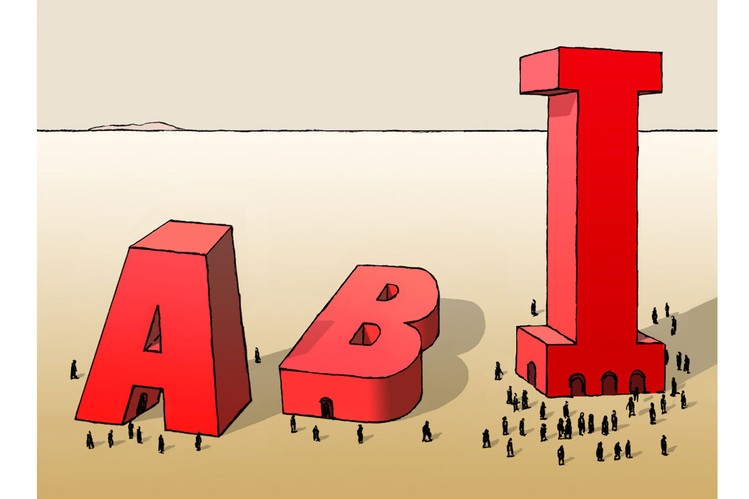

Mutual Fund Share Classes The ABCs of Mutual Fund Fees

Post on: 20 Июль, 2015 No Comment

Do you know the difference between A, B and C mutual fund shares? Or how a no-load fund differs from a C share? Learning these distinctions could save you thousands in investment expenses over your lifetime.

The investment industry has tens of thousands of possible vehicles for parking your cash: ETFs, stocks, bonds, options, futures, currencies and more.

With so many choices out there, its hard to find the right one that fits your needs. You may end up consulting a financial professional to help you out and sift through the possibilities.

Mutual funds are diversified products with many different holdings all balanced by a Fund Manager who decides the appropriate percentages in each stock or bond and when those need to be changed. Seems like a no-brainer to buy one. Alas, nothing on Wall Street is so simple.

Undoubtedly, many of you that go through a financial advisor for your mutual fund selection will be presented with this choice: “A” shares, “B” shares, or “C” shares. These are different ways the fund manager makes his cut for running the fund that youll be investing in. Theyre all sales charges, but applied in different ways, ostensibly to fit your needs. The good news is that there are discounts applied in a tiered fashion and as long as you stay within the same fund family, youre allowed to trade in and out of funds without incurring new fees.

The “A” share class is a sales charge applied up-front in order to get into the mutual fund. The fee for a stock fund averages about 5 percent, and bond funds average around 3.5 percent, although both types are allowed to go as high as 8 percent. In exchange for paying this fee, the ongoing expense ratio in this share class is lower than those in “B” or “C” share classes.

Not all fund families are the same. The popular American Fund family typically charges higher upfront charges than their competitors, but the subsequent expense ratios are lower. These shares are for people who intend to hold on to them for a long period of time to take advantage of the low expense ratio.

“B” shares are slowly being phased out of most mutual fund families, but there are still some that offer this type of share class. They are the opposite of “A” shares in the sense that they charge a “back-end” fee when withdrawing money from the mutual fund.

These fees lessen for every year you stay invested in the fund, generally terminating within seven years. In some cases, they are automatically transferred into “A” share classes after 10 years. Ideally, if you dont end up selling out of the fund, these share classes can be more cost effective than “A” shares. The expense ratios are higher than “As” but less than “C” shares.

For short-term investors, the “C” class should be familiar. There are no sales charges, but the expense ratios can be much higher than their “A” or “B” siblings. These fees can eat away at returns over the long term and average about 1.5 percent. This may not seem like much, but keep in mind sales fees are only paid once, while the expense ratio is an annual cost.

The Finra Fund Analyzer is one way to compare how much the different share classes will affect you over any given time period. You can compare different mutual fund share classes and fund families while adjusting things like expected returns and time period invested. A good rule of thumb is anyone with a time horizon of less than eight years should probably buy “C” shares rather than “A” or “B”.

No-load mutual funds and index funds

Last, but by no means least, no-load funds are a good option for investors just getting into mutual funds. No-load funds and index funds charge no sales fees and generally have very low expense ratios.

These “institutional” shares are almost always cheaper than the alternative fund families and there is no evidence to suggest that “A”, “B”, or “C” shares perform better than no-load funds. T-Rowe Price is a popular no-load fund family and Vanguard. the worlds largest mutual fund company, is built on its reputation for low-cost index funds.

Unlike traditional mutual funds, index funds are not actively managed which means they tend to be more volatile, but offer extremely low expense ratios – often as little as .05 percent. Make sure you do your research and compare a professionally recommended fund against one of these alternatives. There should be few circumstances in which you will need to purchase a “loaded” mutual fund.

If you choose to work with a financial advisor, this is why its essential to understand how he or she is compensated. Advisors who earn a commission from the investments they sell may be more likely to sell loaded funds, whereas fee-only advisors are paid only by their clients, so they will not have this potential conflict of interest. This isnt to say advisors who work for financial institutions wont do a good job, but they do earn their money in a different way and that may include steering clients toward more expensive funds.