Mutual Funds in Annuities

Post on: 12 Апрель, 2015 No Comment

What is an annuity?

Annuities are insurance products. There are basically two types. Immediate annuities are funded with a lump sum payment and offer the investor/insured a monthly payment for the rest of their life. Deferred annuities act as a tax deferred account that allows the investor to accumulate savings that can be ‘annuitized’ at retirement, effectively turning the deferred annuity into an immediate one.

Are there different ways to buy annuities?

While there are the two basic types, this product breaks down further to include three different ways to save, protect or accumulate money.

The fixed annuity is purchased as an immediate annuity. The insurance company then purchases bonds or mortgages as part of a pooled investment. The annuity holder doesn’t pay taxes until the insurance company distributes the interest. In a low rate interest environment, both in bonds and mortgages, the payout can be low as well. Because these are products that will last your lifetime, finding an insurance company that is highly rated is highly recommended. You want these companies around when you reach your hundredth year. This product pays a guaranteed minimum payout.

Indexed annuities are a combination of a fixed annuity (with guaranteed minimum payout rates over your lifetime) and a variable annuity (a product whose return is driven by mutual fund returns). The indexed annuity adds an investment in an indexed mutual fund such as an S&P 500 index. This ties some of the product’s risk to a widely diversified investment. Unlike an investment in an index fund directly, the investor only gets a portion of the index’s gains.

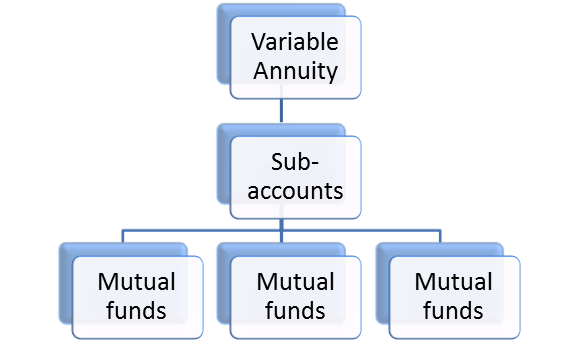

The variable annuity is only slightly different than a fixed or indexed annuity. In this product you pick the mutual funds you would like to invest in. One upside in this type of annuity, the investments you make in the mutual fund are yours and can be kept if the insurance company for some reason goes out of business. The downside: you must pick from the funds the insurance company offers.

Both fixed and indexed annuities keep your invested dollars in a general fund. In the off-chance your insurance company enters bankruptcy proceedings, this money is at the mercy of the creditors.

Do these variable annuity products cost the same as mutual funds?

When you buy an annuity, the fees charged can be much higher and in some instances, the returns are lower as well. You must pay for the insurance product as well as the mutual funds. Your selection of funds is limited to what is offered by the insurance company.

Because mutual funds are the cornerstone of the variable annuity, it is worth noting some other risks. Market declines will impact your payout. Taxes will be an issue if you are in a higher income bracket than anticipated when you retire. And the fees you will be charged include insurance commissions (some as high as 4 percent) along with mutual fund fees. Inside an annuity, these fees tend to be higher than those on the open market often over 2 percent. This should be compared to the average fee charged by an actively managed mutual fund of 1.5 percent.

What kind of fees do annuities charge?

Annuities are complex products. The fees these products charge often relate to the need of the person buying the annuity. In order for the annuity to work, the investor would need to outlive the actuarial’s estimate for their life. If you want the annuity to do more, each extra consideration increases the cost. For instance, if you want to leave money to your heirs, this feature will cost you more.

But there are numerous additional fees someone considering this product should be aware of before they buy.

Insurance charges, the cost of maintaining and selling the product are often referred to as mortality and expense fees (M&E). Some companies charge a fixed maintenance fee but the industry average is 2.45% according to Morningstar.

Surrender charges can be leveled if you decide to leave the annuity before the surrender period expires or you withdraw in excess of the withdrawal limits. The fee may decline over time but normally begins at 7 percent in the first year.

Riders are typical in insurance products and in annuities, they can encompass all sorts of optional guarantees. Each additional choice adds to the cost of the annuity.