Okun s Law and Bernanke s bubbles

Post on: 26 Июнь, 2015 No Comment

16 March 2011

The US will face high unemployment and easy monetary policy for years to come. The American economy has grown continuously since the end of the severe recession in mid-2009. But despite recent decreases, unemployment still remains exceptionally high at 9.0 per cent. This raises the question: How much economic growth will it actually take to drive unemployment back down to an acceptable level?

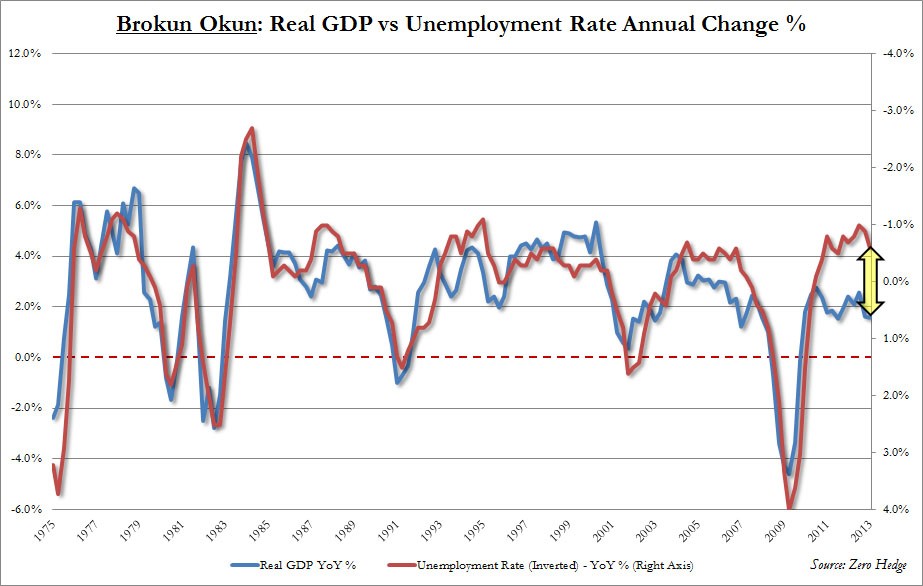

The statistical relationship between economic growth and unemployment is known in economics as Okun’s Law. It is named after American economist Arthur Okun who was the first to study this relationship back in 1962. We recently re-estimated Okun’s Law for the U.S. taking two complicating factors into account.

The first is that unemployment reacts much more strongly to economic growth in a recession than it does during expansion. The second is that falling house prices negatively affect the mobility of homeowners looking for new employment. The U.S.’s famous labour mobility is currently suffering from the drop in house prices. Nearly a quarter of all homes in the U.S. are currently worth less than the mortgage. Unemployed homeowners in negative equity will consequently be less likely to accept a job in another part of the country. This complicates the process of matching employers and job seekers. Our estimation results reveal that, if labour mobility had remained intact, unemployment in the U.S. would now be 2.5 percentage points lower. This demonstrates the vital role a housing market recovery plays in fighting unemployment.

Our estimated Okun’s Law can also be used to calculate future scenarios. The thing that struck us most from the different simulations we carried out was the very low rate at which unemployment can be reduced even if house prices recover. With sustained economic growth of 3.3 per cent, it could take another fifteen years before long-term unemployment returns to an average of 5.7 per cent.

Bernanke’s bubbles

Okun’s Law suggests that U.S. policymakers will be plagued with stubbornly high unemployment for years. There will also be limited room for them to manoeuvre in relation to budget policy. The U.S. budget deficit for 2011 is projected to be no less than 9.8per cent of GDP and the AAA rating of U.S. Treasury Bonds is increasingly becoming a topic of discussion.

This is why monetary policy will have a crucial role to play. The Fed has now pushed the boundaries of its dual mandate, which is focused on both price stability and employment, by embarking on a second round of quantitative easing. There will not be a return to neutral monetary policy as long as inflation in the U.S. does not get out of control. The Fed will not rush to raise the benchmark rate and is not expected to take a steep path to tightening. The U.S. dollar will consequently remain an attractive funding currency for carry trades and other investments for some time to come. This entails the risk of new bubbles being created around the world.

Rabobank’s Financial Markets Research specialists keep a close eye on the latest developments in the markets. They conduct special studies and offer a range of key economic and financial forecasts on foreign exchange and fixed income markets. This article was written by Philip Marey of Financial Markets Research Department.