Noodles & Company IPO Should Be On Investors Radar Noodles & Company (NASDAQ NDLS)

Post on: 16 Март, 2015 No Comment

Fast casual restaurant chain Noodles & Company (NASDAQ:NDLS ) is about to go public. The restaurant chain, which will list on the Nasdaq stock exchange, offers investors the chance to get in on the ground floor before rapid national expansion. Here’s the details (S1 ) investors need to know before shares price.

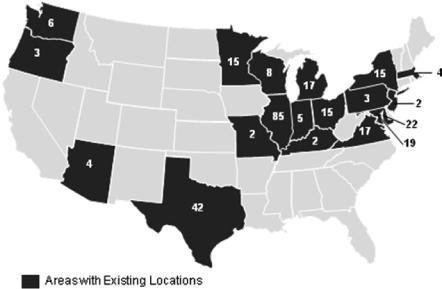

Noodles & Company, which was started in 1995, had 339 restaurants as of April 30th. Of those restaurants, 288 were owned by the company and 51 were franchised. The company only has stores present in 25 states. Noodles & Company didn’t start franchising until 2004 and has seen strong unit growth since that time.

The number that investors should be watching is 2500. This is the number of units that Noodles executives believe they can reach over the course of 15 to 20 years. This represents growth of six times current unit levels. Franchise development deals should pick up as the model is further proven. Noodles & Company says new stores experience a positive return by the third year. The average unit saw sales of $1.178 million in 2012. In the company’s early stages, it has only eight franchisees. Those eight operators are only in 10 states.

Leading Noodles & Company are chief executive officer Kevin Reddy and president Keith Kinsey. While these names won’t jump out to most investors, they serve a significant role. Both Reddy and Kinsey worked for Chipotle Mexican Grill (NYSE:CMG ) while it was still owned by McDonald’s (NYSE:MCD ). With capital from McDonald’s, the duo was able to take Chipotle to 400 locations during the years 2000 to 2005.

Kinsey and Reddy should have similar success with Noodles & Company. They have doubled the number of locations in six years already. In 2012, the company opened 45 locations, of which 39 were company owned and 6 were franchised. In 2013, the company is forecasting it will open 38 to 42 company owned locations, while also adding 6 to 8 franchised locations. Reddy and Kinsey also have an ownership stake, with pre-IPO ownership levels of 2.8% and 1.7% respectively.

To go along with unit growth, Noodles & Company has seen customer bases rise. This has turned same store sales positive over an impressive streak. In 2010, same store sales increased 3.7%. In 2011, same store sales grew 4.8%. In the most recent year ending 2012, same store sales increased 5.4%. Noodles & Company has now seen positive same store sales in 28 of the last 29 quarters.

The restaurant chain prides itself in carrying several different food culture items on its menu. The company carries food that is Asian, Mediterranean and American all on the same menu. Noodles & Company believes it is the only national fast casual restaurant with a menu that contains noodles, pasta, soup, salad, and sandwiches with global flavors.

Here are the strengths listed in Noodles & Company’s S1:

Variety makes togetherness possible

Value that is greater than our competitive price point

Everything is a little nicer here

Desirable and loyal consumer base

Consistent restaurant economics and a flexible footprint

Experienced leadership

Steady, reliable financial performance

A clear path forward