Mutual Funds Can Help Balance Volatility of Stock Market

Post on: 18 Июнь, 2015 No Comment

More Conservative Funds May Reduce Risk

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Investors in individual stocks may find investing in the stock market can be stomach wrenching during periods of high volatility in price and volume.

Just because you buy individual stocks does not mean you are a high risk investor. However, you may want to balance or reduce some of the inherent risk in the stock market by using more conservative mutual funds.

Some mutual funds combine stocks and bonds while other funds may focus more on bonds and other fixed income investments. Here are some of the major types.

Balanced Fund

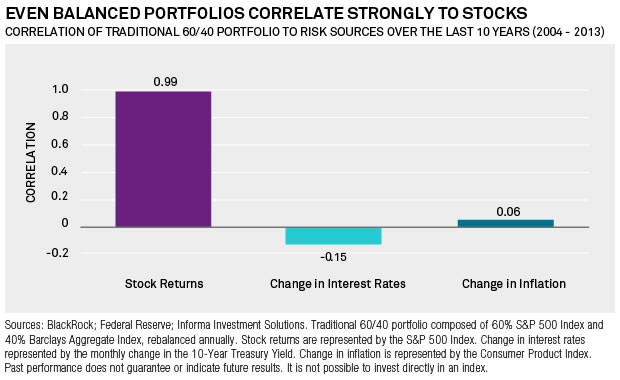

Balanced mutual funds combine stocks and bonds looking for the best from both growth and current income. Balanced funds may answer the question of what the mix of stocks and bonds should be.

The balance of stocks and bonds in a portfolio is different for every individual, so finding a balanced fund that matches your stocks-to-bonds ratio may take some research.

The stocks-to-bonds ratio that is right for you will depend on your age, financial goals, and risk tolerance.

Stocks-to-bonds ratio is the percentage of your portfolio occupied by stocks and bonds. Since bonds are considered more conservative, investors use a higher ratio of bonds for a less aggressive market position and a higher ratio of stocks for a more aggressive position.

The younger you are, the higher the ratio of stocks in your portfolio should be. Older investors should consider reducing the percentage of stocks and increasing their bond assets. A good starting place is to take your age and subtract it from 100. What remains is the percentage of stocks you should have in your portfolio.

Balanced funds have a performance history that evens out the peaks and valleys in the market. They do not rise as high as an exuberant market, nor fall as far as a market in doubt. This makes them attractive to risk-averse investors.

Life-Cycle Funds

Life-cycle mutual funds help investors keep their stock and bond mix correct as they move closer to retirement. Many of these funds feature a target maturity date. People planning to retire on or near the maturity date invest in the fund, which then automatically readjusts the stocks, bonds, and cash mix as the date draws nearer.

The closer the investor gets to retirement, the more conservative the portfolio becomes, with a reduction in the stock percentage and an increase in the percentage of bonds.

The targeted maturity date funds are very attractive to 401(k) participants because they don’t have to worry about making adjustments as time goes on. You can often choose whether you want a conservative, moderate, or aggressive portfolio blend, and the fund will adjust the assets accordingly. Life-cycle funds are designed to be your single investment, since it calculates the proper stocks, bonds, and cash mix. Any additional funds will put your allocation out of balance and defeat the purpose of the life-cycle fund.

Bond Funds

Like pure stock funds, bond mutual funds come in a variety of configurations, but the two major groupings are taxable and non-taxable, and by maturity of the bonds in the portfolio.

Tax-free bond funds invest in primarily municipal bonds. Income from municipal bonds is exempt from federal income tax. The municipal bond market isn’t easy for individual investors to navigate. Many new bonds for sale have minimum purchase requirements of $25,000, which puts them out of the reach of many investors. Tax-free mutual funds are a way for investors with limited means to participate.

Many investment companies offer a variation on the tax-free bond mutual fund in many states that have a personal income tax. There triple exempt tax funds offer income free from city, state or federal income tax. This is possible because many states will exempt the money raised from state and local income taxes to attract new local investors.

Taxable bond mutual funds specialize in issues of corporations. The risk is somewhat higher, but the rewards may be greater also. Corporate bonds have a higher rate of default, since the company could go out of business or not be able to repay the bond.

Other bond funds focus on investing in bonds of different maturities, such as short-term, mid-term and long-term bonds. Each has characteristics that appeal to different investors. Bond maturities reflect matters of risk. The longer the maturity, the higher the risk to the bondholder.

Money Market Funds

Money market mutual funds differ slightly from other funds in how they work. Unlike other mutual funds, money market funds attempt to keep the net asset value, or NAV, at a constant $1. The funds invest in short-term interest-paying securities.

The income generated by the fund is paid to shareholders in the form of additional shares. In other words, your number of shares increases. Money market funds can either be taxable or tax-free, depending on the underlying investments. Tax-free money market funds invest in municipal bonds and other instruments whose income is tax-free. Taxable money market funds invest in U.S. Treasury bills and notes, commercial notes and other short-term securities.

Money market funds, although not insured by the Federal Deposit Insurance Corp. like bank products, are considered very secure and safe investments. Money market funds invest in very short-term products — with maturities often measured in days rather than months.

This very short-term perspective gives them the flexibility to move quickly out of difficult investments if they aren’t working out. In addition, many money market funds invest in U.S. Treasury securities. which are considered among the most secure investments on the market.