Personal Finance Ask the Experts How do interest rates affect bond prices

Post on: 24 Май, 2015 No Comment

Q. When looking for a bond, at what point should you be concerned with interest rates? How much do interest rates affect bond prices? Thanks! Blake — Rocklin, CA

A: Bonds, often referred to as fixed-income assets, are a great way to diversify an investment portfolio. In the current fixed-income market, investors have a variety of choices, including U.S. government obligations, asset-backed securities and corporate, municipal or high-yield bonds.

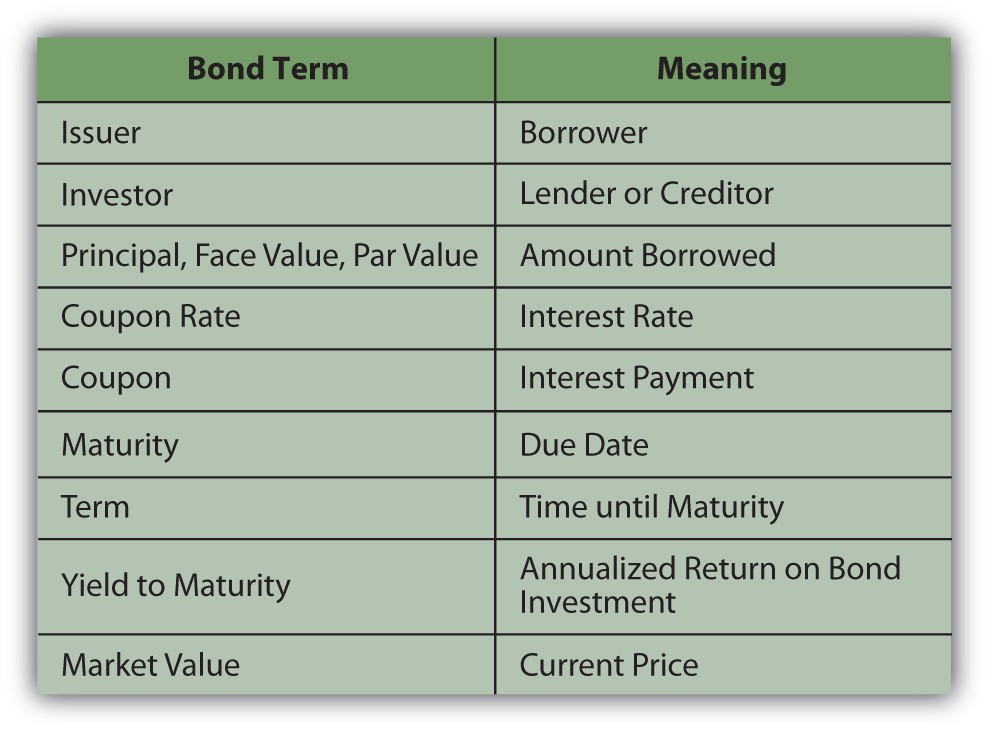

When you purchase a bond, either directly or incorporated in a mutual fund, you’re essentially lending money to the issuer of that security. In turn, the issuer promises to pay you back the principal (or par value) when the bond matures. In the meantime, the issuer also promises to pay you periodic interest payments to compensate you for the loan. This is the part where interest rates become important.

Bonds are typically issued with coupon rates that are at or close to prevailing market interest rates. When purchasing/evaluating your fixed income securities, the question to ask yourself is: how does the prevailing market interest rate affect the value of the bond you already own or a bond you want to buy from or sell to someone else. The answer revolves around opportunity cost.

Investors continually compare the returns of their current bond payments to what they could get elsewhere in the market. Bond coupon rates are mainly fixed so as market interest rates change, a bond’s coupon rate becomes more or less attractive to investors.

For example: A bond is issued for $1,000 for five years with a 5% coupon or interest rate, paid every six months. Then interest rates rise to 6%. If you want to sell this bond, who would buy it when it’s paying 1% under market rates (5% compared with 6%?) You would definitely have to sweeten the deal so the buyer of the bond gets market value. And remember, you can’t change the interest rate on the bond. That’s fixed at 5%. What you can do, however is change the price you will take for the bond. The annual payment of $50 ($1,000 x 5%) must equal a 6% payment. Doing the math, you discover that the face value of the bond must be discounted from $1,000 to $833 so that the $50 fixed payment equals a 6% yield on the buyer’s investment ($833 x 6% = $50).

On the other hand, if interest rates were to fall instead of increase, you could then sell your bond at a premium over face value because the fixed interest rate would be higher than the market rate.

Many other factors such as duration (maturity term) and issuer credit ratings can also affect the price of a bond. The third edition of The Bond Book (Everything Investors Need to Know About Treasuries, Municipals, GNMAs, Corporates, Zeros, Bond Funds, Money Market Funds and More) by Annette Thau is a great read if you’re interested in learning more about bonds.