New IBD Feature NorthCoast ETF Retirement Portfolios

Post on: 22 Июнь, 2015 No Comment

If you’re nearing retirement. you’ve got company. Each day 10,000 Americans turn 65, and that will continue for the next 15 years as baby boomers move their demographic bulk from the working world to leisure land.

But older Americans still have a lot of work to do. The Employee Benefit Research Institute’s annual Retirement Confidence Survey confirms what virtually all such surveys have concluded: 1) that Americans are living longer; and 2) that they do not have anywhere near enough saved for retirement .

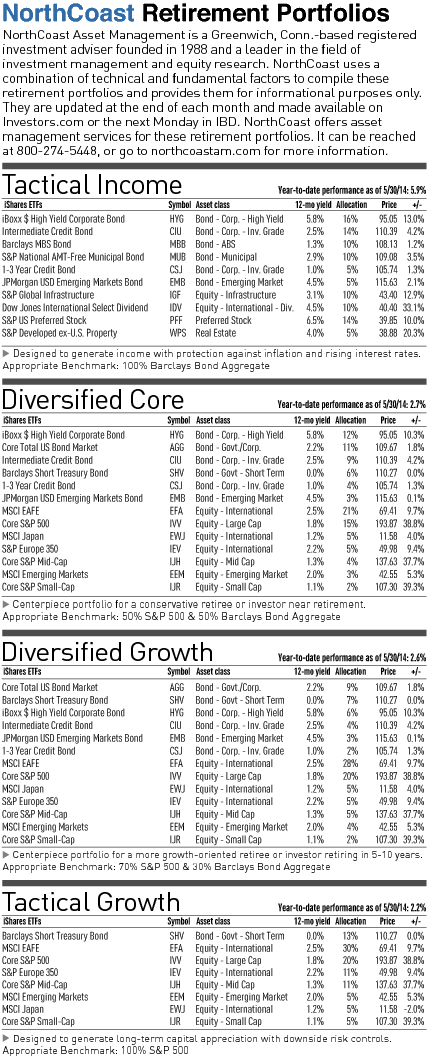

NorthCoast Asset Management may have an answer. The Greenwich, Conn. firm is applying its management skills to BlackRock iShares ETFs in four NorthCoast retirement portfolios. The iShares ETFs are the building blocks that NorthCoast uses to achieve the best returns possible for investors given the amount of risk each portfolio takes.

And now NorthCoast has partnered with IBD to present the holdings of those four portfolios, which are updated on the last business day each month and published on Investors.com.

The portfolios will appear in print on the first Monday of each month. IBD will examine the portfolios’ performance against their benchmarks and highlight any changes in the holdings.

Founded in 1988, NorthCoast has $1.5 billion under management and has already attracted $55 million to its ETF retirement portfolios. The firm’s guiding principle is that avoiding big losses is more important than aiming for big gains.

Many fund companies and financial advisers have set up or follow retirement blueprints that match expected volatility to the investors’ age or stated risk tolerance. Current market action or outlook are not taken into account. But NorthCoast takes that extra step by making modest adjustments to its portfolios to limit losses when the stock and bond markets turn south and ramp up exposure when the trend turns positive.

We’re not trying to get too tricky or gimmicky, said NorthCoast CEO and President Dan Kraninger. There are no heavy sector bets. We’re diversified, transparent and low cost, with an overlay of adjusting a little to market conditions. Small adjustments can save a lot of money in down markets and can add a lot in up markets. For the retirement market we have a good core offering that provides some downside protection.

Why iShares? It offers 300 ETFs, more than enough to meet NorthCoast’s need for investment opportunity, diversification and low costs. IShares’ ETFs provide access to a vast menu of major indexes and market segments in stocks, bonds and commodities, both foreign and domestic.