New tax laws and your investment strategy

Post on: 25 Май, 2015 No Comment

LarryStein

Larry’s Latest Posts

One of the most common questions I hear lately has to do with taxes. In essence: If my taxes have changed, should I change my investment strategy, too?

Sure, some things have changed for 2013, especially if you file jointly with a taxable income over $450,000 ($400,000 for single filers). For those in this top tax bracket, the American Taxpayer Relief Act of 2012 increased your marginal tax rate to 39.6% and the rate on long-term capital gains and qualified dividends rose to 20% (from 15%).

For taxpayers with lower incomes, those three tax categories — tax rates, long-term capital gains and dividends — all remain the same as in 2012. Please consult your tax adviser with respect to all tax information provided.

In addition, in 2013 due to the Patient Protection and Affordable Care Act of 2010, a new 3.8% Medicare surtax will affect joint taxpayers with more than $250,000 in modified adjusted gross income ($200,000 for single filers). Also, there will be a 0.9% Medicare tax on earned income based on the same thresholds. These provisions contain a lot of moving parts, so you should consult your tax adviser to fully understand their impact.

Should you change your investment strategy?

The short answer is no, you should not change your investment strategy in response to the new tax provisions. Even if you’re in the highest tax bracket, the changes are not significant enough to warrant a change. This assumes that your investment strategy makes sense, of course.

For retired investors with high incomes who rely on fixed income, municipal bond interest just became more valuable. The 3.8% Medicare surtax does not include income from municipal bond interest. Therefore, if you’re considering whether you should or should not seek interest from municipal bonds, the new tax legislation may impact your decision model and could now sway the advantage to tax-exempt income.

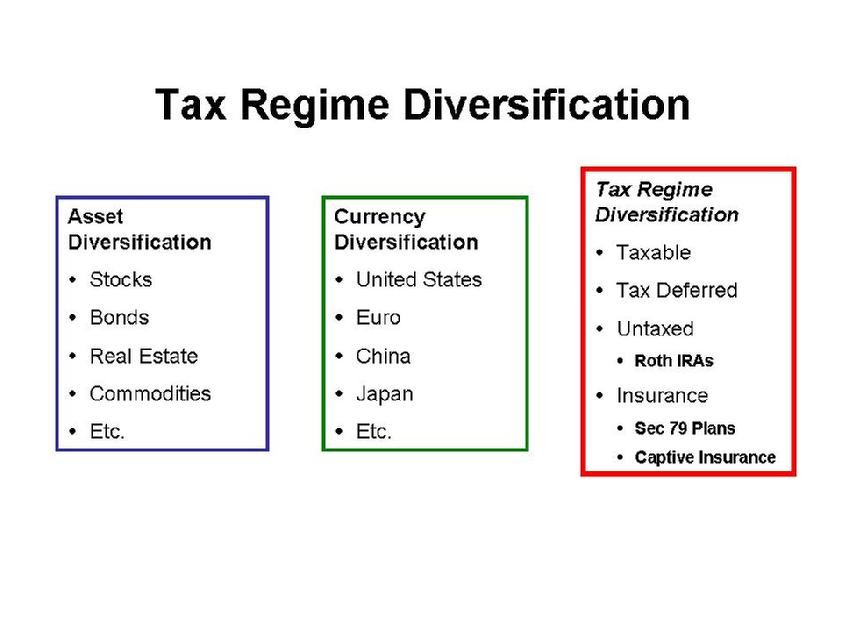

Tax location matters more than ever

With the rise in tax rates, high-income taxpayers should take a fresh look at where their investment assets are located. If you have an IRA or another tax-deferred vehicle, take advantage of these instruments as a home for your taxable bonds. By contrast, place your more tax-efficient assets, such as stocks and exchange-traded funds, in your taxable accounts. Tax-location strategies can have a meaningful impact on after-tax returns, so it’s important to review your particular situation with a financial or tax adviser.

In general, tax implications should not override investment strategy. Sure, long-term capital gains are more advantageous than short-term ones; but if a position needs to be sold, sell it. On the other hand, whether or not you are a high net worth investor, tax location strategies should be an integral part of your overall investment strategy to maximize your after-tax returns.

Especially in retirement, when your income is somewhat fixed, saving money on taxes can help sustain your nest egg and leave additional funds for enjoyment — which can be a nice place to invest.