Parabolic SAR (Stock market) Definition Online Encyclopedia

Post on: 16 Март, 2015 No Comment

Up until now, we’ve looked at indicators that mainly focus on catching the beginning of new trends. Although it is important to be able to identify new trends. it is equally important to be able to identify where a trend ends.

Parabolic SAR (pSAR)

Parabolic SAR was developed by J. Welles Wilder Jr. and is described in his book New Concepts in Technical Trading Systems .

Definition:

The Parabolic Indicator or also known as the Stop And Reverse (SAR ) method is a technical display of a line of dots located either above or below price action.

By James B. Stanley

New trader s often learn a valuable lesson very early in their trading career. And that is that any trade idea is often — at best — a hypothesis.

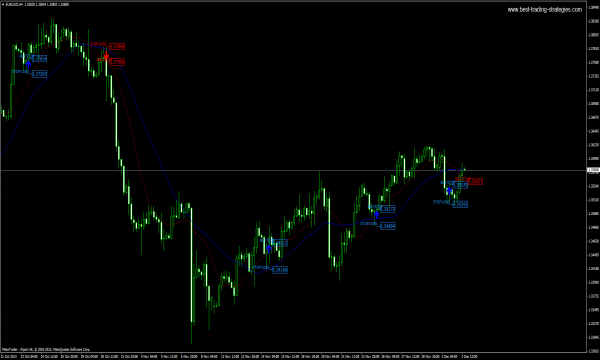

Parabolic SAR default settings (0.02, 0.2),

ADX 28 (with +DI, -DI lines)

As the Parabolic SAR is a trend following indicator. it is only designed to be used in confirmed trends. and will give very bad results in a small ranging or sideways market. Entries are signal ed by the start of a new parabolic arc, and exits are signal ed by the price touch ing the parabolic arc.

What indicators can be used to help determine stop levels? The Parabolic SAR (PSAR) or the Average True Range (ATR ). The pros to the Parabolic SAR is that the stop levels (dots on the chart below) work good in a strong trend but don’t work good at all in range s.

On day 1 of a new trade (the day that the trade is entered), the Parabolic SAR is taken as the significant point from the previous trade.

If the trade is Long the SP will be the extreme Low reached in the previous trade.

PARABOLIC SAR

Stock Trading Training- Parabolic SAR. The Parabolic SAR was developed by J. Welles Wilder. SAR actually stands for ‘stop and reverse ‘ and trails the price of a trend. When the trend changes, therefore, it stops and reverses..

Part 7: Parabolic SAR

The Parabolic System is also known as a Stop and Reverse (Parabolic SAR ) system, and it was developed by Welles Wilder, the author of the Relative Strength Index (RSI ).

The Parabolic SAR is an indicator that, like Bollinger Bands is plotted on price, the general idea of which is to buy into up trends when the indicator is below price, and sell into down trends when the indicator is above price.

I think Parabolic SAR itself can act as a better tool for any disciplined trader. That’s my personal experience too. Combination signal s (RSI. MACD. ADX etc.) sometimes misguide a trader .

Like or Dislike: 0 0

Leave a Reply.

Parabolic SAR (Stop and Reversal ) — Functioning best in trending market s, Parabolic SAR specifies where trader s should place their stops. If Parabolic SAR is above the market rate. the recommendation is to short ; if it is below, the recommendation is to go long.

Parabolic SAR. An indicator that sets trailing price stops for long or short position s. Also referred to as the stop -and-reversal indicator , Parabolic SAR is more popular for setting stops than for establishing direction or trend.

Parabolic SAR is used to set a trailing price stop loss

The Parabolic SAR provides excellent exit point s.