NonStandard Forms of Capital Asset Pricing Models

Post on: 29 Июль, 2015 No Comment

Non-standards Forms Asset Pricing Models

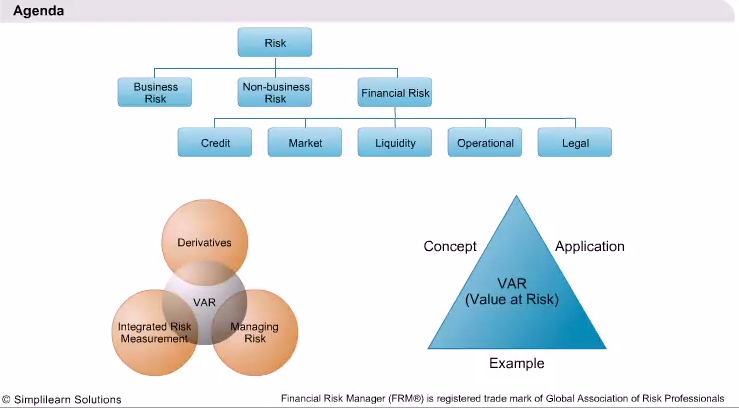

Financial Risk Manager (FRM) Part 1 of the FRM exam covers the tools and technique used in Risk Management and the theories that underlined their use

Non-standards Forms Asset Pricing Models

This is the sixth lecture in the preparation for the FRM Part 1 exam. You must go through Lecture 5 Standard Capital Asset Pricing Model — before proceeding to this topic. The upcoming topic is a very advanced topic in the field of risk management, and at many places you might not fully understand the concept underlying the assumptions or the results of some models, as in these cases researchers have postulated their own different theories, and most results are based on certain research and findings that are well beyond discussion in the course structure. GARP requires you to just have a brief idea about the various practical case scenarios that exist and their possible impact on pricing at equilibrium.

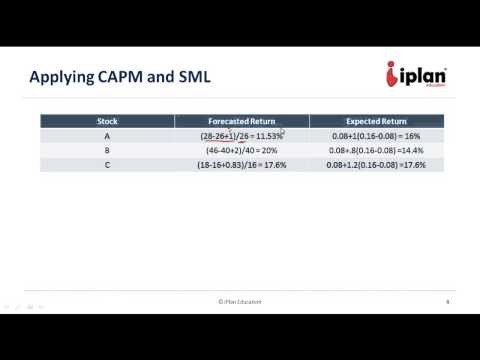

Until now, in CAPM Certification we have studied the standard form of CAPM, or the Capital Asset Pricing Model, used to arrive at the asset prices at market equilibrium. If you recall, we have made many assumptions in arriving at the model, which may not hold in practice. In this lecture, we will briefly see the impact of removing some of the assumptions. In many cases, the model is similar to the standard CAPM, but in some cases it is very different and it is even difficult to determine the price behavior. We will then briefly learn how the model changes when investors decisions are taken over a period rather than at a point of time.

No Short Selling

In one of the assumptions of CAPM, we said that short selling of any amount is possible. We also learned that at equilibrium, all the investors hold the market portfolio. If all the investors hold the same portfolio, then there is no need to short any security; i.e. shorting is not required. Hence, this is not the necessary assumption in the CAPM, and even if shorting is not allowed, there will be no impact on the CAPM derived earlier.

Riskless Borrowing and Lending

We have earlier seen in the standard form of CAPM that unlimited riskless lending and borrowing is allowed to the investor. In practice, borrowing at a risk-free rate may not be available. However, lending at a risk-free rate can be done with the help of an investment in government bonds and T-bills that have a fixed maturity and almost riskless return.