Mutual Funds An Introduction

Post on: 9 Апрель, 2015 No Comment

Consumer Investments

Mutual Funds: An Introduction

Mutual funds use large aggregate pools of money accumulated by combining smaller amounts from many investors. This pool of money is the actual mutual fund. An investor in a mutual fund that buys stock does not own the stock outright. Instead the investor owns shares of the mutual fund with the fund holding actual ownership of the stock shares. Larger pools permit greater buying power and provide a means for the small investor to buy into the stock and bonds of numerous public companies. Mutual funds give the small investor a means to diversify, (a necessity to spread risk) and invest in broad sectors of the capital markets .

Today, there are mutual funds that invest in the stock of companies known as small caps, funds in large caps, growth stocks, corporate bonds, as well as a multitude of companies that invest in a diversified portfolio of financial instruments. Other popular types of mutual fund are those that mirror index funds. such as the S&P 500 Index or the Russell 2000. (Vanguard offered the first index fund in 1976 — the Vanguard S&P 500 Index Fund.)

The S&P 500 tracks the stock performance of 500 major U.S.-based companies. A mutual fund aligned with the index will invest in the companies that make up the index and profits and losses will closely adhere to the performance of the index. Historically these passively managed funds have outperformed actively managed mutual funds more than 90% of the time.

The objectives of mutual funds vary widely. Funds that invest only in growth stocks (newer companies) expect to reap rewards through capital gains. Funds that invest only in income stocks, generally older established companies that pay regular dividends. benefit from a regular return with many mutual fund participants choosing to re-invest profits thus obtaining more shares in the fund. Over time substantial holdings can be accumulated in this way.

Sector funds invest in the stock of companies within one industry, such as consumer staples, or financials. Other funds may be termed global and own the stocks of companies from around the world. Many funds maintain diversified portfolios that contain a mixture of stocks, bonds, Treasury bills, and other assets. There are also funds that take on high risk (aiming for high rewards) and invest only in emerging markets. Money Market Mutual Funds (MMMFs), developed by Bruce Brent and Henry Brown in 1971, invest in low-risk short-term debt instruments such as Treasury bills, bank certificates of deposit, and commercial paper.

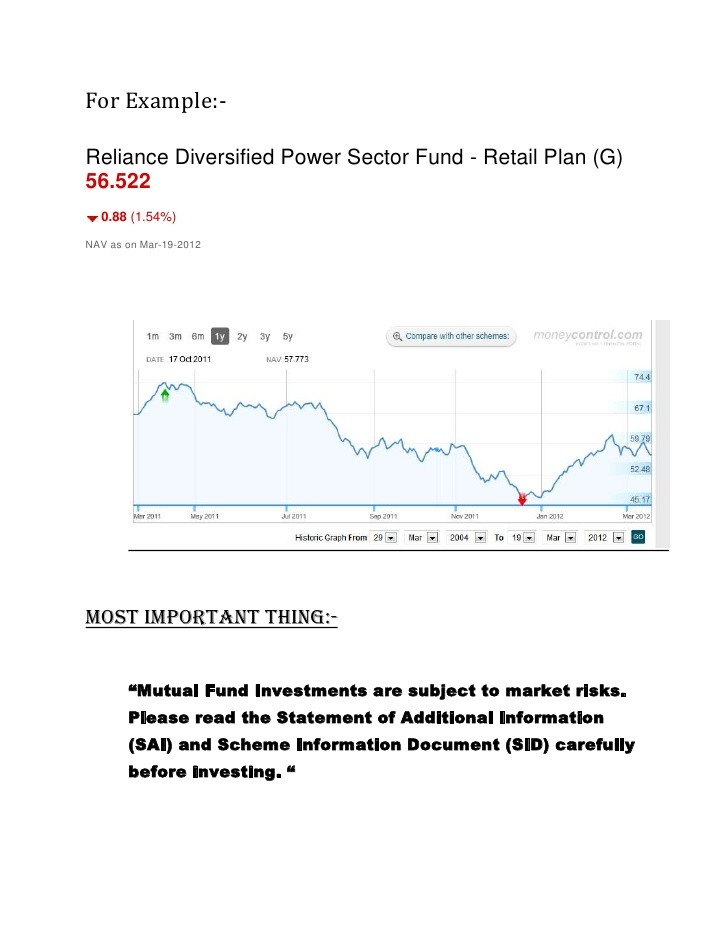

As stock prices rise and fall throughout the trading day, a mutual fund’s net asset value (NAV) also rises and falls. However, mutual funds do not trade on the exchange like stock shares. Instead the NAV is determined at the close of each trading day, calculated by dividing the total number of outstanding shares into the total value of the fund’s assets.

Shares in closed-end mutual funds are traded somewhat like stock shares. A closed-end fund has a limited number of shares available. Once they are all purchased, new investors can participate in the fund only by buying shares from existing investors. An open-end fund on the other hand, sells unlimited numbers of shares and simply buys more assets with each new participant in the fund.

The United States Securities and Exchange Commission (SEC), the American consumer’s watchdog on Wall Street. requires mutual fund offerings in the United States to make known its objectives in a prospectus, (a detailed financial report). Reputable companies will strongly encourage prospective investors to read their prospectus carefully before investing. Through analysis of the prospectus, an investor can garner a great deal of information on a mutual fund, including upfront disclosure on the fees and expenses required to participate. By comparing the prospectus from various funds, an investor can best choose what suits their individual circumstances.