Operating Income and Operating Profit Margin

Post on: 11 Апрель, 2015 No Comment

Investing Lesson 4 — Analyzing an Income Statement

Operating Income and Operating Profit

Operating income, or operating profit as it is sometimes called, is the total pre-tax profit a business generated from its operations. For a business like Kellogg’s, operating income is going to represent the pre-tax profit generated from selling cereal and breakfast items. For a business like Papa John’s, it’s going to represent the pre-tax profit generated from selling pizzas. The operating profit represents what is available to the owners before a few other items need to be paid such as preferred stock dividends and

income taxes (don’t worry — we’ll cover all of those other things later in this lesson).

Operating income can be used to gauge the general health of a company’s core business or businesses. All else being equal, it is one of the most important figures you need to know when you are considering buying an ownership stake in a business through the purchase of common stock or you are deciding whether to lend to a business through the purchase of bonds. The reason is straightforward and intuitive: Unless a firm has a lot of assets that it can sell, any money that will flow to shareholders is going to have to be generated from selling something such as a product or service.

If a company is experiencing declining operating income, there will be less money for owners, expansion, debt reduction. or anything else management hopes to achieve. This is one of the reasons that it is so closely watched by lenders and shareholders. In fact, operating income is used to calculate the interest coverage ratio and operating margin.

Some businesses have operating income that fluctuates wildly with economic conditions. These firms are known as cyclical companies. They consist of things such as steel mills, aluminum manufacturers, automobile manufactures, heavy equipment manufacturers, hotels and resorts, home builders. and many luxury items, such as fine jewelry. These enterprises can still make a lot of money for their owners in the long-run but they won’t have a smooth, upward trend in operating income as they are likely to see their business contract during recessions and depressions. There is a trick you should use when valuing cyclical companies. as a single year of operating profit in isolation is not going to tell you what you need to know.

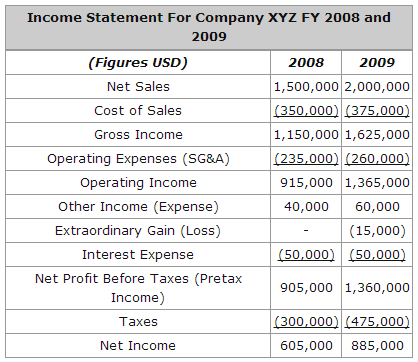

Calculating Operating Income

Operating Margin (or Operating Profit Margin ) The operating margin is another measurement of management’s efficiency. It compares the quality of a company’s activity to its competitors. A business that has a higher operating margin than others in the industry is generally doing better as long as the gains didn’t come by piling on debt or taking highly risky speculations with shareholders’ money.

The most common reason for high operating margins relative to competitors is a low-cost operating model, which means that a company can deliver merchandise or services to customers at much cheaper prices than competitors and still make money. The classic example is Wal-Mart, which is able to get everything from toothpaste to socks into its store at far lower prices due to the efficiency of its warehouse distribution system. I explained the beauty of a low-cost operating model in The Perils of Commodity-Like Businesses. They are the few, exceptional cases when you can make a lot of money in an otherwise unattractive industry.

Calculating the Operating Margin

To calculate the operating margin, divide operating income by the total revenue.

Operating Income Sales = Operating Margin

Just as you learned with the gross profit margin. what is considered good depends on the industry. There is one extremely important thing you must learn, though. I’m serious. Stop what you’re doing and focus on this statement: The most important figure is not operating income. It is return on unleveraged equity. That may not make sense to you now, but by the end of the lesson it will. It is possible (though unlikely) for a business that generates 3% operating margins to be more profitable for owners than a business that has 20% operating margins. Again, don’t worry about the reason; we’ll get to it later. Just realize it. Memorize it. Write it down on some paper. It’s that important.