Optionshouse Review 2015 Rating Cost Fees IRA ROTH Stocks Mutual Funds

Post on: 27 Июнь, 2015 No Comment

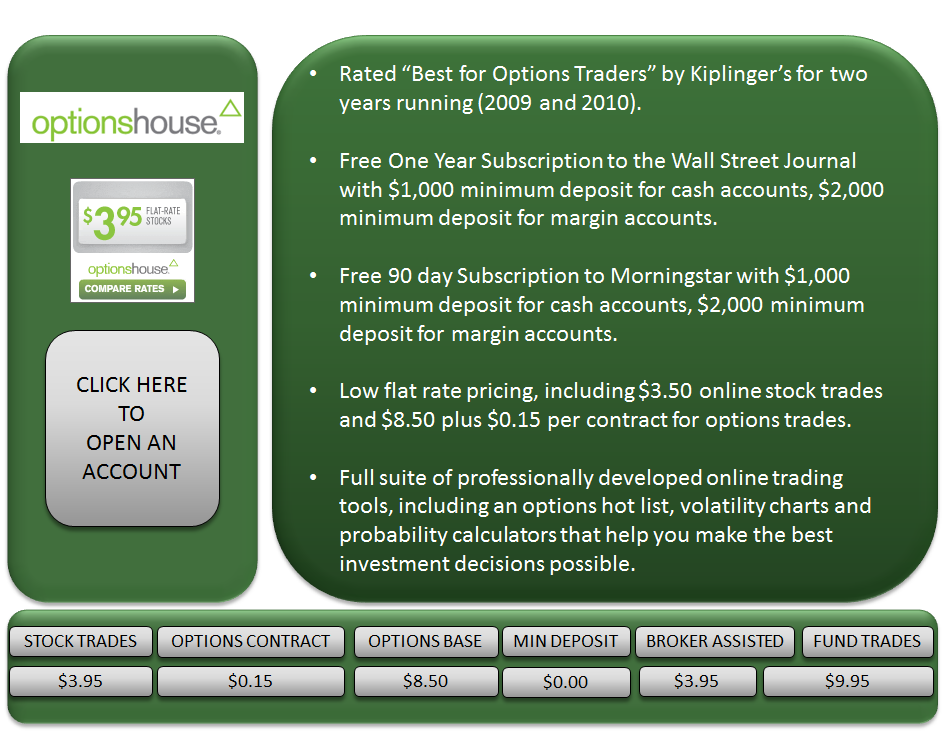

OptionsHouse Pricing

- Stocks/ETFs: $4.95 per trade

- Options: $4.95 + $0.50 per contract

- Mutual Funds: $20 per transaction for no-load mutual funds

- Call support to buy U.S. treasury bonds and listed corporate bonds

OptionsHouse Important Fees and Surcharges

- Extended hours surcharge: $0

- Large order surcharge: $0

- Penny stocks surcharge: $0.005 per share on stocks priced $2 or less that are not options eligible

- Options exercises or assignments: $5

- IRA setup fee: $0

- Annual IRA fee: $0

- Maintenance fee: $0

- Inactivity fee: $0

- Hidden fees: $0

OptionsHouse Account Advantages

- Great commissions

- Very good trading tools and charts

- Virtual trading available

- Free check-writing

- Low margin rates

OptionsHouse Account Disadvantages

- $0.005 per share surcharge on stocks priced $2 or less that are not options eligible

- 2x margin (many brokers offer 4x margin)

OptionsHouse Account Types

- Individua

- Corporate

- Roth IRAs

- SEP IRAs

- Traditional IRAs

- Joint

- UTMA

- UGMA

- Trusts

- Partnerships

- Investment Clubs

- LLCs

- Educational IRAs

OptionsHouse Review

Since 2005 OptionsHouse (OH) has been providing investors with low prices and a high-tech trading platform. Founded by PEAK6 Investments, a leader in developing high-tech tools to manage the risk of options trading, OptionsHouse began as an options trading platform exclusively before expanding in to virtually all other investment areas.

In 2014 the holding company of OptionsHouse, OptionsHouse LLC, completed a merger with competitor and fellow Chicago based online trading firm tradeMONSTER, making way for an expanded customer base and brand new trading platform. In doing so, the new firm hopes to compete with the industry giants like Schwab, Fidelity, and E*TRADE.

Fees and Account Minimums

OH introduced itself in to the trading world by being a low-cost provider and it continues to live up to that expectation. Stocks can be traded for a $4.95 flat fee, significantly lower than more established firms like Schwab and Fidelity whose fees range from $7-$10. Options are traded at the same $4.95 flat fee plus $0.50 per contract (making it a total of $7.45 to trade 5 options contracts), which once again makes the platform a market leader in options trading fees. Mutual fund trade fee of $20 is also cheap compared to many other discount brokers.

There is no minimum to open an account, and the minimum to trade on margin is $2,000 which compares favorably to other industry competitors.

Promotions

It seems that OH is constantly running new account promotions. The current promotion is 90 days of free trading (150 free trades). Promotion link: Trade free for 90 days when you open and fund a new OptionsHouse account

Investment Selection

Starting out as strictly an options trading platform, it is no surprise that OH provides investors with almost every options trading choice available under the sun. ETFs and stocks, including those on the pink sheets, are also available for trade. There are thousands of mutual funds available including Fidelity and Vanguard funds.

Platform Features

As discussed previously, with the merger of OptionsHouse and tradeMONSTER, users can now access a wide range of investing tools. Seasoned investors will love all of these features, but to the novice, these tools will be much too in depth to understand and quite unnecessary. Here are some highlights:

Trading Platform Layout

Upon logging-in, users are presented with a tri-fold layout of account information, investment positions, and a market overview. This layout can be customized to include charting, options chains, and other useful features. From this screen users can navigate to other resources throughout the site.

Options Trading

As its name indicates, OptionsHouse goes far and beyond other online brokers in the realm of options trading. Options chains are given in a clear layout and users are able to switch between expiration dates with ease. The ability to filter through the chain is a useful tool for investors who invest though given parameters. After drilling down in to a specific option contract details such as real-time trades and risk profiles are available to present users with the most information possible.

Bond Trading Tools

To no surprise, resources for trading bonds are just as in depth as stocks and options. There are not many other online platforms that give such an array of research tools for bond trading as OptionsHouse. The bond ticker is in a layout similar to that of stocks and gives real-time updates on bid and ask prices. Drilling down in to a particular bond quote, in-depth information about the bond issuance, current bond offer, and issue size are presented. There is even a bond calculator tool in which the user can simulate various prices and yields for a given bond and examine the yield curve for those simulations. This is a very useful tool and should help investors prepare for future events before purchasing a bond outright.

Mutual Fund Research

OptionsHouse may not have the biggest selection of mutual funds, but sticking with its high regard for research and tools, the platform does not skimp on its offerings for mutual fund research. The mutual fund ticker comes in a nice and easy to read layout that provides a risk profile as well as relative rankings for the fund. Through other areas of fund research users are able to see a fund’s holdings and past performance. An interesting additional feature is examining a fund’s expenses, where the user is given an easy to read explanation of the expenses for each fund and what they mean. An additional fund screening tool gives users a high-end mutual fund screener, with excellent filtering tools to narrow down a search.

Stock Trading

Charting: Charting functionality on the site is comprehensive and includes all types of views and comparison charting necessary to trade and invest like a pro. One feature that sticks out is the ability to quickly jump to important technical events and even set up alerts for an individual quote to be notified when events occur. These events are analyzed for bullish and bearish signals determined on a desired investing time horizon.

Free Virtual Trading: Ever want to try out an investing strategy without committing real money? Want to learn how to trade options for the first time? Virtual trading allows users to trade on the platform using virtual money without taking any risk. It is especially nice for beginners who aren’t yet comfortable using the platform to trade and don’t want to take any risks with real portfolio money.

LiveAction: Scanning tool that searches a database of streaming quotes in real-time to find live action and opportunities in the market. Since the scan is done in real-time users don’t have to worry about delayed data.

strategySEEK: For any given symbol input forecasts and risks and strategySEEK will analyze thousands of option trading strategies and optimize for the strategy most appropriate for your given criteria.

EXIT PLAN: Eliminates uncertainty of when to act by setting alerts or orders aligned to investors trading strategy. Establishes pre-determined exit points for every trade based on profit and loss targets as well as time horizons.

After-Hours Trading

While most online brokers offer after-hours trading up to 8:00pm, OptionsHouse closes trading at 5:00pm each day, limiting active traders in their ability to place after-hours market orders.

Mobile Trading

The mobile trading platform for OptionsHouse is comprehensive and trades can be made quickly and easily on the platform. Mobile trading is available for all Android and iOS devices, tablets, and phones. Most features such as charting and research can be done via mobile, with the only drawback being no alerts can be set.

Customer Service

OH customer service is available from 7AM to 7PM Central time, Monday through Friday. Members can additionally utilize live chat sessions to engage with customer representatives with troubleshooting, or contact the company directly.

What do the Experts Say?

While other online brokers such as E*TRADE, Charles Schwab, and Fidelity have the budgets for big nationwide marketing campaigns, OptionsHouse is seen as a top online firm even according to the experts. Financial newspaper Barron’s recently released a ranking of the best online brokers for 2015, and OptionsHouse was right at the top of the list. Coming in second place, OptionsHouse scored the highest in usability, mobile trading, and portfolio analysis and reporting. OptionsHouse may not yet have the name or size to compete with the larger online brokerage firms, but they certainly have the capabilities to do so in the future.

Review Summary

OptionsHouse is a low-cost broker that is looking to grow its business and make a name for itself. With a great new platform and tons of research available, it stacks up well with any of the big online brokerage firms. Those interested in options trading will be especially pleased with the resources available, but, other investors looking for as many investment options as possible might want to reconsider this discount broker.