Open Your Eyes to Alternative Investments

Post on: 16 Март, 2015 No Comment

Over the last several years, many investors discovered, to their unfortunate surprise, that their portfolios were not nearly as protected from downside risk as they thought and that their traditional idea of diversification fell short.

As part of our efforts to educate investors on what we call The New Diversification, we recently spoke with Professor Christopher Geczy, Academic Director of the Wharton Wealth Management Initiative and an Adjunct Associate Professor of Finance at The Wharton School. Highlights from our conversation are below:

What happened during the credit crisis? Did the entire concept of Modern Portfolio Theory fail?

It’s a great question, and my answer is an emphatic no. Modern Portfolio Theory did not fail—if anything, portfolio construction did. Portfolio construction is challenging enough to begin with, and it’s even harder during times of crisis, when correlations can work against investors.

What happened to some investors during the credit crisis and the great recession is really all about what I would call the physics of diversification, by which I mean that increases in volatility are often naturally related to increases in correlations.

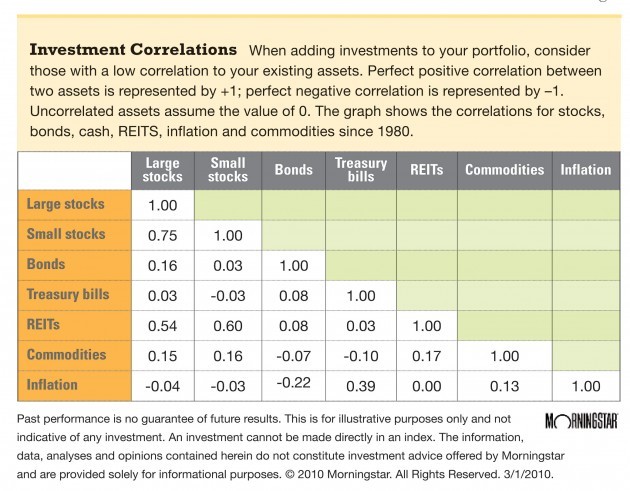

As an example, take a look at what happened to correlation measures during the two significant bear markets of the last 10 years—correlations between many individual investments and even asset classes spiked closer to 1 (with 1.0 representing a perfect correlation and -1.0 representing a perfect negative correlation).

Does this mean that there’s really no such thing as diversification?

Not at all. And to be clear, I’m not saying there is no benefit to investing in different asset classes, different regions and so on. Certainly, a traditional 60% stock / 40% bond portfolio would have done better during the credit crisis than a 100% stock portfolio and may better fit the risk profile of certain investors. At the same time, over the same 15-year time period we discussed earlier, a traditionally diversified portfolio would have outperformed an undiversified portfolio, even if it didn’t really provide much in the way of downside protection.

The point I’m making is that investors cannot necessarily rely on what is traditionally thought of as diversification to meet their long-term goals.

It is also important for investors to understand the sources of risks in their portfolios. The chart below shows that over the last 15 years, the correlation of returns between a 60/40 portfolio and a 100% equity portfolio was 0.98, meaning that they were almost perfectly correlated. Even a portfolio that is exceptionally overweight shows a similar trend. A 30% stock / 70% bond portfolio had a 0.85 correlation to a 100% stock portfolio. To me, that says that a long-only stock and bond portfolio isn’t full diversification.

What sort of assets would you include in your definition of alternative investments?