New Taxes and New Terms How to calculate Net Investment Income under the New 3 8% Medicare Surtax

Post on: 28 Апрель, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

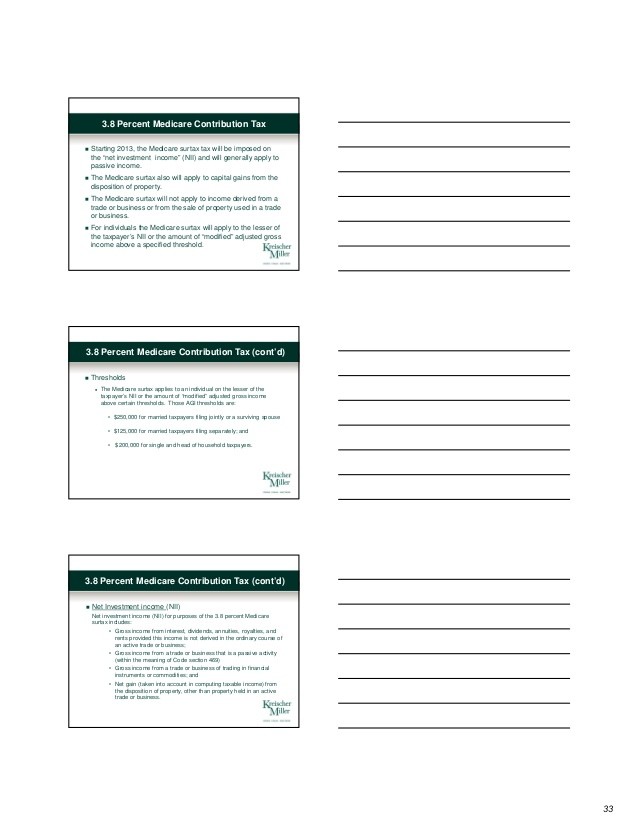

As introduced in last week’s blog post, What the New 3.8% Medicare Surtax Mean for You and Your Investments. Code Sec. 1411 applies a new 3.8% tax on a taxpayer’s net investment income, i.e. the 3.8% Medicare Surtax. There are a number of new terms introduced by Code Sec. 1411 that may require further explanation. A comprehensive understanding of these terms will help taxpayers adjust their taxes this year to account for the 3.8% Medicare Surtax. Therefore, in these next two installments, we will explore the following four main categories of terms found in Code Sec. 1411:

- Net Investment Income (‘NII’) and related terms

- Undistributed Net Investment Income (‘UNII’) and related terms

- Adjusted Gross Income (‘AGI’)

- Modified Adjusted Gross Income (‘MAGI’)

Perhaps the most important of these terms is Net Investment Income. NII, which consists of three parts reducible by certain deduction, plays a critical role in determining the effects of the 3.8% Medicare Surtax. Since under Code Sec. 1411, a 3.8% tax is applied on the lessor of a taxpayer’s NII or MAGI above a predetermined threshold, it is important that taxpayers are able to determine the appropriate amount reported as NII for a taxable year. Basically, these three parts include:

- Gross income from interest, dividends, annuities, royalties and rent, to the extent that it is not derived in the ordinary course of trade or business

- Gross income from trades or businesses trading in financial instruments or commodities or that are considered passive activities to the taxpayer are included under Code Sec. 1411, and

- Net gain from disposing a property

NII can be reduced by certain deductions, which Code Sec. 1411 and the proposed regulations thereunder collectively refer to as ‘Properly Allocable Deductions’.

Since the IRS intended the 3.8% Medicare Surtax to place a tax on investment income, it is natural that income from standard forms of investment assets are included in the NII sum. These include income from rent, royalties, interests, dividends, and annuities. However, taxpayers should note that Code Sec. 1411 is to follow normal income tax rules (i.e. rules that a tax lawyer or accountant might refer to as tax rules under chapter one of the Internal Revenue Code), so for ease of calculation, what is exempted from the regular income tax, such as tax-exempted mutual bonds, are also excluded from the NII sum.

The IRS understands that for some taxpayers, investment income may constitute such taxpayer’s main source of income. In other words, such taxpayers are in a trade or business of investing. Such taxpayers are generally exempted from the 3.8% Medicare Surtax unless their business either (a) is a passive activity with respect to such taxpayer or (b) is a trade or business involved in trading in financial instruments or commodities.

Taxpayers are also subject to the 3.8% Medicare Surtax on gross income derived during the ordinary course of a trade or business (a) of trading in financial instruments or commodities, or (b) is considered a passive activity with respect to the taxpayer. To illustrate, if a taxpayer owns an interest in an S corporation that earns a certain amount in income and distributes half the sum to the taxpayer, the taxpayer would include the amount in his calculation of the NII sum if he does not materially participate in the S corporation. However, if he is materially participating in the S corporation, and therefore the activity is not considered passive, the distributed income would not be included in the taxpayer’s calculation of NII. Needless to say, determining whether a taxpayer or entity is ‘materially participating’ in another entity is difficult, but critical. Therefore, taxpayers should be vigilant during the next couple months as the IRS addresses this issue and reviews comments submitted in order to provide a comprehensive guide for taxpayers.

The last part of the NII determinant refers to any net gain from the disposition of a property. To determine whether the ‘disposition’ of a particular ‘property’ should be included in Code Sec. 1411, taxpayers must look to the normal rules of income taxation (i.e. under chapter one of the Internal Revenue Code). In addition, since only a net gain is recognized, the smallest amount that this third NII component can be in any taxable year, is zero. If the property was ‘held’ during the ordinary course of a trade or business, and that trade or business isn’t a passive activity with respect to the taxpayer or a business of trading in financial products or commodities, then it is also excluded from the NII sum. The sum of these three parts is then reduced by properly allocable deductions such as certain types of losses to ascertain a taxpayer’s NII for that taxable year.

Net Investment Income plays an integral role in determining the effects of the 3.8% Medicare Surtax for a taxpayer and his investments. Because of this, the IRS strives to provide a comprehensive definition of NII to guide taxpayers as they calculate their 3.8% Medicare Surtax amounts this taxable year. However, NII is not the only important term that is critical when determining the effects of the 3.8% Medicare Surtax amounts. Please stay tuned as we explore other noteworthy terms and definitions to help you gain a comprehensive understanding of this new investment income tax.

To learn more about Code Sec. 1411 and access the IRC section, click here .

Learn more about managing your investments and assets from the Wealth Strategies Journal .

By Lewis J. Saret, with assistance from Jenny Ong