Municipal Bonds Types How to Buy Market Data Investment Ideas

Post on: 14 Апрель, 2015 No Comment

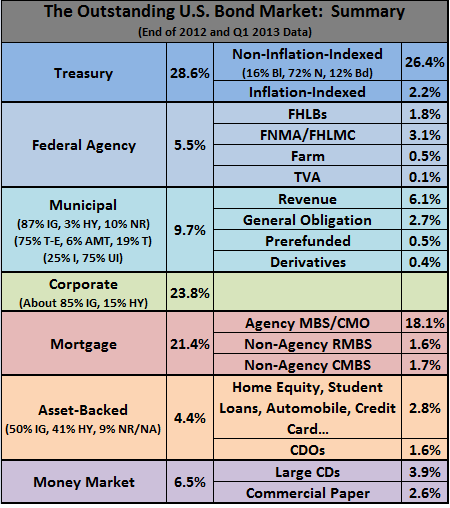

Municipal bonds (also referred to as “munis”) are bonds issued by state governments, local governments, and government agencies such as a port authority or water board. If you combined all the other types of bonds issued in the US together, they would equal less than a third of the number of municipal bonds. There are over 50,000 different government entities that have issued municipal bonds, and over 1.5 million different municipal bond issues. This means that there is enormous diversity in municipal bonds in terms of interest rates, maturity, safety, and how easy they are to buy and sell.

Because they are issued by state and local governments, municipal bonds can offer significant tax advantages. Although there are exceptions, most municipal bonds are free of federal income tax. If you purchase municipal bonds which were issued in the same state where you reside, then municipal bonds are often free from state and local taxes as well. You can learn more about this in our article, Municipal Bonds and Taxes .

Types of Municipal Bonds

There are two main types of municipal bonds, general obligation bonds and revenue bonds. The difference between general obligation bonds and revenue bonds are who is responsible for paying bondholders. General obligation bonds are the responsibility of the government itself and not tied to the revenues of any specific project. Revenue bonds are also issued by a government entity, but bondholder payments are tied to the revenues of the project which they were issued to fund. Because the state or local government is not required to pay if the revenues from the project are insufficient to pay bondholders, revenue bonds are considered riskier than general obligation bonds. You can learn more in our articles How General Obligation Bonds Work and How Revenue Bonds Work .

How to Buy Municipal Bonds

Investors should understand that buying bonds is not like buying stocks. The price you pay for a municipal bond may be completely different from the price someone else pays, even when buying the same bond at the same time. A recent report by the Government Accountability Office stated that individuals buying municipal bonds in the secondary market pay on average 2% more than institutional investors. While 2% may not seem like much, when even long term municipal bonds are yielding less than 5%, 2% makes a huge difference.

It is for the above reasons that we recommend individual investors buy during the retail order period. This is when individuals have the opportunity to buy new bond issues at the same price as institutional buyers. In general you can expect to save a significant amount of money by buying your municipal bonds during the retail order period. For more on this see our full articles on Buying Municipal Bonds During the Retail Order Period and How to Choose a Municipal Bond for Income .

Buying Individual Municipal Bonds vs. Municipal Bond Funds

- When buying individual municipal bonds, you know how much interest income you are going to receive and when, so you can plan accordingly. This is not true with Municipal Bond funds which buy and sell the bonds in their portfolios on a regular basis.

- If you hold a municipal bond to maturity you are not exposed to interest rate risk. if rates rise after you buy the bond. Bond Funds generally do not hold the bonds in their portfolio to maturity which exposes you to fluctuations in the value of the bond due to interest rate movements.

Municipal Bond Safety

In late 2010 Meredith Whitney went on the television show 60 minutes and proclaimed there would be “50 to 100 sizable defaults in the municipal bond market in the next year totaling in the $100’s of billions”. While this scared a lot of people out of the the market, it turned out to be nowhere close to what actually happened. While there are exceptions (like Puerto Rico Municipal Bonds for instance), for the most part municipal bonds are one of the safest investments around, with past default rates averaging just 0.13%. You can read more about this in our full article Municipal Bond Defaults, Safety, and Credit Ratings .

Municipal Bond Performance

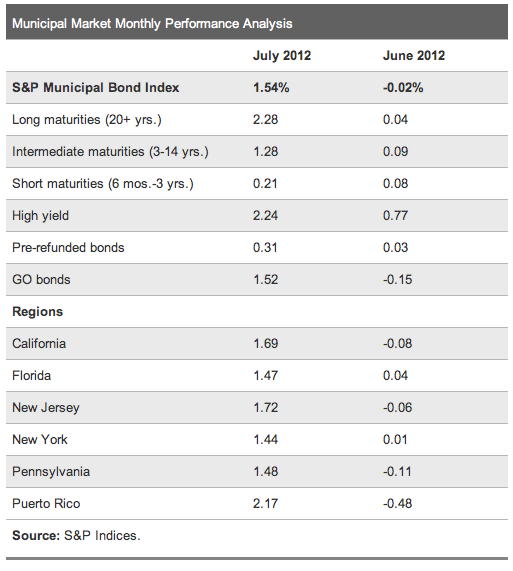

Municipal bonds have performed extremely well over the last 10 years. Not only have they provided investors a steady stream of tax free income, but the bonds themselves have also had large gains in value. This is especially true over the last year and a half:

Municipal Bond Performance 2011-2012 (as represented by the MUB Muni Bond ETF)

While we are unlikely to see the same performance in the next 10 years, the income from Municipal Bonds should continue to be higher for many investors than what they will be able to get from other income investments with similar risk profiles. For in depth information on the historical performance of municipal bonds, how to compare them to other investments, and how to determine what you should expect in the future see our article on Historical and Present Municipal Bond Performance .

Municipal Bond Market Data

In addition to tons of education on municipal bonds, we also have lots of market data here at Learn Bonds to help you analyze the market and make decisions. Municipal bond experts Municipal Market Advisors have allowed us to publish their AAA municipal bond yield curve once a week. This allows you to see where yields are on AAA municipal bonds for 1 through 30 year maturities. You can find that data here .

Municipalbonds.com has allowed us to publish their municipal bond rates table, which shows the yields at which municipal bonds from all 50 states have traded within the last week. This gives you a rought comparison of the type of pricing people are getting for specific maturity bonds from different states. You can find that data here .

And finally we have an up to date table of the credit ratings for all 50 states which you can find here. If you are not famliar with credit ratings you can read our article How Bond Credit Ratings Work .

Municipal Bond Market Updates and Investment Ideas

Once a month we publish BlackRocks Municipal Bond Market Update which covers everything thats happened over the last month, as well as their outlook for the market going forward. You can find BlackRocks updates here. If you would like a daily update, we cover all the major bond market stories each day in our daily Best of the Bond Market post, which is also available via email. You can find that here. And finally we have a special category for municipal bond and municipal bond fund trading ideas which you can find here .

Want to learn how to generate more income from your portfolio so you can live better? Get our free guide to income investing here .