National Debt

Post on: 5 Апрель, 2015 No Comment

I’m calling it; that’s enough talk about Janet Yellen and the Federal Reserve’s likely strategy to continue printing money until the economic renewal picks up steam.

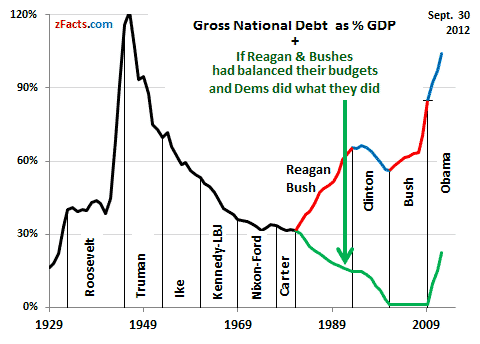

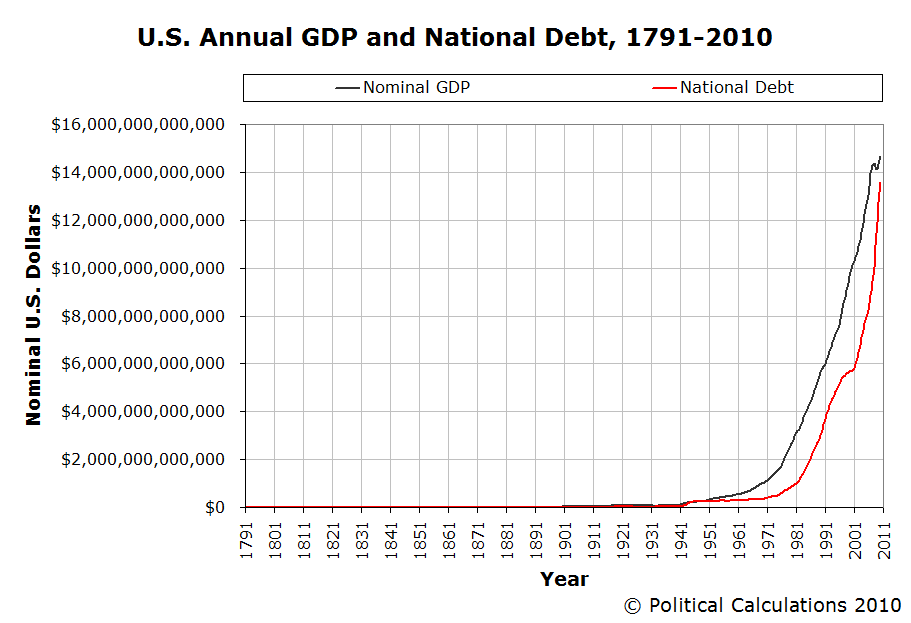

America has spent trillions to save its housing, financial, and auto sectors, and in the process, it has likely crippled the future generations with its massive build-up of national debt.

Yet at the same time, across the Pacific Ocean, China has seen decades of economic growth that has driven the country to surpass Germany and Japan to become the second-largest economy in the world, trailing only the United States. But unlike good old America, the Chinese have also managed to build up reserves of over $3.5 trillion.

And while there are still many in the United States who dish on China, I’m not in that camp. Having traveled to China, I can tell you the growth there has been staggering and it is reflected in the building of massive super cities that make New York City look small.

The money and wealth creation in China from the rural areas to the urban centers has driven the domestic consumption, and I expect this trend to continue.

And while the focus here was on the Federal Reserve and its suspect quantitative easing strategy, the Communist Party in China was meeting to discuss the future of the country.

At the core of the massive reforms in China will be major changes to its current policies as the country gets set for what will likely be another 20 years of growth superior to the United States and other Western countries. China doesn’t want its economic engine to stall. Read More

Hooray for the folks in Washington! The playground battles among politicians have settled for now, but trust me, it’s going to get nasty again as we move towards the extended deadlines in the New Year.

But for now, the government is open for business again and the Treasury can continue to make its interest payments on the enormous national debt. Yet the resolution agreed upon last Wednesday is only a bandage solution. The country has only delayed the inevitable—that it must control spending and its national debt.

The nearly $17.0 trillion in national debt and annual deficits continue to grow, adding to the mounting financial crisis America could witness not long down the road if the spending doesn’t stop. I don’t think I would be buying Treasury bonds anytime soon, as there are superior yields in other debt-laden markets, like Italy or Spain.

America has become somewhat of a jester on the international stage. China is talking about making the renminbi the de-facto global currency. I think this is more wishful thinking than anything; more likely, it’s just some propaganda to remind the United States it needs to work out its national debt situation. China does hold about $1.7 trillion in U.S. national debt, so the country should be concerned. I kind of wonder how much interest the Chinese will have towards the future U.S. bond auctions.

When China said the national debt needed to be resolved, some genius in Congress said China should mind its own business.

Can you imagine a company telling its largest debt holder to take a hike and mind its own business? This would never Read More

The United States is currently not the top country in the world for business—wait, hold on; how can that be true? Isn’t America the most powerful nation in the world?

Well, according to Donald Trump, America is losing its business advantage amid a declining U.S. economy. In an interview with CNBC’s Piers Morgan last Thursday, Trump went on and blamed China, India, and Mexico for the country’s demise, saying American jobs have been stolen by these countries, thereby negatively impacting the U.S. economy.

While I agree with Trump that the loss of jobs in this country is a major issue, I wouldn’t go as far as to lay the blame 100% on these countries. Hey, the global economy is forever interconnected. All countries do what they can to move ahead. It’s no different with China, India, and Mexico. They have a major cost advantage in cheap labor and manufacturing space, so they take advantage of it. That’s just the basis of competitive advantage between countries.

Countries focus on their advantages, whether it’s labor, technology, or an easy business climate. For Trump to squarely lay the blame for the decline of the U.S. economy on just three countries is the easy way out.

Yes, it’s not relatively cheap to manufacture in the U.S. economy, as far as the labor costs and business incentives go, compared to the emerging markets, where you have people willing to work for $10.00 a day and in some of the worst working environments found. It’s not good, but that’s the reality.

With the massive and overdone quantitative easing by the Federal Reserve and the massive spending Read More

It’s a fact: Janet Yellen will take charge of the Federal Reserve in the New Year and unless something drastic happens, the Federal central bank is likely to maintain its flow of easy money into the economy—albeit, perhaps at a slower pace than that dictated by current chairman Ben Bernanke.

The reception of Yellen was evident in the emerging markets, as shown by the chart of the iShares MSCI Emerging Markets below and the shaded oval.

With Yellen at the helm, I expect the continued flow of liquidity will benefit the emerging markets. This is because the easy money will keep U.S. bond yields lower, and investors, armed with the cheap market, will search for higher yields and high potential investments that, at this time, are generally found in the emerging markets. This is why the emerging markets got a boost when Yellen was appointed.

Chart courtesy of www.StockCharts.com

Now, while there were many who ditched the emerging markets, I was not one of them, as I continue to feel the key to economic growth in the global economy will be tied to the rise in consumer spending in the emerging markets. Simply put, the emerging markets will continue to be an excellent place to have some capital invested, whether it’s the BRIC countries (Brazil, Russia, India, and China) or the four “Little Tigers” in Southeast Asia (Hong Kong, Singapore, South Korea, and Taiwan). I’m bullish on these areas of the world. When you look at the wealth creation in these emerging pockets, you’d understand why I am.

Just take a look at the major acceleration in consumer spending in Read More

I wasn’t going to talk about the government impasse and the upcoming debt ceiling deadline today, but it’s really the only thing people seem to want to discuss.

Even with the third-quarter earnings season flowing in, the headlines continue to want to key in the mess in Congress. Hey, I don’t blame them; America’s future is at stake in this critical showdown, which is why both parties want to make the best debt ceiling deal possible.

Could you imagine lending a substantial sum of money to a friend, and then you start hearing talk that your friend may not be able to pay you back?

Well, there’s some uneasiness developing in the world financial markets, as China and Japan are wondering—sometimes out loud—whether their more than $2.0 trillion in U.S. Treasuries are at risk. China held about $1.28 trillion in U.S. Treasury bonds as of July 31, according to the Department of the Treasury. Japan holds about $1.14 trillion in U.S. debt.

The problem is that unless the U.S. can resolve its debt ceiling crisis and move ahead; I expect there will be some hesitancy from the Asian powerhouses when deciding whether or not to buy U.S. bonds in the future; and this could have an impact on yields and what the Treasury has to pay. Without strong buying from China and/or Japan, the U.S. Treasury could be in trouble, since there would simply be no money left in the coffers. Luckily for now, investing in U.S. bonds for foreign reserves is still a better option than the alternatives, such as the euro or gold, but that could change.