New York Chapter Meeting ft Michael CFA Charlie Bilello CMT

Post on: 20 Июль, 2015 No Comment

New York Chapter Meeting ft Michael A. Gayed, CFA & Charlie Bilello, CMT

The New York Chapter of the MTA invites you to our next chapter meeting on Monday, December 15, 2014. We are honored to have Michael A. Gayed, CFA and Charlie Bilello, CMT as our guest speakers for this event.

* PLEASE NOTE THAT NYSSA IS

HOSTING REGISTRATION FOR THIS EVENT *

Please direct any registration related questions to:

Derly Zapata (646) 871-3405

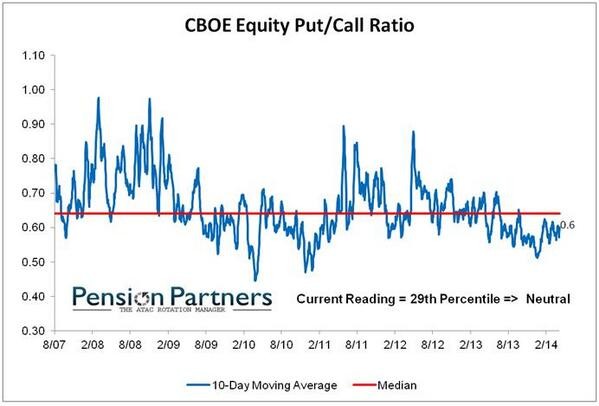

Michael A. Gayed, CFA, and Charlie Bilello, CMT, of Pension Partners, LLC co-authored two award-winning papers in 2014 that challenge the efficient market hypothesis by revealing market anomalies that have persisted over time. In separate papers, they focus on the utilities sector and Treasury bonds, providing a systematic way to outperform the market on an absolute and risk-adjusted basis. Importantly, they also show how the unique behavior of utilities and Treasuries can be used to anticipate periods of higher volatility and market corrections. Their work has important implications for both asset allocators and active managers.

Registration for this event is open to members and non-members of the MTA. We encourage you to bring clients or colleagues interested in technical analysis to this presentation.

All attendees will be entered into a contest to win a free Kindle and will also receive a complimentary copy of Michael E.S. Gayeds book, Intermarket Analysis and Investing which has received 4.5 stars on Amazon!

Complete event details are listed below. We hope to see you there!

Steve Suttmeier, CFA, CMT

Dan Russo, CMT

MTA New York Chapter Co-Chairs

Date: December 15, 2014

Time: 5:30 8:30 PM

- 5:30 – Registration

- 6:00 – Welcome remarks and presentation from Cornelius Luca – Thomson Reuters Eikon

- 6:30 – Tyler Wood introduces the speakers

- 6:35 – 7:20 presentation

- 7:20-7:30 – Q&A from the Audience

- 7:30 – 8:30 professional networking and reception

- 9:00 – All guest must depart

Topic: Generating Alpha: Predicting Volatility and Corrections

Speaker: Michael A. Gayed, CFA

As Chief Investment Strategist, Michael helps to structure portfolios to best take advantage of various strategies designed to maximize the amount of time and capital spent in potentially outperforming investments. Prior to this role, Mr. Gayed served as a Portfolio Manager for a large international investment group, trading long/short investment ideas in an effort to capture excess returns. From 2004 to 2008, Michael was a Portfolio Strategist at AmeriCap Advisers, LLC, a registered investment advisory firm which managed equity portfolios for large institutional clients. As a member of the investment committee, Michael performed detailed analysis on various stocks and worked closely with the principals of the firm to structure client portfolios. In 2007, he launched his own long/short hedge fund, using various trading strategies focused on taking advantage of stock market anomalies.

Speaker: Charlie Bilello, CMT, CPA

Charles V. Bilello, CMT is the Director of Research at Pension Partners, LLC. Mr. Bilello is responsible for strategy development, investment research and communicating the firm’s investment themes and portfolio positioning to clients. Prior to joining Pension Partners, he was the Managing Member of Momentum Global Advisors, an institutional investment research firm. Previously, Mr. Bilello held positions as an Equity and Hedge Fund Analyst at billion dollar alternative investment firms, giving him unique insights into portfolio construction and asset allocation.

Location:

Thomson Reuters Headquarters

3 Times Square

7th Ave between 42nd & 43rd Street

New York, NY 10036

Cost: Registration is free for members and non-members.

This chapter meeting qualifies for 3 Continuing Education (CE) credits.

Receive Your Complimentary Copy!

All attendees will receive a copy of Michael E.S. Gayeds book,

This eye-opening book brings together todays most relied upon tools of market analysis. Michael E.S. Gayed clearly explains how this powerful combination of major schools of thought of market analysis can help investors dramatically improve their judgment on likely market performance and spot important trends, thereby making successful investment decisions.

Intermarket Analysis and Investing begins with an overview of investment analysis that examines types of risk and portfolio structuring. Then it moves on to the three prominent schools of thought in market analysis with discussions of Economic, Fundamental, and Technical Analysis.

This book also examines the positive aspects and pitfalls to contrarian investing, top-down and bottom-up market approaches, comparative market analysis, and common-sense trend analysis.