Mutual Funds for Beginners

Post on: 27 Июнь, 2015 No Comment

February 5, 2010 By Jeff

Mutual Funds for Beginners

What are mutual funds?

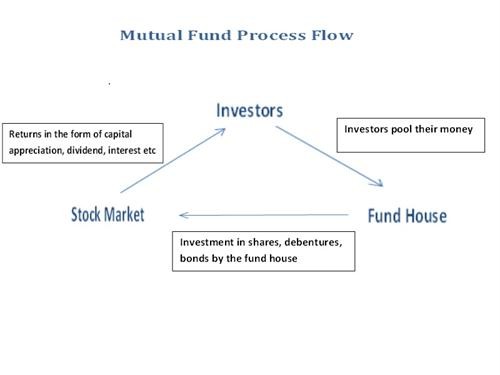

Mutual funds are a type of collective investment which is professionally managed, usually by a person known as a fund manager.

To beginners, mutual funds sound complicated but lets try boiling it down in to an analogy

Lets say you had a group of people who wanted pie but didnt have the money or the time to buy all the ingredients to make the pie.

Collectively however everyone could pool up their money and give it to one person who would buy the ingredients and bake the pie, and when they were done everyone who contributed got a slice equal to the amount they put in.

This is essentially what a mutual fund is.

In this example the investors want to buy a lot of different stocks and other securities, but dont have enough money to buy each security individually, but collectively they could put their money together and have a fund manager (the baker in our analogy) buy all the securities and manage the fund.

Mutual funds can be made up of stocks, bonds, treasuries, and other types of securities, or they could be a combination of all of them.

You can buy mutual funds in a single sector, like the tech or energy sectors, or they could be spread across many sectors. They could be aggressive in the investments that they make (high risk / high reward) or they could be more conservative and invest in treasuries and municipal bonds.

You can even find funds that invest only in Earth friendly stocks if you wanted the options are really limitless.

Why Invest In Mutual Funds

Diversification

One of the reasons mutual funds are popular is that they provide people with a fairly inexpensive way to diversify their portfolio.

When you diversify you essentially buy different securities in different areas which spreads the amount of risk around rather than putting all your eggs in one stocks basket.

Diversifying prevents one stock from taking down your entire portfolio because you have other securities that (hopefully) remain steady or go higher.

The problem with diversification is that buying a lot of different securities can be expensive, especially when companies like Apple or Google are hundreds of dollars each. With mutual funds you can buy just a slice of the fund, which is made up of many stocks without having to buy them individually.

One of the nice things about investing in mutual funds is that they are managed by someone else, the fund manager, who you are trusting to make good decisions with your money.

Usually this is a good thing since most fund managers have a ton of experience investing before they ever become a fund manager, but it can also cause people to lose track of their investments and assume that everything is fine.

I would strongly encourage anyone who invests in mutual funds to keep a close eye on your funds performance and if you dont like what you see go find another fund.

Disadvantages of Mutual Funds

Mutual funds are not risk free of course (is anything really?) so there are a few disadvantages to investing in mutual funds.

Fees and Transaction Costs

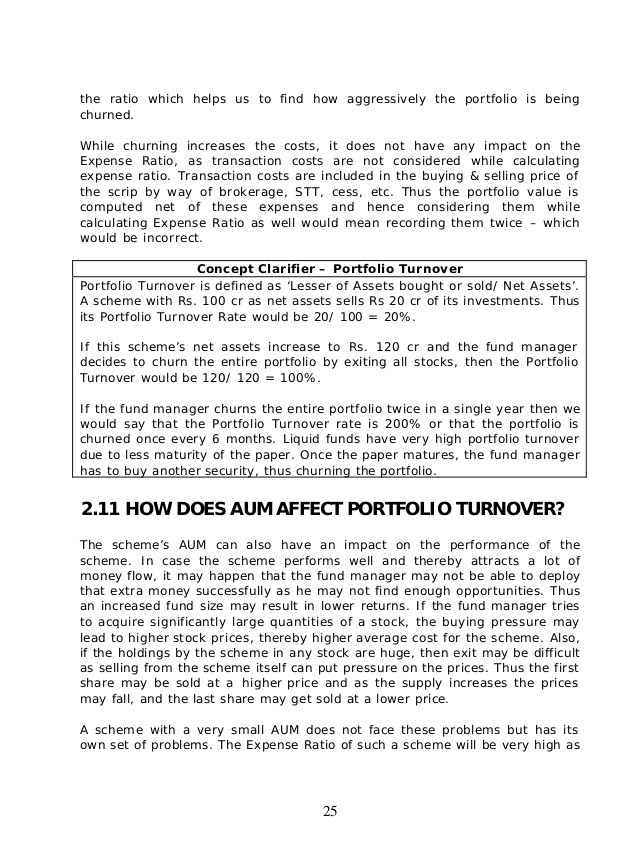

These fees can be commissions paid to invest in the fund initially, a fee to maintain the fund, fees to sell the fund, or another type of fee not named here. More commonly investors can be charged a transaction fee for every buy/sell that the fund makes as a whole, and this can really add up over time.

This is why it is very important to read and understand all fee disclosures when you first buy in to the fund. Its also important to take a look at the funds (and the fund managers) history to determine whether the fund makes a lot of transactions historically. Fees can really eat away at your return on investment so pay close attention here.

The downside to diversification is dilution. Lets say you bought in to a fund that had Apple stock in it. Apple is one of the best performing stocks over the last decade or so, and if you bought in to the stock ten years ago you probably made a fortune, but if its only a part of a fund you would not have made nearly as much, especially if other investments performed poorly.

If on the other hand Apples new release of IPads gets recalled and the stock plummets as a result, youll be happy you diversified. Like Diversification is about minimizing the risk, but it also can minimize the reward as well.

Mutual Funds Can Lose Money

Repeat after me: ANY investment can lose you money, and this includes mutual funds.

The diversification can help prevent losses, but no investment is perfect. A lot of investors look to mutual funds because they are generally safer than buying individual stocks, but unless your broker 100% guarantees a return (and very few do) you can find yourself with a loss at the end of the quarter, especially these days.

Some funds are safer than others, like funds that are made up of treasuries, municipal bonds and high strength corporate bonds, but nothing is perfect so invest at your own risk.

How To Buy Mutual Funds

A lot of new investors assume buying mutual funds is more difficult than it really is.

All you really need to buy in to a mutual fund is an investment account. You can use a low cost online broker like TradeKing , TD Ameritrade or E*Trade , or you can use a broker at your local bank or financial planner to buy in.

You really do not have to be wealthy to purchase mutual funds, in fact anyone can do it with very low investment mutual funds available.

A general rule of thumb to follow is that if you have $5,000 or less to invest investing in mutual funds will give you a lot more diversification than buying $5,000 worth of stocks would and you stand a better chance of making some return on your investment without losing all of your money.

And of course, while it is good to invest as much as possible you should never invest more than you can afford to lose.

How To Choose a Mutual Fund

Here are a few significant factors that you will want to consider before deciding on the mutual fund that you want to invest in:

The type of mutual fund – if it is considered to be a high-risk equity fund, you may want to consider continuing your search for a safer fund to invest in. Search for a fund that involves medium to low risk with an approach that is balanced.

The management style of the mutual fund – you will quickly discover that not all funds are managed the same way. As the funds differ from one to the next, so do the investment styles of portfolio managers. While one manager may take a purchase-and-hold approach to the fund, whereas others will actively trade the fund’s assets.

The fees that will be charged – although this is not always a hard and fast rule, those mutual funds that are more actively managed will carry higher fees than others that are not as actively traded. In order to determine if the mutual fund is actually worth investing in, investigate the past history or track record of that particular fund.