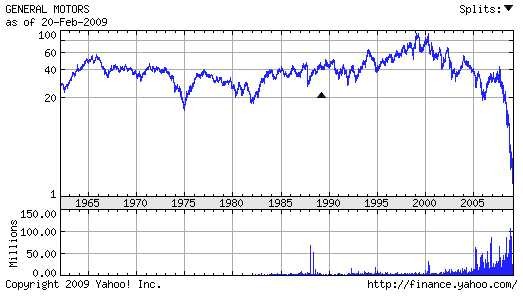

Old GM Bondholders Getting Shares in New GM May Depress Price Bloomberg Business

Post on: 23 Май, 2015 No Comment

April 7 (Bloomberg) — Investors holding bonds in the old General Motors Corp. will receive stock and warrants for shares in the new General Motors Co. on April 21, an action that analysts said may depress the stock price.

Old GM, now known as Motors Liquidation Co. will give bondholders 150 million shares in GM and warrants to buy 272.8 million more shares. A trust holding the shares will distribute them directly to bondholders’ brokerage accounts on or after April 21, according to a memo distributed Wilmington Trust Inc. a money-management firm hired by the creditors’ committee.

Some of the bondholders are retail investors who may sell the shares and briefly sink GM’s stock price, said David Whiston, an analyst with Chicago-based Morningstar Inc. Investors have probably priced in the dilution, so it won’t change GM’s long-term value, he said. He has not changed his $48 a share valuation based on the release of shares to bondholders.

“I would think that there will be more selling than holding,” Whiston said. “Any sell-off in GM is a buying opportunity. Long term, I think the company is positioned very well.”

Bondholders were promised stock and warrants in the new GM to make up for some of their loss during the predecessor company’s government-backed bankruptcy. The warrants given to bondholders for new GM stock are already in the money, according to a report by Kirk Ludtke, senior vice president of CRT Capital Group, a money management firm in Stamford, Connecticut.

Warrant Release

When U.S. Bankruptcy Court releases the warrants and stock through a trust, bondholders will collectively get 136.4 million warrants for one share each at $10 a share and an equal amount at $18.33 a share, said Wilmington Trust, which is based in Wilmington, Delaware.

Owners of old GM bonds must notify Wilmington Trust by April 15 to get stock and warrants on April 21. If they notify Wilmington later, the bondholders will get their shares and warrants at a later date.

Currently, Motors Liquidation has about $30 billion in claims allowed by bankruptcy court, of which about $29 billion are from the bondholders, said a person familiar with the matter.

There may be as much as $8.8 billion in additional claims that could be allowed by the court, Ludtke said in the report.

If the approved unsecured claims exceed $35 billion, GM would have to issue up to 30 million shares, Jim Cain, a company spokesman, said in an interview. GM doesn’t expect claims to reach that amount, the company said in a regulatory filing.

The bonds issued by General Motors Corp. should recover about 30 cents on the dollar when the shares are distributed later this month, Ludtke said in a telephone interview. He expects GM’s share price to rise to $40, which implies a recovery rate of about 40 cents on the dollar, Ludtke said.

GM shares were unchanged at $32.87 yesterday in New York Stock Exchange Composite trading, down from a high of $38.98 on Jan. 7. The shares were priced at $33 for the initial public offering in November.

To contact the reporter on this story: David Welch in Southfield, Michigan, at dwelch12@bloomberg.net.

To contact the editor responsible for this story: Kevin Orland at korland@bloomberg.net.