Municipal bonds and low tax bracket investors

Post on: 18 Июль, 2015 No Comment

Ask NJMoneyHelp

December 11, 2014

Photo: cohdra/morguefile.com

Q. Im retired and self-manage my well-diversified and well-balanced seven-figure portfolio in stocks and bonds. Are there times when investing a small portion of the portfolio in municipal bond funds makes sense even though Im in a low tax bracket? Muni fund returns and yields have been better than some other bond alternatives in this very low interest rate environment.

A. Youre right that municipal bonds dont often make sense for investors who are in a low tax bracket.

When youre looking at bonds, you need to evaluate the return and risk of the alternatives, as well as the tax impacts, said Peter McKenna, a certified financial planner with Highland Financial in Riverdale. He said in a situation where a high-quality municipal bond provides a better tax-equivalent yield for the same risk, it should certainly be considered.

That means you need to compare the returns.

McKenna said tax-free and taxable returns cannot be compared side-by-side, but instead, you need to restate the expected return on a common tax basis, either as an after-tax yield or tax-equivalent yield.

A taxable bond can be calculated on an after-tax basis and compared to a tax-free municipal yield, he said. Alternatively, a tax-free yield can be `grossed up to determine the equivalent taxable yield.

For example, he said, a 3 percent taxable yield results in a 2.40 percent after-tax yield in a 20 percent tax bracket. Conversely, a 2.40 percent tax-free yield equates to a 3 percent tax-equivalent yield in the same tax bracket.

Now for the formula:

After Tax Yield (ATY) Tax-Equivalent Yield (TEY)

Taxable Yield x (1 – Tax rate) = ATY Tax-Free Yield = TEY

(1 – Tax rate)

3.00% x (1 – 20%) = 2.40% 2.40% / (1-20%) = 3.00%

McKenna said using this, you can compare the yield on two different kinds of bond investments and decide if the municipal bond or fund yield is higher or lower than the alternative.

When youre doing your analysis, McKenna said, its important to know whether the bond or fund in question is taxable at the federal, state and local jurisdiction of the investor.

Some municipal bonds are not subject to standard federal income taxes, but are subject to the Alternative Minimum Tax, so it is important to know which taxes, if any, apply to the bonds being considered, McKenna said. It could be tax-free in none, one or all of the above depending on the issuer and investor’s residence.

Before buying a bond investment, you need to consider risk.

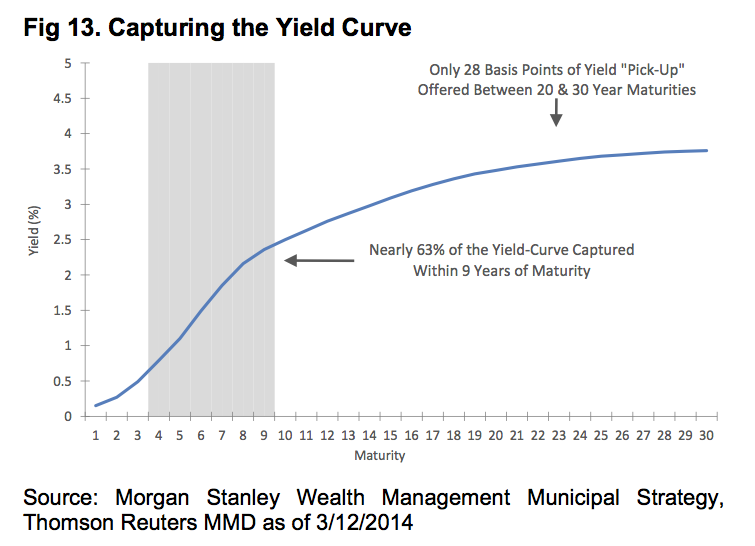

Factors such as taxation, maturity date, call date, coupon rate, default risk, liquidity, etc. all impact a bond’s risk, McKenna said. It is critical to understand each of these elements as they will impact the actual returns.

Plus, he said, all of these expected returns are based on an investor holding the bond to maturity. Find out if a liquid market exists for the bonds and how much of a discount from fair value youll have to pay to trade them if they need to be redeemed before maturity.

While there is a transparent market for listed stocks where you can see the price movement minute by minute, bond markets are far less transparent, McKenna said. It is difficult to know beforehand how much of a mark-up or concession the dealer has included in the price for selling or buying the bond. These amounts can be material and are difficult to quantify.

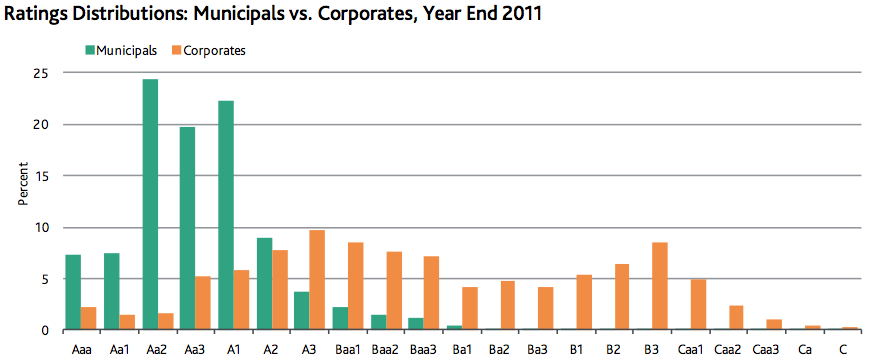

McKenna said while many people view municipal bonds as a “safe” investment, the credit quality of the issuing entity can be very different, even within a given state. There are some very good municipal bonds available, he said, but there are also some higher yielding bonds with considerable default risk.

If it is not apparent why one bond is yielding more than another, keep digging and asking questions until you understand the risk you are being paid to take, he said.

So are muni bonds right for you?

Tax-free municipal bonds make the most sense for people in the highest federal and state tax brackets, but at times the municipal market offers tax-equivalent yields that are attractive for lower bracket taxpayers, McKenna said.

I recommend using well-managed, inexpensive mutual funds rather than individual bonds for most retail investors, he said. Most do not have the time and skill to objectively evaluate the risk/reward of individual bonds and an opaque market makes it difficult to know if you are getting a fair price when buying or selling bonds.

NJMoneyHelp.com presents certain general financial planning principles and advice, but should never be viewed as a substitute for obtaining advice from a personal professional advisor who understands your unique individual circumstances.