Payden Emerging Markets Bond HighEnergy Investing

Post on: 9 Июнь, 2015 No Comment

Error.

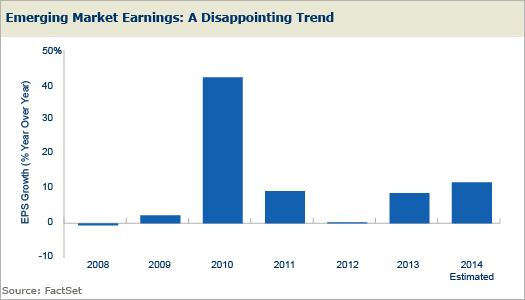

Investors have a love-hate relationship with emerging markets. Recently, the hate has been more apparent, with skittish investors worried about falling oil prices, slowing growth, and shaky debts. But Kristin Ceva, lead manager of Payden Emerging Markets Bond (ticker: PYEMX), a top-performing emerging-market bond fund with $832 million in assets, argues that the fundamental reason investors look to emerging markets—faster growth than the developed world—remains unchanged.

Kristin Ceva and Arthur Hovsepian focus on emerging-market debt—and the price of oil. Photo: Manuello Paganelli for Barron’s

With more than 60 countries considered emerging markets—including both oil exporters and oil importers, and countries across the political, economic, and geographic spectrum—it’s hard to speak of emerging markets as a group. Ceva, 48, and her co-manager, Arthur Hovsepian, 42, diversify with nearly 200 holdings spread across the globe, mixed between government debt (about three-quarters of the portfolio) and corporate bonds (one-quarter). With the dollar strong, the vast majority of their holdings are in dollar-denominated debt, and as the risks in emerging markets have multiplied in recent months—with oil below $60 a barrel, down from over $100 early last year—they’ve rejiggered the portfolio to protect it from future shocks.

“Our job is to stress-test all the names that have oil exposure, and make sure they can withstand a $40 or $50 oil-price environment over the next year,” Ceva says, noting that most of the oil companies in the portfolio are 100% government-owned entities. “That’s not our prediction, but we cannot rule that out.”

Already underweight Russia, Ceva and Hovsepian reduced exposure in November as the ruble dropped and sanctions were expanded; today, the fund has just 1.5% of assets there. The selloff of energy-related bonds has also created opportunities to buy on the cheap, she says, pointing to Kazakhstan’s state-owned oil company, KazMunaiGas, whose bonds have a yield-to-worst (the yield given the worst-case scenario, short of default) of 6.1% and a maturity of 2021. “The company has been penalized too much, and we don’t see any problems with their willingness to pay,” she says. “There are some pockets of opportunity being created.”

The fund has a good track record of finding those pockets of opportunity. Over the past five years, Payden Emerging Markets Bond has returned an average annualized 6.8%, versus 5% for the emerging-market bond category, according to Morningstar. For the past year, as emerging-market bond funds have slipped 0.8%, the fund has risen 5.3%. Its trailing 12-month yield is 5.1%.