Myths V Understanding Current Fundamentals Of The Market PIMCO 25 Year

Post on: 16 Март, 2015 No Comment

Summary

- U.S. Treasury bonds are quite possibly the most criticized and misunderstood investment in the market today.

- Many have put forth a view of the global economy and the U.S. Treasury market that simply does not conform to the data.

- Treasury bonds remain an important, though often neglected part of any portfolio. Now may be the time to consider bonds for part of your portfolio.

Contrary to the gloom and doom forecast of the bond bears, who call for the end to the rally in Treasury bonds (NYSEARCA:ZROZ ), the Long-Term U.S. Treasury STRIPS market (NYSEARCA:EDV ) finished 2014 with a 45.10% return, and is up over 14.25% YTD. I feel as though the bond market is simply misunderstood by many investors, who perpetuate ongoing myths to support their contention that the bond market is in a bubble and is set to burst. The reality is far different. In this article I want to disprove many of these myths and arrive at a realistic understanding of the U.S. bond market, and why 2015 will not be the end of the rally in Treasury Bonds .

Myth: The U.S. Treasury bond market is expensive.

Reality: One could argue that certain parts of the high-yield market are expensive, however, to declare the entire government bond market expensive, is to ignore the fundamental structure of the zero coupon U.S. Treasury bond, which sells at a deep discount and matures at par. When you analyze the sovereign debt from around the world, the U.S. offers a comparative value relative to the yields of its global peers, such as the German bund. The German bund continues to move lower, with the 30-year at 0.94%, and the 10-year at 0.35%, the U.S. long Treasury offers an immense amount of value at 2% on the 10-year and 3% on the 30-year.

Myth: The bond market will push yields meaningfully higher.

Reality: Given the economic fires burning overseas, any short-term market-based rise in interest rates is only the set up for future declines in rates. The economic fundamentals are simply too weak globally for any sustained rise in yields. Additionally, the domestic economic environment is lackluster at best. The GDP growth rate for the entire recovery period is only 2.3%. With no acceleration in the GDP growth rate, and global risks mounting, I find it hard to understand how investors will sell Treasuries and push the yields meaningfully higher.

Myth: The Fed will raise interest rates because:

1. GDP growth is strong and getting stronger.

2. Velocity is rising thus causing an uptick in inflationary pressure.

3. Wages are rising.

Reality:

1. GDP through the entire recovery period is 2.3%. We have seen no meaningful GDP growth, and I do not believe we will see said growth going forward until we deal with the structural challenges we face. The economy still remains below potential creating an output gap that is unlikely to close until 2019, given current trends.

2. Deflationary forces are rising around the world. The U.S. continues to be at risk of deflation as the inflation rate continues to run below trend. The Fed has expanded their balance sheet by over $4 trillion, and yet velocity is still at a 50+ year low. Until we see an uptick in overall velocity, there can be no real inflationary pressure.

3. Wages continue to stagnate. In fact, the U.S. middle class has not seen a rise in their income in 20 years. While political parties continue to argue over whose fault this is, the economic fundamentals tell us that the structural dynamics of the American economy remain imbalanced. It is time for fiscal policy makers to address these challenges, as I believe we have reached the end of the efficacy of monetary policy.

In short, the Fed can not raise interest rates any time soon, and if they do, it will be a decision that could very well send the U.S. into recession given the weak economic fundamentals.

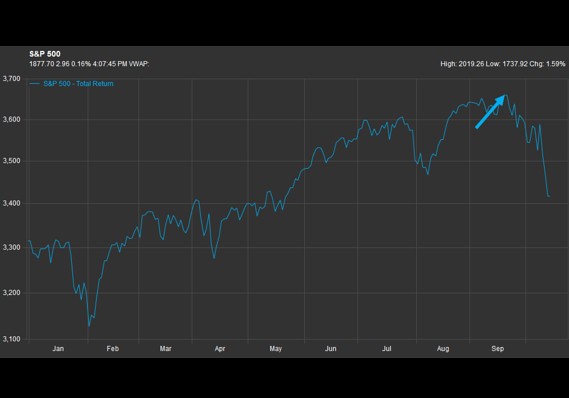

Myth: The dividend yield of many S&P 500 companies is higher than the 10-year Treasury.

Reality: Yes, the current dividend yield is higher than the yield on the 10-year U.S. Treasury. However, the structures of U.S. Treasury yields and equity dividend yields are very different. With equity dividend yields, you have no guarantee to receive the stated dividend yield. Management can decide to change the dividend yield or do away with it all together, as we have recently seen with some of the equities in the energy sector. Furthermore, in a year such as 2008, those dividend payers that everyone likes so much were reduced to rubble along with the rest of the market. The fact of the matter remains that the only way to plan for a financial need, or achieve a financial objective is through the predictable power of the U.S. Treasury market, particularly with Zero Coupon U.S. Treasuries, backed by the full faith and credit of the U.S. government, as close to a guarantee as one will receive in the investment world. Anything else is simply speculation that your investment will be worth more in the future than it is now. I am not against the stock market, and I am not advocating that investors engage in 100% bond portfolios, though that can be done .