No letup on risk for hedge funds this December

Post on: 17 Июль, 2015 No Comment

David Grogan | CNBC

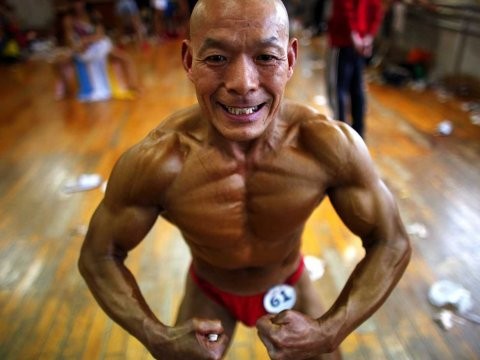

Larry Robbins

A long-held perception is that hedge funds, especially those up big for the year, like to take it easy in December. Why keep risk on, the thinking goes, when you can guarantee a fat, marketing-friendly return for the year?

Do I hope they are locking in their profits? I sure the hell hope so, said financial advisor Ed Butowsky of Chapwood Investment Management.

But anecdotal evidence, data and conversations with investors in hedge funds show most are standing by their bets this year and keeping risk on.

Take Philippe Laffont’s Coatue Management. The technology and Internet-focused hedge fund manager with $7.51 billion in assets could sit on his 16.64 percent gain through November by lowering risk levels or shifting to cash.

But, according to investor materials, Coatue recently ramped up its market exposure from 31.79 percent net long in October to 47.57 percent in November, meaning the size of its long bets on stocks outweigh its shorts by even more. Laffont did this by increasing Coatue’s long positions in Internet companies and decreasing its short bets on technology stocks (its top longs include Facebook. Google and CBS ).

(Read more. Hedge holdings soar despite returns trailing behind equities)

I honestly do not think there is as much window dressing in hedge funds as mutual funds to show different exposures or lock profits, said Karim Leguel, head of alternatives at investment advisor and manager Rasini Fairway Capital. Window dressing is the concept of a money manager altering strategy at the end of a reporting period to make their fund returns look better to investors.

Coatue isn’t alone.

—David Tepper’s Appaloosa Management’s main fund is up 38.3 percent through November net of fees on investments like Delta Air Lines and United Continental Holdings but has not cut its risk levels, according to a person familiar with the situation.

—Larry Robbins’ Glenview Capital Management is up 37.48 percent through October on investments such as McKesson and Thermo Fisher Scientific. according to HSBC’s Alternative Investment Group. As of Dec. 9, the flagship fund is 81 percent net long in its stock holdings versus 76 percent on Nov. 4.

—Nelson Peltz’s Trian Fund Management’s main fund is up 35.92 percent through Dec. 6 on bets on like PepsiCo and Mondelez International. But the concentrated fund’s net exposure has remained at 100 percent for the last 12 months, according to a person familiar with the situation.

—Dan Loeb’s Third Point is up 22.4 percent this year through November on bets like Yahoo and Nokia but even dialed up its equity exposure from 53.5 percent at the end of October to 60.8 percent at the end of November, according to marketing materials.

—And John Burbank’s Passport Capital is up 18.3 percent through November on stocks like McGraw Hill Financial and Cytec Industries but increased its net exposure from 24 percent in October to 44 percent in November (the 2013 average is 46 percent).

Spokespeople for Appaloosa, Glenview, Trian, Third Point, Coatue and Passport declined to comment.

Those and other examples aren’t surprising to many hedge fund observers.

I haven’t noticed anything like window dressing—I certainly don’t think of it as a trend, said Eric Siegel, head of hedge fund research and management at Citi Private Bank, which advises $290 billion in client capital.

Data from big banks largely supports that view.

Bank of America Merrill Lynch’s hedge fund clients had an average long/short exposure ratio of 1.92 in November, virtually unchanged from October. And leverage increased 5.1 percent in November, from 2.36 times to 2.48 times, according to a report compiled by the bank’s capital strategy group.

Speculation around the Fed’s future tapering plans notwithstanding, hedge funds continued to increase leverage through the end of November, said Omeed Malik, head of Bank of America’s emerging manager program.

Hedge funds also had an average net exposure of 20.5 percent as of Dec. 6, barely down from 21.2 percent as of Nov. 29, according to Credit Suisse data. The Swiss bank also said that clients used average leverage of 2.6 times, similar to what it was most of the year.

While risk levels haven’t changed much, Credit Suisse’s hedge fund clients have increased the use of index hedges, meaning placing bets that the broad stock market will decline. That move is typical at year-end to lock in gains, according to the bank.

Citi’s prime brokerage unit had similar data. Hedge funds have reduced their market exposure in December, as is traditional, but there has not been wholesale de-risking according to a spokesman for the bank. Citi declined to provide specific numbers.

UBS data about its hedge fund clients did show a dip in exposure, but it was a reversion to the mean. U.S. equity managers decreased net exposure from 41 percent on Dec. 3 to 36 percent on Dec.10—the exact average for the last 12 months.

We have not seen a lot of window dressing. Some gains are being crystallized but exposures are being maintained and high conviction names are still very prevalent in portfolios, said Adam Taback, president of alternative strategies for Wells Fargo Private Bank.

While few managers appear to be taking December off, some are still wary of the phenomenon.

I do think there is window dressing with various hedge funds, with the tendency more apparent with the smaller sized and emerging managers, said Paul Chai, an investor in hedge funds at $100 million alternative investment management firm Grandway Asset Management.

Investors say strategy changes late in the year depend on the hedge fund’s strategy. High-turnover equity traders are most likely, but investors in more illiquid bonds or algorithm-based traders are unlikely to bear the cost of an exposure change, even if they wanted to.

Year-end profit taking may not even work were it to happen.

To what extent it works is unclear, said Michael Hennessy, co-founder of $6.5 billion fund of hedge funds Morgan Creek Capital Management. It’s obviously been an up year thus far, but we may get a ‘Grinch rally’ in late.

—By CNBC’s Lawrence Delevingne. Follow him on Twitter @ldelevingne .