News or Noise Big Week for Economic Reports

Post on: 30 Март, 2015 No Comment

by David Fisher posted on March 10, 2015

Last week was a particularly heavy week for data releases on global economic conditions. The news covered the U.S. the eurozone and Asia. Generally speaking, the data confirm our view of a global convergence of solid economic fundamentals, though some problem spots still exist.

No. 1: A Breakout Jobs Report?

Many analysts called the Labor Department jobs report the breakout employment report that investors were worried would eventually come. The ability for the Federal Reserve Board to remain patient with “emergency level” interest rates when the headline unemployment rate is back to full employment levels and job creation is running at multi-decade highs is starting to be hard to believe.

For February, the economy created a solid 295,000 new jobs and the unemployment rate dropped from 5.7% to 5.5%. Even the more inclusive U-6 figure is starting to normalize. Some data suggest that there could be between 1 million and 2 million workers who will eventually be pulled back into the labor force, leaving some room for a labor slack argument. Wage increases continue to appear mild, which also provides evidence for some slack.

Other data, though, are showing pricing pressures, including some of the work done by our research provider Ned Davis Research. Anecdotal evidence from the wage increases by Wal-Mart and other retailers, as well as the tougher negotiations recently witnessed in the West Coast port settlement, all suggest that wages may finally be turning. The monthly Job Openings and Labor Turnover Survey (JOLTS) data are out this week, and the Fed meeting of March 16 and 17 will be watched to see if the word “patient” is removed from the Federal Reserve’s policy statement.

We still believe the employment data to be noise because it just confirms the momentum that has existed for several months. In reality, the timing of the start of Fed rate increases is not the most important variable. With markets still at or near record highs, we believe the market is saying something similar. Rather, the pace and sharpness of rate increases, once they start, remain more significant. The markets continue to believe the Fed will be slower in raising rates than the Fed itself has indicated. A change in that sentiment could affect markets later this year, so for this stay tuned.

No. 2: Eurozone Gets a Growth Upgrade

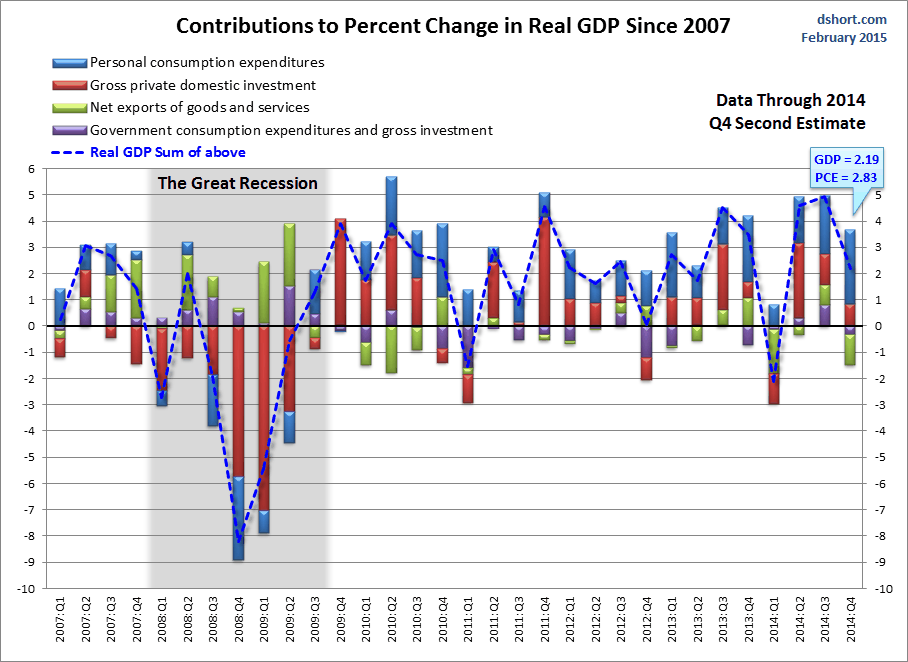

There were several key data releases in Europe last week, including a report on the gross domestic product of the European Union on Friday. The report showed that for the fourth quarter, the overall economic activity of the 18-country eurozone increased by 0.3%. Both geographically and by economic type, the growth was broadly based. Recent reports on unemployment, manufacturing and inflation were also slightly better than forecast.

As the reports from the eurozone continue to impress, we are seeing multiple of our research providers increase their forecasts for EU-wide GDP growth in the next year. A few months back, BCA released a report that didn’t necessarily predict, but did show, how a GDP growth rate as high as 3% was possible in the eurozone for 2015-16. This past week, Strategas increased its baseline forecast from 1.5% to 2%. Strategas points out that the consensus rate of growth is still 1.2%. It is possible that the consensus will trend higher the next few weeks as economists factor in the announcement by the European Central Bank that it increased its own forecast to 1.5% growth in 2015 and 1.9% in 2016. The Strategas report points to the geographic broad-based nature of the trend, with Germany, Spain and others exceeding expectations—though France is still not impressing.

Finally, Ned Davis Research, which has been skeptical on Europe, published a piece on Thursday titled “This is What We’ve Been Waiting For!” The report pointed to the solid growth in eurozone bank lending (both consumer and business) and the growth in M3 money supply.

Because the markets have yet to fully accept the growth potential—even if temporary—we believe this remains a newsworthy story. The combination of lower currency, lower oil, lower interest rates and central bank stimulus may ignite economic activity and corporate profits that are above current expectations.

No. 3: China Exports Up; Premier Sounds Note of Caution

Chinese exports were up sharply in February over the previous year. Though the information was skewed by the timing of last year’s Chinese new year, the figures were far ahead of expectations and showed that global growth is rebounding, which is helping the Chinese economy. However, imports continued a series of weak reports, declining 20.5% from the previous year. The data are skewed by the significance of commodity inflows in the country’s trade. Both crude and iron-ore showed 11% volume increases, while the net import value was down 46% and 39%, respectively, due to the large price declines.

The trade data are just the most recent evidence of the difficulties facing policymakers in transitioning a country that relied heavily on internal infrastructure spending and manufacturing for exports.

As we predicted last week, the Chinese leadership lowered the 2015 GDP growth guidance to 7%, but the tone of Premier Li Keqiang’s address to Parliament on Thursday was even more cautious than most expected. During his speech he said, “The downward pressure on China’s economy is intensifying … [and] deep-seated problems in the country’s economic development are becoming more obvious. The difficulties we are facing this year could be bigger than last year. The new year is a crucial year for deepening all-round reforms.”

From a political perspective, Li is likely trying to bring down expectations and to set the stage for more significant reforms. He also called to citizens “bonds of attachment and affection” as the leadership realizes that maintaining such high growth rates and increases in the standard of living much longer will not be possible.

But these stories are not news, and with Chinese markets moving higher for much of the past year, we believe current trends are priced in. At some point, upside surprise exists for China, though it may not be here yet.

No. 4: Apple Added to the Dow

After the market close on Friday, Dow Jones announced that it would add Apple to the famed Dow Jones Industrials Index, replacing AT&T. This is clearly a reasonable decision given the overrepresentation of telecom in the index, with both AT&T and Verizon previously included.

That said, after the amazing run Apple has had in recent years, the wisdom of the timing must be questioned. Going back five years, Apple has appreciated by 291%, compared with 31% for AT&T. With Apple stock rising nearly 70% over the last 12 months and now nearing a $750 billion market capitalization, we wonder how much more upside can remain. Part of the answer to that question will also be realized this week with the much anticipated announcement of the Apple Watch release. At that event, likely the company’s biggest of the year, Apple will go over final details for the watch and give updated release schedules for iOS software and iMac laptops.

Additional Resources

Like most of you, we are inundated with information on our phones, in our email inboxes and on the Internet. Clearly, the world doesnt need another investing blog to reprocess stale information or reformat the days useless headlines. Thus, in our investment blog, News or Noise, weve taken up the challenge of sorting through the infinite bits of background noise and seeking the few truly newsworthy nuggets of information. What are the stories today that are likely to be meaningful for investors in the future? A very small number of headlines are important, and of those, many are immediately processed by investors. Only a tiny fraction of all the new data is truly relevant and underappreciated .