Mutual Funds vs Stocks Bonds

Post on: 16 Март, 2015 No Comment

Mutual funds vs stocks and bonds may seem like a division between common folk and the wealthy, but that’s a common misconception held by many people who are unfamiliar with mutual funds. Owning a portfolio of stocks and bonds that is large enough to be appropriately diversified is beyond the means of most investors. But even the wealthiest investors can benefit from the diversification and cost efficiency of mutual funds.

This is really a continuation of The Benefits of Mutual Fund Investing. If you haven’t read that section yet, you may want to read it now.

There’s no need to feel inferior because you don’t have the wherewithal to assemble a well-diversified portfolio of individual securities, because even wealthy investors would be better off owning portfolios of mutual funds. Indeed, many investment advisors are now putting all or a part of their wealthy clients money in mutual funds, which is a trend that is expected to persist.

Most investors don’t have enough investable funds to construct a well-diversified portfolio of individual securities. But this problem is easily overcome by building efficient portfolios of high-performing mutual funds that provide broad diversification with professional management, have high expected rates of return with relatively low risk, are free of company-specific risk, and provide all of that in return for relatively low fees and expenses.

If you think that mutual funds are for unsophisticated investors with little money to invest, then you have probably been misled by the marketing efforts of those who sell individual securities or sell their firms’ expertise at picking individual securities, or your opinion may have been influenced by acquaintances who have been misled by such marketing efforts. After all, how many intelligent, well-educated and worldly people do you know that would voluntarily admit that their investment portfolios had delivered substandard returns with high volatility due to some combination of trading costs, excessive trading, poor security selection and inadequate diversification?

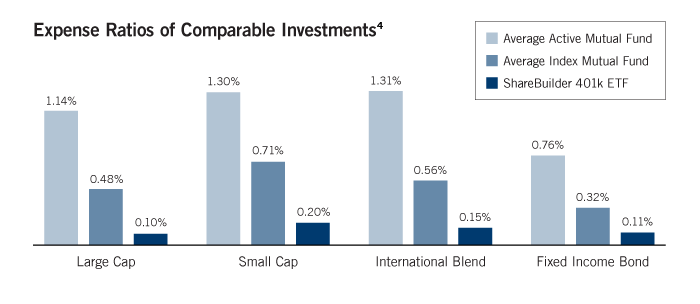

Even if you have a few million dollars to invest, you can benefit by constructing your investment portfolio with mutual funds rather than individual securities. Mutual funds offer you the opportunity to diversify away the company-specific component of risk and also enjoy broad diversification across asset classes. You could achieve this by investing millions of dollars in individual securities, but your performance would be impaired by your trading costs. Thanks to economies of scale, mutual funds’ trading costs are merely a fraction of that which an individual would pay. And if you construct your portfolio with no-load mutual funds, you will pay no commissions, which will further enhance the performance of your portfolio.

If you still think mutual funds are just for the little guys, then consider this: Some of the most successful mutual funds require minimum investments of $25,000 to $50,000. One of them is an international small cap fund, which would probably only make up between 5% and 10% of a well-diversified portfolio, with 10% being pretty high. If 5% of your portfolio is worth a minimum of $25,000, then the total value of your portfolio would have be at least $500,000. I know, that’s chump change for some of you. So let’s move on to another hypothetical example.

Typical model portfolios used by financial planners and investment advisors contain between 25 and 30 large-cap U.S. stocks, which are ordinarily purchased in multiples of 100 shares to avoid the excessive cost of trading odd lots. 2700 shares at an average of, say, $50 per share would come up to $135,000. But a portfolio with 100 shares each of 27 companies probably wouldn’t be weighted in accordance with the advisor’s recommended asset allocation, so it would be necessary to purchase 200 or 300 shares of some of the stocks to get close to the recommended weightings. Let’s say that brings you up to $350,000. However, there are a few significant problems with this portfolio.

The number one problem is that you haven’t fully diversified away company-specific risk. In theory you have diversified away about 2/3 of the specific risk if your portfolio is broadly diversified across industries, but in reality, if one of those 27 companies goes belly up you’ll lose a big chunk of your portfolio. Even if that one company just loses much of its value when the Wall Street Journal reports that the SEC is investigating accounting irregularities at the company, it will have a measurable impact on the overall performance of your portfolio.

The next problem is that you are not sufficiently diversified across asset classes, investing styles and geography. You’d have to throw down another $1 million or so to cover these missing pieces of your portfolio, and even then you would still have significant exposure to company-specific risk. Remember, specific risk is not an issue with mutual funds. So you need to multiply that $1.35 million by a factor of at least 1.5 to get rid of most of the specific risk. At $2 million, we’re now talking about what most people would consider to be serious money. If you think $2 million is chump change, then I’m not sure whether I should envy you or pity you.

Finally, the fees and expenses you would pay, including commissions, to maintain your actively-traded portfolio of individual securities are significantly higher than what you’d pay to maintain a portfolio of mutual funds, and the mutual funds would address all of the other deficiencies noted above. Who could ask for more?

Mutual funds vs individual stocks and bonds? No contest!

1 2 3 4 5 6 7 8 9 10 11

Section Intro Next Section