Optimal Asset Allocation with the Kelly Criterion Don t Quit Your Day Job

Post on: 22 Июнь, 2015 No Comment

Share the post Optimal Asset Allocation with the Kelly Criterion

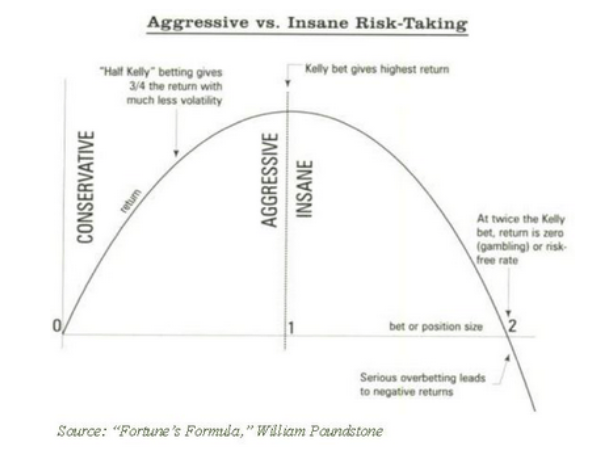

The Kelly Criterion is the brilliant summation of a betting strategy first discovered by Information Theorist John Kelly. Kelly came up with a betting system, his criterion, which optimizes bankroll growth based upon known odds and a definite payout. Roughly, if you can find an exploitable, repeatable edge Kellys system tells the maximum you should bet based upon that criteria.

Extending it a bit further (as done by folks like Ed Thorp. author of two Bibles for the investor/bettor [amazon-product text=Beat the Dealer type=text]0394703103[/amazon-product] and [amazon-product text=Beat the Market type=text]0394424395[/amazon-product]) we can do a bit of hand-waving and make it work for the stock market. While some derivations of Stock Market Kelly involve using back-looking numbers like beta or something else to approximate the continuous (read: they can go to any price) returns of securities, were going to do it in a discrete way assuming discrete numbers for wins and losses. If youre itching for something stronger, Ill see what I can do about another article in this series.

Using the Kelly Criterion For Asset Allocation

On the Worst of the Free Financial Advisor podcast. I already discussed how to calculate the proper allocation of capital into a single stock when you have a decent guess as to your edge and your odds. However, what if youre not into the whole individual stock thing and you are just trying to set up categories of assets for your retirement? Kelly can also guide you here!

Lets say that youre investing with a 10 year time-frame you want to buy a house or retire, for example. You have an extra $100,000 and are trying to determine the best course of action in allocating those funds between stocks and treasury bonds. Well, then all we have to calculate is your edge and your odds.

Like I said on the show, garbage in, garbage out. All we can do is take an educated guess and hope that it is close enough to reality to guide our choices you know past performance is no guarantee of future results. As they say, history doesnt repeat itself but it rhymes .

According to T. Rowe Price, up until 2009 (closest I can find) the S&P 500 beat Treasury Bonds 85% of the time over rolling 10 year periods starting in 1926. Well use .85 for our odds of stock out-performance. As for edge? Thats a tough one but for arguments sake, lets use the earnings yield of the S&P 500 and subtract the 10 year treasury yield to come up with (roughly) 7% 2% = 5% (lots of studies have used an edge of 5% for stock vs. bond returns so this is reasonable, or were at least wrong with everyone else). On the downside, lets say the worst youll do in stock over 10 years is 0%, a loss/opportunity cost of 2% (I know, I know. Stock has actually lost money over a ten year period before, namely 1928-1938.). Remember, normal Kelly is

John Kelly (wikipedia)

(probability*(1+odds offered)-1)/(odds offered)

It needs to change a bit to take into effect the fact that generally a security wont go to zero so even a losing bet has some value. Therefore, we simplify to

(Expected Value)/(odds offered)

Heres the math:

Expected value = .85*.05 (5%) .15*.02 (-2%) = 0.0395 divide by odds offered (winning bet so .05) = 79%.

So, in this theoretical portfolio, aim for 79% stocks and 21% bonds. The standard disclaimer applies: these numbers are guesses, so adjust your expectations accordingly.

Ready to try it out? Heres a calculator which applies the concepts above to come up with an allocation.