New Patterns of Investment in the Global Economy Implications for

Post on: 8 Июнь, 2015 No Comment

New Patterns of Investment in the Global Economy: Implications for U.S. Leadership

As prepared for delivery

It is a great pleasure for me to be here at the Peterson Institute today. I would like to extend my sincere thanks to Fred Bergsten, my good friend, valued mentor, and first boss, for allowing me to share with you my thoughts about a particularly relevant and important topic: The rapidly growing importance of the emerging economies in the global economy and the implications for U.S. strategic leadership.

As the 21st Century unfolds, this generation of Americans faces a fateful choice. We can:

- fail to invest in a stronger and more competitive economy at home;

- shy away from making tough choices to put our nation on a sound financial footing and to promote greater reliance on clean, domestic energy; and

- fail to seize on opportunities for increased trade and investment presented by the changing global economic geography

Or we can:

- make the investments in education, clean energy, improved infrastructure and innovative research necessary to be more robust competitors in the expanding and more competitive global economy;

- take measures needed to ensure that government and household revenues and spending are brought into better balance; and

- work with other nations, particularly the emerging powers, to expand market opportunities for our citizens, obtain investment to increase domestic jobs, and promote a prosperous and stable global economic order that tackles the formidable challenges the world faces in this new century.

The first set of alternatives would weaken our economy and severely diminish Americas ability to shape the global economy of the 21st century in ways that serve our nations interests or the overall interests of the global economy. In contrast, the second set of options will strengthen our nations economy and strengthen Americas capacity to shape the worlds economic future in ways that serve both our nations and the global interest. This latter set is most similar to the efforts that our country took in the 1950s and 1960s. During that period, we built the interstate highway system, helped our returning veterans to attain new knowledge and skills through the G.I. bill, and upgraded our educational system following the launch of Sputnik. We also created the global trade and financial institutions that bolstered our prosperity and security for half a century.

The growing role of emerging markets like China, India, Brazil, and other smaller nations poses a formidable competitive challenge to America. But it also creates enormous export and investment opportunities, as well as opportunities for major new partnerships. The question is whether we can adapt ourselves, our companies, our schools, and our nation to compete in the more integrated and competitive global economy. Successfully rising to this demanding challenge will enable us to stay competitive and significantly improve our living standards and high quality job opportunities.

One key aspect of this challenge will be forging new patterns of international cooperation new partnerships and ways of organizing our economic relationships. Perhaps the most vivid illustration of the degree to which our economy has increasingly integrated with others is reflected in our trade levels. When I came into government in 1969, trade (exports plus imports) was a little more than 10 percent of GDP. Today it is 25 percent. And foreign investment into the U.S. was less than one percent compared to the level of private fixed investment. In the past 4 years it has been about 11 percent.

Because the U.S. is highly dependent on trade and inflows of investmentas well as the stability of the international economy and the openness and stability of the sea, air, space and communications linkages that connect the world economy we have a strong interest in exercising leadership to ensure that this system remains stable, open, market-oriented, and smoothly functioning. And as the U.S. endeavors to both grow the economy and bring deficits under control, we will need to increasingly employ smart diplomacy, engaging with others to pursue common aims.

We will need robust partnerships with other nationstraditional allies and emerging powerswho have an interest in making common cause with us, leveraging shared resources and expertise. And we will need the sophistication to recognize that our interests quite often may converge in one area while they diverge in another and therefore we must be able take advantage of the former while minimizing the disruption of the latter.

Changing Patterns of Global Investment Flows

Ive recently returned from a ten day trip to China and India. Although trade and financial relations with these and other emerging economies tend to receive the lions share of public attention, today I would like to focus on an aspect of our relations that is not in the news as much, but is of growing importanceforeign direct investment.

As the companies of these countries play a greater role in overseas investment, the need for a consistently-applied set of rules and principles will become more pressing. This issue provides an excellent example both of why it is so important to engage these powers bilaterally and in global institutions, and of why the U.S. must exercise strategic leadership in addressing the resulting challenges and opportunities.

Investment is only one of the many important issues facing the global economy, but it is of growing importance, as it presents an opportunity to integrate the rapidly-growing emerging market economies into the international economic system in a way that trade alone cannot. Investing in another economy creates familiarity with its culture and institutions and gives the investor a stake in that countrys success.

As the companies of emerging economies benefit from a rules-based system and level playing field, we expect them to press governments in their home countries to support similar policies. Moreover, if that does not occur, many of their companies will encounter resistance to their enjoying such opportunities in other nations markets.

In March, I had the opportunity to address the United States Council for International Business (USCIB), where I discussed the importance to global growth of foreign direct investment. I also noted how investment patterns are changing as rising global players become more prominent.

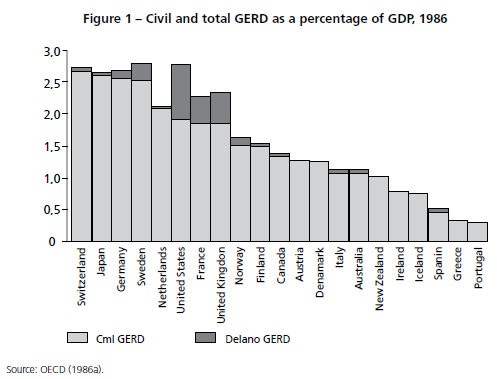

Outward FDI flows from emerging and developing economies as a group comprised almost 20 percent of total flows in 2008. Their stock of overseas investment amounted to nearly $2.7 trillion more than three times their total a decade earlier. In 2008, Brazil, Russia, India, China, and South Africa contributed almost 10 percent of world investment outflows; a huge leap compared to their contribution of only 1 percent a decade ago.

We recognize the importance of these new players. And we welcome their cooperation to maintain a system that is open and fair. All of us share an interest in their adherence to a set of basic investment principles that have proven valid over time, such as:

- opening more of their economic sectors to foreign investment;

- fair, equitable, and non-discriminatory treatment of foreign investment;

- predictable regulatory and legal environments;

- and accepting investor-State arbitration, among others.

Today, the United States is the worlds largest recipient of foreign direct investment (FDI). In 2008 alone, we received about $320 billion in FDI flows, contributing importantly to U.S. private investment of $2.1 trillion. Although inward FDI dropped sharply in 2009 during the global recession, it has begun to pick up again this year.

Most of this investment still comes from the advanced countries, but as outward investment from emerging markets continues to grow, we would expect them to become a more significant presence here. There are a number of reasons why foreign investors are attracted to the United States:

- proximity to the American consumer;

- our adaptable economy;

- a well-established and consistently-enforced system of laws; and

- a minimum of government intervention in the economy; our skilled work force;

- our spirit of innovation.

It is important that we continue to emphasize these strengths because international investment can be a key component of a sustained U.S. and global recovery, a source of new technology and innovation, and a boost to domestic job creation. Foreign owned subsidiaries in the United States employ 5.5 million people and generate approximately 18.5% of U.S. exports. This means that the U.S. needs to ensure a positive attitude toward inward foreign investment from a wide range of countries, particularly the new, large capital exporters.

One area in which foreign investment can be especially useful is in infrastructure. In a recent speech in Milwaukee, President Obama proposed establishing an infrastructure development bank to leverage federal dollars and focus on the smartest investments. This is a powerful idea that can produce enormous benefits for Americans in terms of jobs, modernized infrastructure and a more efficient economy. And we need this to keep up with other countries that recognize the importance of a robust infrastructure for a robust economy.

If structured correctly, this could bring in hundreds of billions of dollars of investment from abroad to support our infrastructurefrom investors eager to buy the bonds of this institution. It provides another opportunity to take advantage of changes that have taken place in the global economy. In short, inward foreign investment to the United States can serve U.S. economic interests.

There is one aspect of U.S. investment policy that tends to attract a lot of attention and produce a lot of misunderstandings so I would like to spend a couple of minutes on this. Like other countries, the United States has policies to screen investment if there are national security implications. The Committee on Foreign Investment in the United States (CFIUS) has the authority and tools necessary to protect U.S. national security interests and does so very effectively. But in areas in which national security issues do not arisewhich constitutes the vast majority of investmentthe open investment policy that the U.S. maintains is very attractive to foreign investment and allows American citizens to reap the benefits of growth and job creation.

In fact, the Department of Commerce has a very robust Invest in America program, which promotes and supports inbound FDI to the United States. And our embassies around the worldand our governors and mayorsare all actively engaged in explaining the attractions of investment in the United States.

Challenges for the Global Investment Regime

I would now like to discuss several specific challenges for international investment rules in this new global environment. Some of these you will recognize as age-old problems; others are newly posed by the particular challenges of integrating large, growing but relatively less economically developed countries into the global investment regime.

The purpose of my trip to China was to engage both on the multilateral level at the UNCTAD World Investment Forum (WIF), as well as bilaterally with the Chinese and others to discuss with them the key policy challenges that are emerging from the changing patterns of FDI flows. One, there is the issue of the growing role of state-owned enterprises (SOEs) and sovereign wealth funds and their impact on the competitive landscape. Some SOEs may be motivated by strategic as well as economic considerations. And in most cases the government has a vested interest in the success of these firms. This raises concerns about potential distortions from government ownership. It also raises concerns that an uneven playing field created by both direct and indirect government benefits to SOEs will inhibit competition and innovation. The principle known as competitive neutrality put forth by the Australian government and the OECD, suggests an approach to address these challenges. Some measures to help maintain competition include:

- reshaping management incentives within state-owned enterprises;

- effectively applying competition law in merger and acquisition transactions to avoid creating an uneven playing field;

- intensive evaluation of the taxation, financing and regulatory advantages that exist for state-owned enterprises within an economy; and

- implementing corporate governance reforms within these enterprises.

Another important investment challenge concerns the handling of innovation and intellectual property. Questions are arising about national and even local policies to promote innovation by domestically based firms using discriminatory or exclusionary methods and government procurement tests that adversely impact foreign-owned firms. Here, Im primarily referring to Chinas policy of Indigenous Innovation.

For the United States, protecting intellectual property (IPR) is a core national economic goal. Discrimination against or exclusion of the products of foreign companies on the basis of where technology was developed or the nationality of who holds the patent, are harmful and make firms less inclined to engage in the cross-border innovative process on cutting edge projects. As emerging countries develop their own innovative technologies, they will need fair treatment abroad for their own companies. That means they must practice it at home as well. I made these points repeatedly during my visit to China.

When a constructive dialogue does not succeed or when rules or norms are violated, we must assert our legal rights and enforce our economic interests and team up with other countries in Europe and Japan to do likewise. Corporate social responsibility and investor credibility is also growing in importance as nations attract foreign investment from a more diverse array of sources. The OECD is updating its Guidelines for Multinational Enterprises to reflect current challenges. And it has recently issued revised recommendations for combating bribery of foreign public officials. We continue to encourage non-OECD emerging market countries to accede to the OECD Anti-Bribery Convention. Discussions are also underway with respect to possible guidelines on conflict minerals.

Anti-corruption: Building on the progress made since Pittsburgh to address corruption, the G-20 agreed in Toronto to establish a Working Group to make comprehensive recommendations for consideration by Leaders in Korea in November 2010 on how the G-20 could continue to make practical and valuable contributions to international efforts to combat corruption and lead by example. We are actively looking for ways to engage G-20 emerging markets countries more deeply into this work.

Another challenging issue relates to competition for natural resources. Firms owned by governments or acting on their behalf are playing a greater role in global natural resources investment and trade. Ted Morans research suggests that investments of some types can expand supplies and competition, while other types can limit competition and distort markets.

The United States and other developed countries need to work actively on these issues through both OECD and UNCTAD. Greater collaboration between them also would be beneficial, as in their recently-begun joint work evaluating evolving practice with respect to international investment agreements.

I had the opportunity during my trip to China to host an informal meeting of major developed countries and emerging economies on the changing landscape of international investment and the new issues it raises. Such engagement, in combination with our bilateral efforts, can be important in supporting the work of both institutions and more effectively shaping their agendas on international investment, to better foster fair and open competition.

Strategic Response: The Case of China

Let me now turn to the bilateral challenges we face with China. As I noted earlier, investment is one of many issues that are important to the U.S.-China relationship, albeit one that is very important. The Obama administration has demonstrated its commitment to engaging in meaningful dialogues with the Chinese government on important economic issues through:

- the Strategic and Economic Dialogue (S&ED);

- the U.S.-China Investment Forum,

- the Joint Commission of Commerce and Trade (JCCT); and

- the bilateral dialogue with Chinas National Development and Reform Commission (U.S. State Dept. — NDRC).

We have encouraged China to work towards a more transparent, open, and fair business environment domestically. We will continue to engage China on allowing fair and transparent access to our goods, services and investments.

Separately, we are utilizing our Investment Forum with China to conduct regular, high-level discussions regarding investment. These talks co-led by my colleagues at Treasury, Commerce, USTR, and me — have provided a valuable forum for exchanging information on investment issues of mutual concern, and for encouraging policies that are conducive to cross-border investment.

We are also consulting with those members of the U.S. business community who have invested in China, because as practitioners they often have a better understanding of these investment policiesor practicesthan government officials do. Some members of the U.S. business community believe China may be growing less receptive to foreign investors than it has been. We are working with them to try to identify the specific sources of their concerns, and use our existing fora to try to address them.

And we also look forward to engaging China on the subject of its investments in developing countries. We want to avoid misunderstandings and to encourage Chinese companies to operate in a manner consistent with international practices in regard to corporate responsibility, and avoidance of nationalistic policies in such areas as raw materials. Chinas investments have the potential to make valuable contributions to development in a wide range of countries under the right circumstances. And we believe that they will want to be responsible investors to ensure a receptive attitude toward their investments in other countries over the long term.

We also would like to facilitate dialogue at the sub-national level between Chinese companies and authorities interested in investing abroad and American governors and mayors who are seeking foreign investment. This is one of the initiatives from the last S&ED for which our follow-up efforts are underway. The U.S. government has been focusing diligently on a number of proposals to make sub-national discussions operational. Such a platform could, among other things, help states and cities explore opportunities for attracting Chinese investment and for Chinese companies to understand better the environment for such investments.

The importance of finding a way to address these issues with China should not be understated. I was impressed with the keynote address on September 7 of Chinese Vice President Xi Jinping at the WIF in Xiamen. This has received too little attention in the United Statesand yet it has potentially significant implications for Chinese investment and reform policies. Vice President Xi spoke of the need to depoliticize bilateral trade, noted that China is seeking to improve its IPR protection, and discussed Chinas openness to foreign investment and its commitment to treat foreign and Chinese companies equally, particularly with respect to indigenous innovation. At the same time he stressed Chinas going-global strategy and noted that China is now in a new phase of reform and opening-up. It is working to integrate the transformation of its external and internal patterns of development in order to gain a new degree of international economic cooperation and competition in a globalized world economy.

The U.S. must explore in greater depth what these statements mean and whether they open up new opportunities and clarify some earlier concerns about Chinese investment policy for foreign companies. We have worked hard over the past 20 years to level the playing field for trade and investment through the establishment of rules-based systems. But the ideology of state capitalism remains attractive to many.

We obviously cannot force China to adopt any particular set of policies or standards regarding regulation of foreign investment or corporate behaviors. But if the United States, Europe and Japan lead by example, and remain committed to the principles I described earlier in this talk, we will be in a strong position to convince China that it is also in its interest to adopt these principles. And one important way of doing so is to join the WTOs Government Procurement Code.

We must maintain a dialogue with China to emphasize that its own interests are served by adhering to such global rules and standards as its companies become major foreign investors. Chinas companies have, along with ours, an interest in being fairly treated, having their intellectual property protected, supporting anti-corruption measures and avoiding the politicization of investment abroad.

It may seem strange to end a speech on emerging global economies with a comment about Europe, but I think it is appropriate here. On Sunday, I was in Bremen, Germany for the 20th anniversary celebrations of German Unity and have been reflecting on how the fathers of the post-World War II era, Americans and Europeans alike, had such vision to focus on economic recovery of Europe and the establishment of new global institutions such as the GATT, IMT, and World Bank, as the linchpin for global growth and political stability.

Given the enormous changes underway in the global economy, we now need to bring the same energy and commitment to integrating the rapidly-growing emerging markets, especially at a time when we are facing the challenge of a new economic geography. We want not only China and India, but also Russia, Brazil and other major emerging economies, including those in Africa, to play an integrated and responsible role in the global economy. This will create new market opportunities for all. Maintaining and expanding investment flows is critical to economic prosperity in both the United States and the rest of the world.