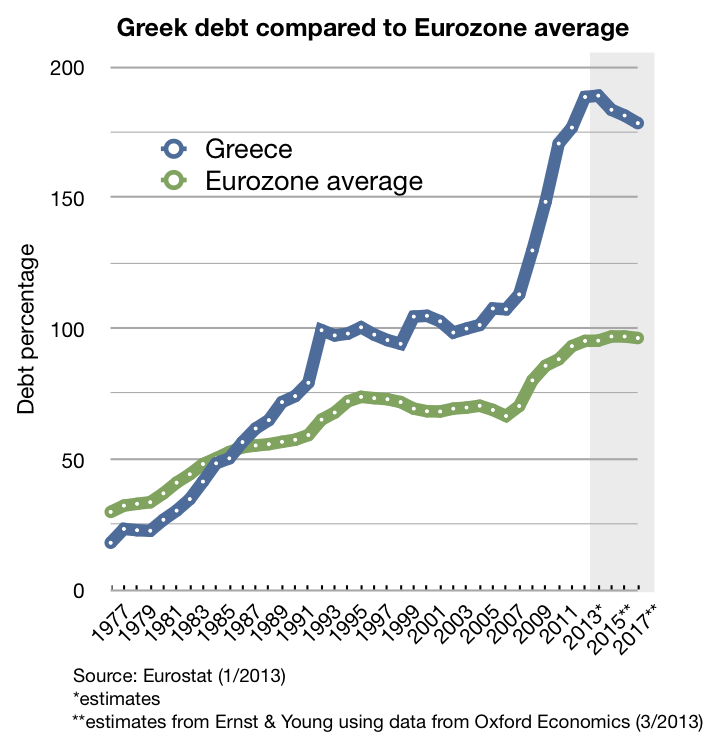

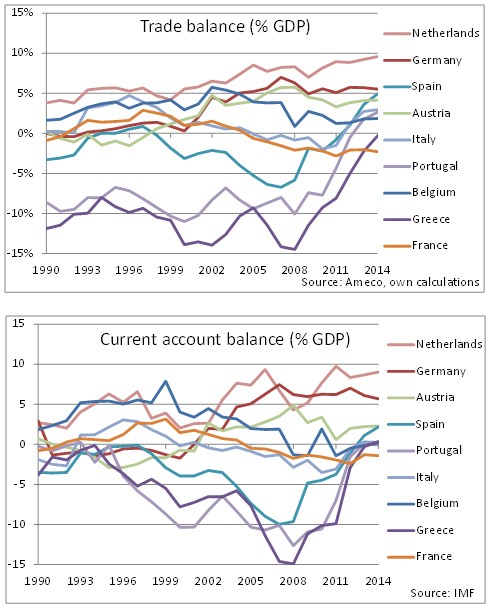

It is time to have a deeper look at government deficits in the European Union, following the press release of the latest Eurostat data today and specifically the area which has been known as PIGS (originally termed by a German minister who looked like Groucho Marx) or PIIGS lately. PIIGS is an acronym that refer to the economies of Portugal, Italy, Ireland, Greece, and Spain. Some of these countries have a high current account deficit relative to GDP. That is, they have seen large capital inflows in recent years, particularly from other countries such as Germany where investment opportunities are limited given the very poor performance of the German property market and the low yields available on German government bond markets.

The European Union and the Eurozone has since inception had a balanced current account, but that is nolonger the case. There has been significant capital flows between the euro countries. Germany, as a nation traditionally with a large current account surplus, was the main source of capital for deficit nations such as Portugal, Spain, Greece and Ireland.

Government deficit (-) / surplus (+), % of GDP

Portugal, Spain and Greece have reported large inflows of foreign capital (capital flows tend to drive current account imbalances and not the contrary) since the inception of the euro and these inflows have led to current account deficits in those countries as well as helping to spur domestic inflation and to create asset price bubbles. The Spanish property market bubble being a case in point. The sharp rise in the price of Greek government bonds, as seen by the sustained fall in yields on Greek government bonds prior to the recent sell off since the introduction of the euro, being another case in point.

A great deal of the recent turmoil on Greek bond markets may partly be blamed on the result of selective reporting, largely in the UK and US media, and, more so, speculative financial market activity. Given the very large external funding requirements of UK and US the recent crisis also appears to be an attempt to draw international capital away from the Eurozone in order that countries, such as the UK and the US can continue to fund their large and growing external deficits which are matched by large and growing government deficits. Anglo-Saxon countries do not have large domestic savings pools to draw on and therefore are dependant on external savings. This has traditionally not been the case in the Eurozone which was completely self funding until recently.

The table above shows the government deficit (-) or surplus (+) as a percentage of GDP for the period of 2006 to 2009, source Eurostat. The GDP of the PIIGS countries corresponds to a third of the Eurozone, but at the same time they accounted for half of the government deficit of the Eurozone! The biggest sinner among the PIIGS countries is Spain with a government deficit of 118 bn EUR by the end of 2009, followed by Italy (81 bn EUR), Greece (32 bn EUR), Ireland (23 bn EUR) and Portugal with a government deficit of 15 bn EUR.