My Three Big Calls Anthony Gillham on developed market government bonds emerging market debt and

Post on: 2 Июль, 2015 No Comment

15 May 2014

My Three Big Calls: Tony Lanning on Japan, UK small caps and pan-European miners

The US housing market is a case in point. Since former Fed chairman Ben Bernanke first spoke about tapering in May 2013, 30-year mortgage rates have jumped by around 1 per cent. This risks choking off the very thing that has fed the US revival and means it will be difficult for the new chair, Janet Yellen, to raise rates any time soon.

Emerging market debt

Emerging market debt proved to be another part of fixed income at the mercy of an increasingly bearish consensus by the end of 2013. Commentators were quick to jump on the sell-off and offer reasons why the asset class should enter a period of structural decline. This is at odds with history.

While it is likely that a surge in inflows from retail investors resulted in yields falling too far too quickly, the subsequent sell-off has left a significant margin of safety, particularly in local currency bonds where index level yields rose as high as 7 per cent.

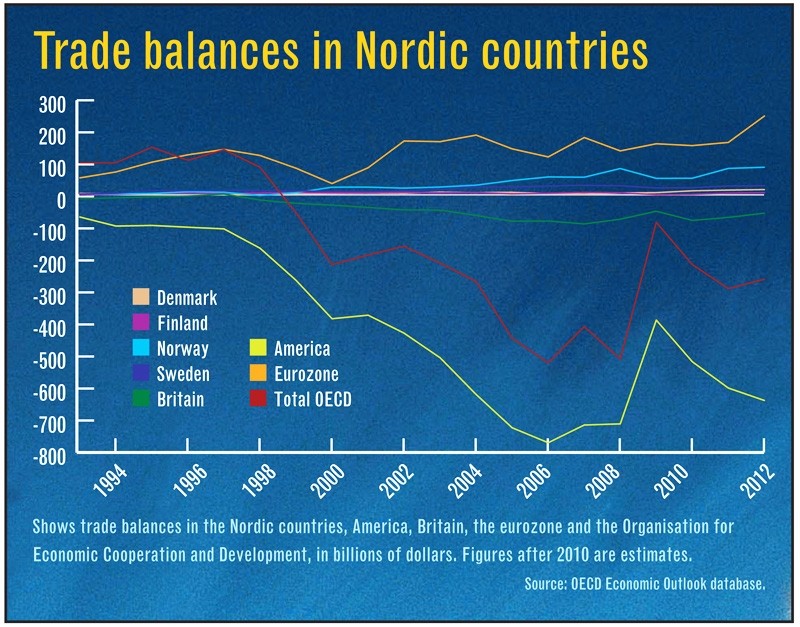

Concern that this was transitory has been largely proven false. Emerging countries have acted swiftly to deal with their weaknesses, such as growing current account deficits. Certainly, key emerging market current accounts lie in stark contrast to the UK, yet sterling goes from strength to strength. Buying the dips has been a good strategy this year, although only now is the rally that started in the middle of Q1 attracting attention.

Specialist credit

High-yield credit proved largely immune from the 2013 turmoil, particularly in Europe, where credit spreads have continued to compress. They do not offer adequate compensation for the risk in the eurozone.

It is not fashionable to talk about political risk in the eurozone, but it bubbles away below the surface. The risk of disruption has not gone away, particularly as European elections loom, and at low spread levels there is little margin of safety.

However, global credit markets are far from uniform and offer specialist opportunities where a margin of safety does exist. Nordic high-yield is a case in point and, despite its largely secured nature, has significantly lagged the traditional European market.

So the case for a strategic approach to fixed income is stronger than ever, particularly as value in mainstream opportunities diminishes, bringing our multi-asset approach to fixed income to the fore.

Anthony Gillham is manager of the Old Mutual Voyager Strategic Bond Fund