Options The Basics Of Covered Calls

Post on: 26 Апрель, 2015 No Comment

Introduction

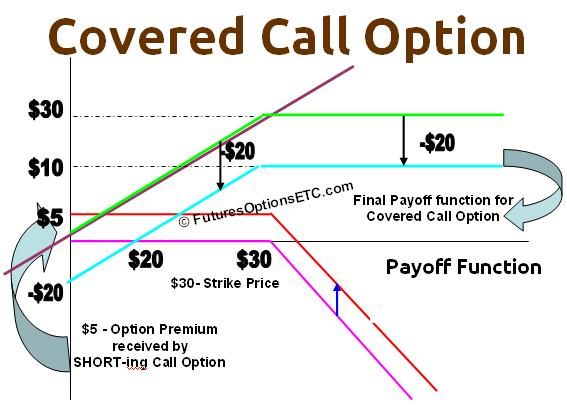

The strategy known a covered calls or covered writing involves the purchase of stock and the sale of calls on a share-for share basis. The strategy provides income in addition to any dividends received in stable markets, income and some capital gains in rising markets, and a small amount of protection of capital in declining markets.

An Example

Assume that 100 shares of stock XYZ are purchased for $43 per share and that one 60-day 45 Call is sold for $0.80 per share. Also assume that no dividends are received during these 60 days. Exhibit 1 is a graphical representation of this strategy on a per-share basis. For simplicity, commissions and taxes are not included, but these are important factors to be considered when undertaking any investment.

Strategy Discussion

The covered call position earns a profit if the price of XYZ stock is above $42.20 at option expiration. $42.20 is the break-even point at expiration and is calculated by subtracting the call premium received of $0.80 from the purchase price of the underlying shares of $43.00. The potential profit in this example is limited to $2.80 per share, which is equal to the $2 rise in price from $43 to $45 plus the call premium received of $0.80.

The upfront premium and the lower break-even point are the benefits received in return for accepting a limit on potential profits.

Don’t Forget About Risk

If the price of XYZ declines, the premium received from selling the call offers limited protection. In this example, the premium received of $0.80 lowers the break-even price to $42.20 per share. Below that price, the position is nearly the same as owning XYZ shares at a cost basis of $42.20. The covered writer bears the risk of a significant price decline in the underlying stock.

Subjective Considerations

Many investors have become disenchanted with covered writing during bull market periods. Even though covered writing usually performs well relative to bonds, this strategy can lag behind stock market gains during periods of sharply rising prices. Therefore, it should be remembered that the primary goal of covered writing is income. Consequently, an investor is suited for covered writing only if income is the goal or if the target selling price matches the effective selling price of the underlying shares. Effective selling price means the price at which shares are sold including the option premium. In the example above, the effective selling price is $45.80, which is calculated by adding the strike price of $45 plus the call premium of $0.80.

A writer of covered calls should answer, Yes to three questions:

(1) Do I believe this stock will trade in a neutral to bullish direction?

If you believe that the stock will rise or fall sharply, then a covered call is not an appropriate strategy. If the stock declines sharply, losses will mount below the break-even point. If the stock rises sharply, then the covered call limits profits. Neutral to bullish is the forecast that justifies picking this strategy.

(2) Am I willing to own this stock if the price falls a little.

Since the risk of loss in the covered call strategy is on the downside, and since every stock investors makes some mistakes in market timing, it is important to be comfortable owning the underlying stock. A common mistake in picking stocks for covered calls is to look only on the size of the call premium. Picking a stock only because it has a big call premium without knowing the fundamentals of the stock is a sure-fired way of losing money.

(3) Am I willing to sell this stock at the effective price, which is equal to the strike price plus the call premium?

It is simply not possible to have it all. It is unrealistic to expect to keep stocks that are rising in price and to also get the covered call premium. Sometimes, your timing will be perfect, and the stock will rise just short of the strike price of the covered call, which will then expire worthless. However, there will also be times when the stock price rises above the strike price and is called away. If you love a particular stock and absolutely do not want to sell it, then hold that stock in your long-term investment portfolio and don’t sell covered calls on it.

And don’t forget about early assignment. Although calls can be repurchased to close out the obligation to sell the underlying stock, the possibility of an early assignment cannot be ignored. If an early assignment occurs, then the shares must be sold.

Implementation

For the income-oriented investor suited for stock market risk, implementing a covered call means buying shares of a stock that is willingly owned and selling calls on a share-for-share basis. Some of or all of the net premium (after commissions) could then be withdrawn. But do not forget to maintain appropriate reserves for taxes. Implementation, however, does not stop there!

Covered writing is not simply a buy-and-hold strategy. It involves thinking ahead about appropriate action in both bullish and bearish scenarios. If the stock price decline occurs, where will you sell and take a loss?

If the stock rises and assignment occurs, will you re-purchase the shares and write another call, or will you invest elsewhere?

If the call expires with the stock price nearly unchanged, an equal amount of thought is required to decide whether to write another call or to sell the shares and invest elsewhere.

In this view, the goal of covered writing is income, but the risk of owning shares must be managed carefully. Results should be compared to fixed-income investments, not to unmanaged stock market indexes.

Summary

Covered writing involves the purchase of shares of stock and the sale of calls on a share-for-share basis. It is appropriate for income-oriented investors who are suited to take stock market risk. Implementation involves thinking ahead to option expiration and taking appropriate action as needed. Income-oriented investors may want to withdraw the net premium and treat it similar to interest income. Results should be measured against fixed-income investments and not against stock market averages.